Mileage tax California 2026 remains one of the most closely watched transportation policy discussions in the state, as lawmakers continue evaluating a major shift away from fuel-based road funding. As of today, California has not enacted a statewide mileage tax, but legislative activity, extended studies, and ongoing public debate confirm that the idea is firmly on the policy agenda.

The discussion centers on how California will pay for roads, bridges, and transportation infrastructure in an era when gasoline consumption is declining. With electric vehicles and fuel-efficient cars now common on California roads, traditional gas tax revenue is no longer keeping pace with maintenance needs. This reality has pushed state leaders to seriously consider charging drivers based on miles driven rather than gallons purchased.

Why Mileage-Based Charging Is Under Review

For decades, California relied on fuel taxes as the backbone of transportation funding. That system worked when most vehicles used gasoline and fuel consumption closely tracked road usage. Today, that link is weakening.

Several trends are reshaping transportation finance:

- Electric vehicles do not contribute to fuel tax revenue

- New vehicles travel farther on fewer gallons

- Road repair costs continue to rise

- Traffic volumes remain high despite efficiency gains

As a result, lawmakers are examining whether a mileage-based model could create a more stable funding structure. Under this approach, drivers would contribute based on how much they use the road system, regardless of vehicle type.

Supporters describe the idea as a way to modernize infrastructure funding. Critics see it as a potential cost increase for everyday drivers.

Current Legal Status in California

There is no mileage tax in effect in California in 2026. Drivers are not being charged per mile, and no enrollment or payment system exists statewide.

What is active is the state’s research and planning framework. California has authorized continued analysis through advisory committees that are studying how a mileage-based system could operate if lawmakers choose to pursue it in the future.

These committees are not writing tax bills. Their role is to evaluate feasibility, impacts, and design options before any binding proposal is introduced.

Any actual mileage tax would require:

- New legislation

- Public hearings

- Regulatory development

- Implementation timelines

None of those steps have been completed.

What Lawmakers Are Studying Right Now

The ongoing evaluation focuses on several key questions that must be resolved before any policy decision is made.

Revenue Stability

Officials are assessing whether mileage-based charging could reliably fund long-term transportation needs without frequent rate changes.

Equity and Fairness

Researchers are analyzing how a mileage tax would affect different groups, including commuters, rural drivers, low-income households, and urban residents.

Administrative Complexity

A statewide system would need to process millions of vehicles efficiently, securely, and at low cost.

Public Acceptance

Policymakers are closely watching public reaction, knowing that widespread opposition could stall or stop any proposal.

These studies are shaping how the mileage tax California 2026 conversation evolves.

Mileage Tracking Options Being Evaluated

One of the most sensitive issues in the debate is how miles would be measured. California has examined multiple approaches during pilot programs and technical reviews.

Options under consideration include:

- Annual odometer reporting during registration

- Smartphone applications that calculate mileage

- Vehicle-installed devices

- Flat mileage estimates for certain drivers

- Non-location-based reporting methods

State planners have consistently stated that future systems would need to offer choices. The goal is to allow drivers to select methods that align with privacy preferences while maintaining accuracy.

No single tracking method has been approved or mandated.

Cost Concerns for California Drivers

Although no official rate exists, cost remains the dominant concern for the public.

Under a mileage-based system, total annual costs would depend entirely on how much a person drives. High-mileage drivers would pay more, while low-mileage drivers would pay less.

This structure has raised several concerns:

- Commuters with long daily drives

- Workers in areas with limited public transit

- Families managing rising transportation expenses

- Small business owners relying on personal vehicles

Without a final rate or structure, lawmakers have avoided committing to specific cost figures. That uncertainty has fueled skepticism and resistance among drivers.

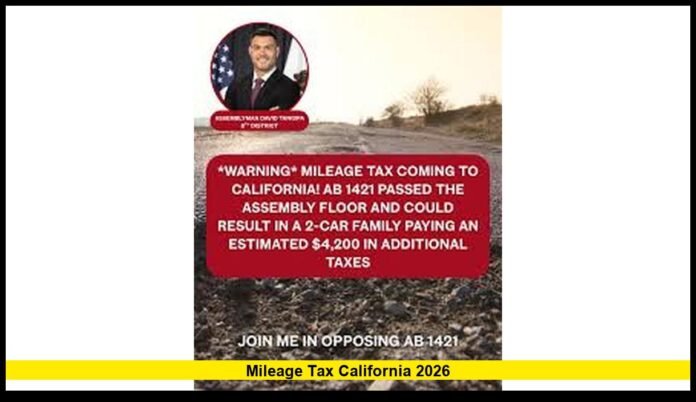

Political Resistance and Public Pushback

Opposition to the mileage tax California 2026 idea has grown stronger as awareness spreads.

Many critics argue that Californians already face:

- High fuel prices

- Elevated vehicle registration fees

- Rising insurance premiums

- Increased cost of living

They worry that a mileage tax could add another layer of expense, especially if fuel taxes remain in place alongside any new system.

Some lawmakers have framed the proposal as unnecessary, pointing to past transportation funding increases. Others argue that reform is inevitable as gasoline consumption declines.

Public opinion remains divided, with skepticism outweighing support in many regions.

Electric Vehicles and the Funding Gap

Electric vehicles play a central role in the mileage tax discussion. As EV adoption rises, more drivers use roads without contributing to fuel tax revenue.

Supporters of mileage-based charging argue that this creates an imbalance, where some drivers pay for road maintenance while others do not. They view per-mile charging as a way to ensure everyone contributes proportionally.

Opponents counter that EV owners already pay higher upfront costs and additional registration fees. They argue that penalizing EV adoption could slow progress toward clean transportation goals.

This tension continues to influence how policymakers frame the issue.

How California Compares to Other States

California is not alone in examining mileage-based funding. Several states have explored similar concepts, often through voluntary pilot programs.

What sets California apart is scale. Any statewide system would affect tens of millions of drivers and generate billions in revenue. That scale increases both the potential benefits and the risks of implementation.

Lawmakers are proceeding cautiously, aware that mistakes could undermine public trust.

Timeline Moving Forward

The mileage tax California 2026 discussion is part of a longer timeline rather than an immediate policy change.

Expected next steps include:

- Continued technical review throughout 2026

- Additional public input and legislative hearings

- Formal recommendations delivered in 2027

- Potential introduction of legislation after recommendations

Even if lawmakers act quickly, any new system would take years to implement.

What Drivers Should Know Today

For now, the situation is clear:

- No mileage tax is in effect

- No per-mile billing exists

- No mandatory tracking is required

- No payments are being collected

Drivers should be cautious about misinformation claiming otherwise.

However, the ongoing debate signals that California is actively rethinking how it funds transportation. The decisions made in the coming years could reshape driving costs across the state.

Why the Debate Matters

Transportation infrastructure touches every part of California’s economy. Roads support commuting, shipping, emergency services, and daily life. How those roads are funded affects not only drivers but businesses and communities statewide.

The mileage tax discussion reflects broader changes in technology, energy use, and transportation habits. Whether or not California ultimately adopts a per-mile system, the conversation highlights the challenges of funding public infrastructure in a rapidly changing environment.

As California continues evaluating this issue, drivers’ voices and awareness will play a critical role in shaping the future of transportation funding across the state.