The long term capital gains tax rate continues to play a major role in how Americans invest, sell assets, and plan for future income, with federal law maintaining preferential rates of 0%, 15%, and 20% for qualifying gains. These rates remain in force today, applying to profits from assets held longer than one year and structured to reward long-term ownership rather than short-term trading.

For U.S. taxpayers, understanding how long-term capital gains are taxed is essential. From stock portfolios and real estate sales to inherited assets and dividend income, these rules directly affect after-tax returns and long-term financial outcomes.

Understanding Long-Term Capital Gains

A long-term capital gain occurs when an asset is sold for more than its purchase price after being held for more than 12 months. The holding period is critical. Assets sold before reaching the one-year mark are treated as short-term gains and taxed at ordinary income rates.

Long-term gains receive favorable treatment under federal tax law. This distinction reflects a policy choice to encourage stability in financial markets and long-term investment behavior rather than rapid buying and selling.

How the Long Term Capital Gains Tax Rate Works

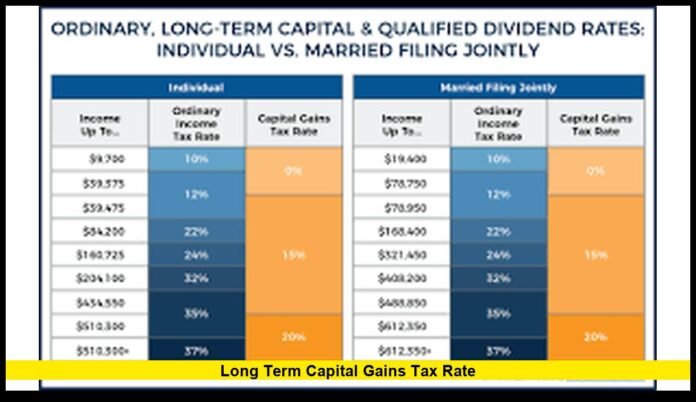

The long term capital gains tax rate is not a flat tax. Instead, it depends on a taxpayer’s total taxable income and filing status. Federal law divides long-term gains into three brackets:

- 0% rate for taxpayers within lower income ranges

- 15% rate for most middle-income earners

- 20% rate for high-income individuals and households

These brackets are indexed for inflation, meaning income thresholds are adjusted periodically to reflect changes in the cost of living. This adjustment helps prevent taxpayers from being pushed into higher tax rates solely due to inflation.

Why Long-Term Rates Are Lower Than Ordinary Income Taxes

Ordinary income, such as wages and salaries, is taxed at progressive rates that currently reach as high as 37% at the federal level. Long-term capital gains, by contrast, top out at 20% for most taxpayers, excluding additional surtaxes.

This gap can create meaningful tax savings. For investors deciding when to sell appreciated assets, the difference between long-term and short-term treatment can amount to thousands of dollars in reduced tax liability.

The 0% Capital Gains Opportunity

One of the most impactful features of the current system is the 0% long-term capital gains rate. Taxpayers whose taxable income falls below certain thresholds may owe no federal tax on qualifying gains.

This benefit is especially relevant for:

- Retirees with lower annual income

- Individuals temporarily earning less income

- Households with flexible timing on asset sales

Careful planning can allow some taxpayers to sell appreciated assets without triggering federal capital gains tax, as long as income remains within the 0% bracket.

Assets Commonly Subject to Long-Term Capital Gains

Long-term capital gains most often arise from the sale of:

- Publicly traded stocks and exchange-traded funds

- Mutual funds held longer than one year

- Real estate, including investment properties

- Ownership interests in businesses or partnerships

- Certain digital assets held beyond the one-year threshold

In each case, the tax applies only to the gain, not the total sale price. The gain is calculated by subtracting the asset’s adjusted cost basis from the sale proceeds.

Special Federal Rates for Certain Assets

Not all long-term gains receive the standard 0%, 15%, or 20% treatment. Federal tax law applies different rates to specific asset categories.

Collectibles

Items such as artwork, antiques, rare coins, and certain precious metals may be taxed at a maximum federal rate of 28%, even when held long term.

Depreciation Recapture on Real Estate

When depreciated real estate is sold, a portion of the gain related to depreciation may be taxed at a federal rate of up to 25%. This rule applies regardless of the taxpayer’s standard long-term capital gains bracket.

Understanding these distinctions is important for investors with diversified portfolios that include nontraditional assets.

Net Investment Income Tax and High Earners

Some taxpayers are subject to an additional federal levy known as the Net Investment Income Tax, which applies at a rate of 3.8% to certain investment income, including capital gains.

This surtax affects individuals and households whose income exceeds specific thresholds. For those taxpayers, the effective tax rate on long-term gains can exceed 20%, making comprehensive planning even more important.

State Taxes and Combined Impact

While federal rules receive most of the attention, state taxes can significantly influence total tax liability. States take different approaches:

- Some tax capital gains as ordinary income

- Some provide partial exclusions or preferential rates

- Some impose no income tax at all

The interaction between federal and state rules can substantially change the final amount owed, particularly for large asset sales such as real estate or business interests.

Qualified Dividends and Capital Gains Alignment

Qualified dividends are generally taxed at the same rates as long-term capital gains. This alignment allows dividend-paying investments to benefit from the same favorable tax structure when certain holding and eligibility requirements are met.

For income-focused investors, this rule can enhance after-tax returns and support long-term portfolio strategies.

Timing Matters More Than Many Realize

The exact timing of an asset sale can determine whether a gain qualifies as long term. Selling even one day before the one-year holding period ends can convert a gain into short-term income, subjecting it to much higher tax rates.

Investors often monitor holding periods closely, especially near year-end or during periods of market volatility, to ensure transactions receive long-term treatment.

Capital Losses and Their Role

Capital losses can be used to offset capital gains, reducing overall tax liability. When losses exceed gains, a limited amount may be used to offset ordinary income, with remaining losses carried forward to future tax years.

This mechanism allows investors to manage taxable income more effectively, particularly in years when gains are unusually high.

Long-Term Capital Gains and Retirement Planning

For retirees, the long term capital gains tax rate can significantly influence withdrawal strategies and asset liquidation decisions. Selling investments during lower-income years may reduce or eliminate federal capital gains taxes.

This planning approach can help stretch retirement savings and improve long-term financial security.

What Has Stayed the Same

Despite ongoing public debate around tax reform, the federal framework governing long-term capital gains has remained stable. The same three-tier rate structure continues to apply, and no new federal laws have altered these rates as of today.

Any future changes would require formal legislative action, and none are currently in effect.

Why Awareness Still Matters

Even without recent changes, misunderstandings about capital gains taxation remain common. Many taxpayers incorrectly assume all gains are taxed the same way or overlook the impact of holding periods, income levels, and special asset rules.

Clear knowledge of the long term capital gains tax rate allows investors to make informed decisions that align with both financial goals and tax efficiency.

Key Takeaways for U.S. Taxpayers

- Long-term gains apply only after assets are held more than one year

- Federal rates remain at 0%, 15%, and 20% based on income

- Special rates apply to collectibles and certain real estate gains

- High earners may face an additional 3.8% investment surtax

- Timing and income planning can significantly reduce taxes owed

These principles apply across a wide range of investment scenarios and remain relevant for both new and experienced investors.

Keeping track of the long term capital gains tax rate can help you protect more of your investment returns—share your perspective below or stay tuned for the latest confirmed updates.