The latest inflation data today in the United States confirms that inflation remains a significant influence on everyday life — affecting household budgets, consumer spending, and broader financial markets. Prices continue to rise across many categories, from groceries and energy to shelter and services.

📊 Most Recent Inflation Figures

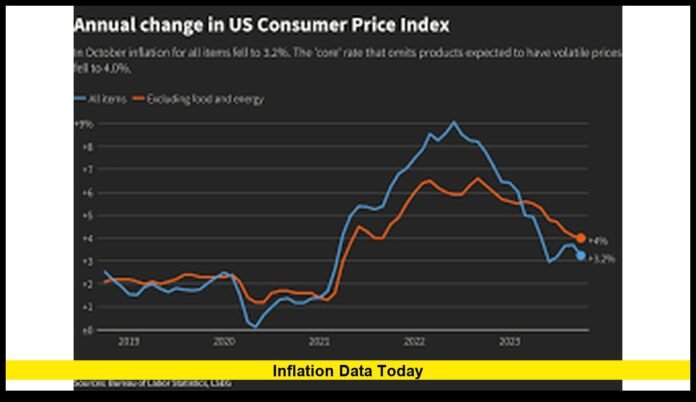

- The Consumer Price Index (CPI) for all urban consumers rose 3.0% over the 12 months ending in September 2025.

- On a monthly (seasonally adjusted) basis, the CPI increased 0.3% in September 2025.

- The core CPI — which excludes food and energy — also rose by 3.0% year-over-year, signaling persistent inflation across goods and services beyond the more volatile categories.

- Over the past year, energy prices climbed about 2.8%, while food costs increased around 3.1%.

These numbers show that inflation remains a daily reality, not just a headline figure. Costs continue to creep upward, and many households feel the impact when they shop for essentials, pay for utilities, or budget for rent and services.

🔎 What Is Driving Inflation

Several major factors contribute to ongoing inflation:

- Housing and shelter costs: Rent and owners’ equivalent rent indexes have risen steadily. A tight rental market combined with high demand drives up housing costs. Many renters and homeowners are seeing monthly expenses rising for shelter and related costs.

- Food and groceries: Everyday staples — produce, meats, dairy, packaged foods — are more expensive. Dining out costs are also elevated, putting pressure on both grocery budgets and restaurant spending.

- Energy and fuel: Gasoline, heating oil, and utility costs remain elevated. Fluctuations in global energy markets often work their way to local gas stations and utility bills, affecting household budgets directly.

- Goods and services across the board: From medical care and household supplies to transportation, recreation, and personal services — many categories are seeing moderate but steady price increases. That means inflation isn’t confined to just a few items; it is broadly felt across daily living.

As a result, families are facing higher costs across multiple fronts. Even those who might cut back in one area (say dining out) may still find pressure in other areas like housing or utility bills.

💡 How Inflation Affects Everyday Americans

• Shrinking Purchasing Power

When inflation hovers around 3.0%, a dollar doesn’t stretch as far as it used to. Groceries, fuel, rent, and utilities take up more of the household budget than before. For people on fixed incomes — retirees, those living paycheck to paycheck — this can feel especially painful.

• Savings Lose Value Over Time

If savings or cash holdings don’t earn interest that keeps up with inflation, their real value erodes. For individuals saving for long-term goals — retirement, education, large purchases — this makes maintaining purchasing power more challenging.

• Higher Borrowing Costs and Financial Decisions

Inflation and economic conditions influence monetary policy. If inflation stays elevated, interest rates on mortgages, loans, and credit could rise or remain high, increasing borrowing costs. That influences decisions around buying homes, cars, or making other big-ticket purchases.

• Wage Pressure and Cost-of-Living Adjustments

Employees may feel pressure to negotiate higher pay to keep up with rising costs — especially in sectors where labor demand remains high. On the flip side, employers may face challenges balancing wage demands with operating costs.

• Budgeting Becomes More Complex

With many everyday expenses rising — from food to utilities to rent — families may need to tighten budgets, cut back on discretionary spending, or re-evaluate long-term financial plans.

📉 Economy-Wide and Market Impacts

A 3.0% inflation rate impacts not just households — it changes how businesses operate and how markets react.

- Consumer behavior shifts: When prices rise, people may delay big purchases, reduce discretionary spending, or prioritize essentials. That can slow demand in sectors like retail, travel, and non-essential services.

- Business cost pressures: As their own costs for materials, utilities, wages, and logistics rise, businesses may increase prices to maintain margins. That can feed a cycle of further inflation if demand holds.

- Interest rate and policy uncertainty: Policy makers and central banks — observing persistent inflation — must decide whether to maintain or adjust interest rates. That affects mortgages, savings rates, and overall economic growth.

- Market volatility: Inflation surprises or unexpected inflation data can cause swings in bond yields, stock valuations, and investor sentiment. Uncertainty about future inflation often creates volatility in financial markets.

🔮 What’s Coming Next — What to Watch For

- The next full CPI release covering data beyond September 2025 is scheduled for mid-December 2025. This upcoming report will be key to understanding whether inflation is moderating, accelerating, or remaining stable.

- Other inflation measures — such as the price index used by the Fed — may offer additional insight into long-term trends. Markets and households alike will watch those closely.

- Energy prices, global supply chain pressures, and demand for housing remain wildcards. Volatile energy costs or a housing crunch could push inflation higher. Conversely, improved supply conditions or energy stability might ease pressure.

- Wage trends will matter. If wages rise in response to inflation, some households might keep up with rising costs. If wages remain flat, many could struggle to preserve purchasing power.

🛠 What You Can Do to Mitigate Impact

If rising inflation is affecting your budget, here are some practical steps to consider:

- Review and adjust your household budget: Identify areas where you can trim expenses or find cheaper alternatives — from groceries to utilities to discretionary spending.

- Build an emergency fund: Having savings set aside helps cover unexpected cost increases or financial shocks.

- Consider fixed-rate loans for big purchases: Fixed rates protect against future interest rate hikes if inflation and rates climb.

- Shop smart for essentials: Compare prices, use discounts or coupons, and opt for generic brands where possible.

- Monitor inflation trends: Stay aware of upcoming inflation reports and economic indicators. Predicting when costs might ease or rise again can help with financial planning.

🧭 What This Means for the Near Future

Even though the current inflation rate is much lower than the double-digit highs of recent years, a 3.0% yearly increase still exacts a real cost on American households. That means tighter budgets, more careful spending, and ongoing pressure on savings.

Core inflation’s persistence — even after stripping out food and energy — suggests inflation is not just driven by short-term spikes. It reflects structural price pressures across goods and services. That means many of today’s higher costs are likely to stick around for a while.

For individuals and families, that could mean rethinking financial plans, prioritizing essentials, and watching discretionary spending closely. For policymakers and markets, it means uncertainty over interest rates, borrowing costs, and economic growth.

The upcoming CPI release and any related inflation reports over the next months will be crucial. They could shift expectations, influence interest-rate decisions, and determine whether inflation continues creeping upward, stabilizes, or begins declining.

Curious how inflation has affected your personal spending lately? Share your thoughts or observations in the comments below — and keep checking back as we track upcoming data together.