Medicare beneficiaries across the United States are entering 2026 with significant changes to healthcare costs, and the medicare part b premium 2026 is one of the most important updates affecting millions of enrollees. From higher monthly premiums to increased deductibles, these adjustments have a direct impact on household budgets, especially for retirees and individuals living on fixed incomes.

This article explains the confirmed changes to Medicare Part B for 2026, why costs are rising, how income can affect what you pay, and what beneficiaries should consider as they plan for the year ahead.

Understanding Medicare Part B Coverage

Medicare Part B is the portion of Original Medicare that covers outpatient medical services. This includes doctor visits, preventive screenings, diagnostic tests, outpatient procedures, durable medical equipment, and certain home health services. Unlike Medicare Part A, which is typically premium-free for most people, Part B requires a monthly premium.

Enrollment in Part B is optional, but most beneficiaries choose to enroll because it plays a critical role in accessing routine and preventive medical care.

Confirmed Medicare Part B Monthly Premium for 2026

For 2026, the standard Medicare Part B monthly premium is $202.90. This is an increase of $17.90 per month compared with the 2025 standard premium of $185.00.

Most beneficiaries pay this standard amount, which is typically deducted directly from Social Security payments. Those who are not yet receiving Social Security benefits receive a bill for the premium.

The increase is notable because it represents one of the larger year-over-year jumps in recent history and exceeds the percentage increase in Social Security benefits for the same year.

Why the Medicare Part B Premium Is Increasing

Medicare Part B premiums are set each year based on projected program costs. Federal law requires that beneficiary premiums cover a portion of expected spending on outpatient services.

For 2026, higher anticipated costs for physician services, outpatient care, and related medical services contributed to the premium increase. Rising healthcare utilization and higher prices for medical services are major drivers behind these adjustments.

The premium is recalculated annually using actuarial projections and updated cost data, which explains why the amount can change from year to year.

Higher Medicare Part B Deductible in 2026

In addition to the higher monthly premium, the Medicare Part B annual deductible has also increased for 2026.

- 2026 Part B deductible: $283

- 2025 Part B deductible: $257

This means beneficiaries must pay $283 out of pocket for covered Part B services before Medicare begins paying its share. After the deductible is met, Medicare generally covers 80 percent of the approved amount for most services, while beneficiaries pay the remaining 20 percent.

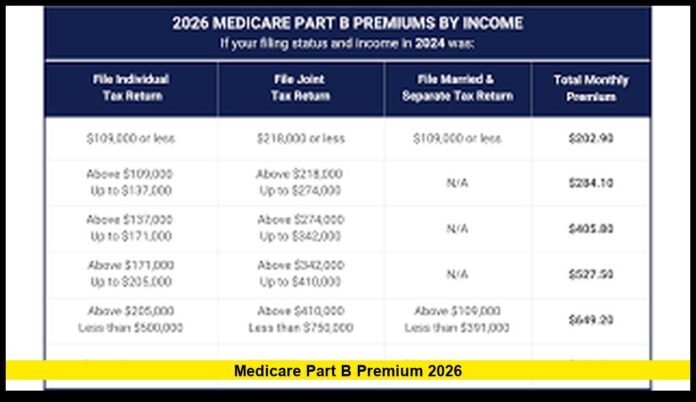

Income-Based Premium Adjustments (IRMAA)

Not everyone pays the standard Medicare Part B premium. Beneficiaries with higher incomes may be subject to Income-Related Monthly Adjustment Amounts, commonly known as IRMAA.

For 2026, individuals and married couples with incomes above certain thresholds will pay higher monthly premiums. These income levels are determined using tax return data from two years prior.

Higher-income beneficiaries may see their monthly Part B premiums rise well above the standard amount, depending on their income bracket. While only a minority of Medicare enrollees are affected by IRMAA, the added cost can be substantial.

Impact on Social Security Benefits

For most retirees, Medicare Part B premiums are deducted directly from Social Security checks. Although Social Security benefits increased in 2026 due to a cost-of-living adjustment, the larger increase in the Part B premium means a significant portion of that benefit increase may be absorbed by healthcare costs.

As a result, some beneficiaries may notice only a modest increase in their net monthly Social Security payment after the higher Medicare premium is deducted.

What New Medicare Enrollees Should Expect

People enrolling in Medicare Part B for the first time in 2026 will generally pay the standard $202.90 monthly premium, unless they qualify for income-based adjustments.

New enrollees should also be aware of enrollment deadlines, as delaying Part B enrollment without qualifying coverage can result in late enrollment penalties that permanently increase monthly premiums.

Assistance for Low-Income Beneficiaries

Some beneficiaries with limited income and resources may qualify for programs that help pay Medicare costs. These programs can cover Part B premiums and, in some cases, deductibles and coinsurance.

Eligibility requirements vary by state, but expanded outreach and streamlined enrollment processes have made it easier for eligible individuals to receive help paying Medicare expenses.

Other Medicare Cost Changes to Know About

While the Medicare Part B premium increase has drawn the most attention, other Medicare costs have also changed in 2026. These include adjustments to hospital deductibles under Part A and changes in benefits and cost-sharing for Medicare Advantage plans.

Because costs and benefits can vary widely depending on the type of coverage, beneficiaries are encouraged to review their Medicare options carefully each year.

Steps Beneficiaries Can Take to Prepare

With higher costs now in effect, Medicare beneficiaries may want to take proactive steps to manage expenses:

- Review current Medicare coverage and compare available options

- Confirm whether income-based adjustments apply

- Explore assistance programs if income is limited

- Monitor Social Security statements for premium deductions

- Consider discussing long-term healthcare planning with a trusted advisor

Planning ahead can help reduce financial strain and prevent unexpected expenses.

What This Means Going Forward

The medicare part b premium 2026 reflects broader trends in healthcare spending and underscores the importance of understanding how Medicare costs are determined. While the increase presents challenges for many households, staying informed allows beneficiaries to make better decisions about coverage and budgeting.

As healthcare costs continue to evolve, awareness and preparation remain essential for protecting both access to care and financial stability.

What do you think about the 2026 Medicare changes? Share your thoughts below and check back for future updates.