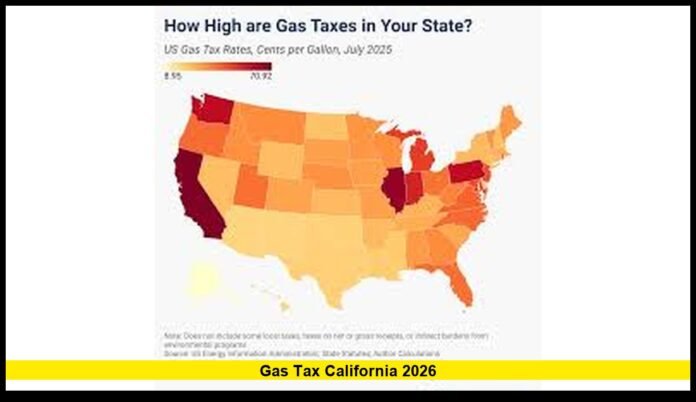

Gas tax California 2026 continues to affect millions of drivers as the state relies on fuel taxes to maintain highways, bridges, and local roads. In 2026, California still enforces one of the highest gasoline excise tax rates in the country, while policymakers closely examine whether the current system can keep pace with changing vehicle trends and long-term infrastructure demands.

With fuel efficiency improving and electric vehicles becoming more common, the gas tax remains stable in law but increasingly central to statewide debate. This article explains the confirmed facts, current rates, and policy actions shaping California’s gas tax in 2026, without speculation or outdated claims.

Current Gas Tax Rates in California for 2026

As of 2026, California’s gasoline excise tax is set at 61.2 cents per gallon. This rate applies statewide and reflects inflation-based adjustments required under existing statutes. Diesel fuel is taxed separately under a different rate schedule, but it remains part of the same transportation funding framework.

The gas tax rate itself did not come from a new vote or emergency legislation in 2026. It is the result of automatic indexing built into California law, which adjusts fuel taxes to account for rising costs over time.

For drivers, this excise tax is charged before other costs are added. While it is a major component, it is not the sole reason gasoline prices fluctuate.

How the Gas Tax Fits Into the Price Drivers Pay

Many drivers associate higher gas prices directly with taxes, but the gas tax represents only one part of the final amount paid at the pump.

The full price of gasoline in California includes:

- The state excise tax per gallon

- Wholesale fuel costs

- Refining and distribution expenses

- Environmental compliance costs

- State and local sales taxes

Because of these layers, fuel prices can rise or fall even when the gas tax remains unchanged. In 2026, this distinction remains important as drivers assess why prices differ across regions and over time.

Why the Gas Tax Is a Central Issue in 2026

The gas tax has long been California’s primary tool for funding transportation infrastructure. However, several confirmed developments are putting pressure on this model.

Fuel efficiency continues to improve. Modern vehicles travel farther using less gasoline, which reduces the amount of tax collected per mile driven.

Electric vehicles are also becoming more common across California. These vehicles do not purchase gasoline and therefore do not contribute to gas tax revenue, even though they rely on the same roads and highways.

At the same time, California maintains one of the largest transportation networks in the United States. Roads, bridges, and transit systems require consistent funding for maintenance, safety upgrades, and repairs.

These realities have led lawmakers to examine whether the gas tax alone can meet future needs.

Legislative Developments Confirmed in 2026

In 2026, California has not replaced or removed the gas tax. Instead, lawmakers have taken a procedural step focused on long-term planning.

State legislation extended the operation of the Road Usage Charge Technical Advisory Committee, a body tasked with studying alternative methods of transportation funding. The committee’s mandate is limited to analysis and recommendations.

The committee is expected to deliver its findings to lawmakers by January 1, 2027. Its work does not authorize new taxes, fees, or pilot programs for drivers in 2026.

No mileage-based charges have been approved, implemented, or scheduled during this year.

Understanding the Mileage-Based Funding Discussion

A mileage-based funding system would charge drivers based on how far they travel rather than how much fuel they buy. Supporters argue this approach better reflects actual road use, particularly as gasoline consumption declines.

Opponents raise concerns about cost impacts, fairness, and privacy. Drivers in rural areas often travel longer distances, which could result in higher costs under a mileage-based structure.

As of 2026, these discussions remain analytical. California drivers are not being billed per mile, and the gas tax remains the only statewide road-use charge tied directly to fuel consumption.

Public Reaction and Political Response

Transportation costs remain a sensitive topic for Californians. Many drivers already face high fuel prices compared with other states, making any discussion of alternative charges controversial.

Some lawmakers and advocacy groups argue that the gas tax places a disproportionate burden on working families. Others emphasize that infrastructure requires reliable funding to remain safe and functional.

Despite strong opinions on all sides, the only confirmed policy affecting drivers in 2026 is the existing gas tax structure.

How Gas Tax Revenue Is Protected

California voters approved constitutional protections that restrict how gas tax revenue can be used. Funds collected from gasoline and diesel taxes are legally reserved for transportation-related purposes.

These uses include:

- Road and highway maintenance

- Bridge repairs and seismic safety improvements

- Local street and road projects

- Public transportation infrastructure

This restriction remains in effect in 2026, ensuring that fuel tax revenue cannot be diverted to unrelated state spending.

The Role of Inflation Adjustments

One reason the gas tax remains a focal point is its built-in inflation adjustment. Rather than requiring new votes or legislation, California law allows fuel tax rates to adjust periodically to reflect rising costs.

In 2026, this mechanism continues to operate as designed. While it can result in small increases over time, it also provides predictable funding for long-term projects.

For drivers, this means changes to the gas tax typically occur gradually rather than suddenly.

What Drivers Can Expect for the Rest of 2026

For the remainder of 2026, California drivers should expect stability rather than major shifts. The gas tax rate is set for the fiscal year, and no additional increases beyond scheduled adjustments have been approved.

The next major development will occur in 2027, when lawmakers review recommendations related to future transportation funding models.

Any change to how drivers are charged would require new legislation, public debate, and formal approval.

Why Gas Tax California 2026 Matters Beyond the State

California’s transportation policies often influence national conversations. As other states face similar challenges with declining fuel tax revenue, California’s approach in 2026 is being closely watched.

The decisions made now may shape how states across the country fund infrastructure in an era of cleaner vehicles and changing driving habits.

For now, California continues to rely on its established gas tax system while evaluating long-term solutions.

Key Takeaways for Drivers

- California’s gasoline excise tax in 2026 is 61.2 cents per gallon

- The gas tax remains in effect with no replacement approved

- Mileage-based funding is being studied, not implemented

- Gas tax revenue is restricted to transportation uses

- No new statewide driving charges have been enacted this year

How do you feel about California’s current gas tax system and its future direction? Share your thoughts and keep checking back for verified updates as policies develop.