Understanding liquidation vs bankruptcy has never been more important for Americans watching the shifting financial landscape in 2025. Rising costs, tighter lending standards, and slowed revenue growth have pushed many companies to choose between reorganization and full shutdown. The decisions businesses make have direct consequences for employees, customers, investors, and entire communities, which is why the distinction between liquidation and bankruptcy matters so much today.

Across industries, companies are assessing whether they can recover from financial strain or whether a final wind-down is necessary. This year’s economic environment has shown that even long-standing businesses must confront difficult choices, and everyday Americans are eager to understand what each option involves. This article breaks down both processes clearly, offering an up-to-date look at how they work and why they continue to shape the 2025 economic picture.

What Bankruptcy Means in Today’s U.S. Economy

Bankruptcy is a federal legal process that helps individuals or businesses manage debt when obligations become impossible to meet. It provides legal protection, time, and structure while the filer works to reorganize their finances or eliminate certain debts. The goal is either recovery or an orderly resolution.

Chapter 7 Bankruptcy

Chapter 7 is the most final and direct form of bankruptcy for businesses and some individuals. It involves the sale of nonexempt assets and the distribution of proceeds to creditors. For companies, Chapter 7 typically results in closure. For individuals, it can eliminate unsecured debt such as credit cards and medical bills.

A trustee handles the sale of assets and ensures that funds are distributed according to federal rules.

Chapter 11 Bankruptcy

Chapter 11 is often used by companies seeking a second chance. The business continues operating, sometimes with new financing, as it restructures debt, renegotiates contracts, or sells selected assets.

The aim is not closure but survival.

Some Chapter 11 cases succeed, allowing companies to return to normal operations with healthier finances. Others eventually convert to liquidation if the business cannot regain stability.

Chapter 13 Bankruptcy

Chapter 13 applies to individuals who want to keep their assets while repaying debt over time. Instead of liquidation, the filer makes structured payments to creditors. This chapter offers homeowners and wage earners a chance to recover from temporary hardships.

Bankruptcy is designed to balance relief for debtors with fairness to creditors. It offers protection from aggressive collections while allowing legal oversight to guide the outcome.

What Liquidation Means for Businesses and Individuals

Liquidation is the sale of assets to pay creditors. It can occur inside bankruptcy—most commonly within Chapter 7—or outside the federal court system through state procedures or business wind-down agreements.

Key Features of Liquidation

- Assets such as equipment, real estate, vehicles, contracts, and inventory may be sold.

- Creditors receive payment in a specific legal order.

- Most businesses do not reopen after completing liquidation.

- Once assets are sold and funds are distributed, the entity typically dissolves.

Liquidation is final. While bankruptcy may offer a pathway to recovery, liquidation is the end of the business’s life cycle.

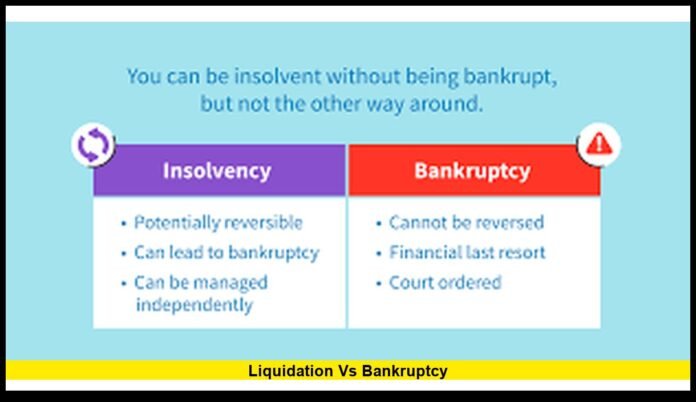

Liquidation vs Bankruptcy: The Distinction That Matters

Although these two terms often appear together, they are not interchangeable.

At a Glance

| Feature | Liquidation | Bankruptcy |

|---|---|---|

| Purpose | Convert assets to cash | Reorganize or eliminate debt |

| Outcome | Business closes | Business may survive |

| Legal Status | Can occur with or without bankruptcy | Always a federal legal process |

| Who Oversees | Trustee or representative | Court, trustee when required |

| Employee Impact | Jobs typically end | Jobs may continue |

| Flexibility | No path to recovery | Options allow reorganization |

Liquidation is an action. Bankruptcy is a legal status. Bankruptcy can include liquidation, but liquidation does not require bankruptcy.

This difference shapes the options available to companies facing financial hardship.

Why More U.S. Companies Face This Choice in 2025

Financial stress has increased across multiple sectors this year. Several factors have pushed businesses to evaluate whether they can reorganize or must shut down permanently.

1. Higher Borrowing Costs

Interest rates remain elevated. Companies that relied on debt before costs increased now face bills that exceed their cash flow, forcing many to consider formal restructuring.

2. Shifts in Consumer Spending

Americans have adjusted their spending habits, reducing purchases in some categories while increasing them in others. Businesses that cannot adapt quickly face declining revenue.

3. Supply Chain Pressures

Although supply chains have improved compared to earlier years, certain materials and transportation services remain costly. Long-term contracts signed during stronger economic periods now create financial strain.

4. Commercial Real Estate Challenges

Office vacancies and retail downsizing have lowered revenue for landlords and tenants. Businesses in affected locations often struggle with underperforming stores or lease obligations they cannot afford.

5. Changing Investment Priorities

Investors are more cautious in 2025. Companies that depended on aggressive growth financing now face limited capital options.

These conditions have made liquidation and bankruptcy central topics in financial discussions across the country.

How Liquidation Works Inside Bankruptcy

When liquidation occurs within bankruptcy, the process is structured and supervised.

Steps in a Typical Chapter 7 Liquidation

- Filing initiates legal protection from creditors.

- A trustee is appointed to control nonexempt assets.

- The trustee reviews records, identifies assets, and manages sales.

- Sales may involve auctions, private deals, or bulk transfers.

- Proceeds are distributed to creditors according to federal priority rules.

- Remaining eligible debts may be wiped out.

- The case closes once funds are distributed and reports are filed.

This orderly system ensures that creditors receive fair treatment and that debtors follow established legal guidelines.

Liquidation Through Chapter 11

Some Chapter 11 cases start with the hope of recovery but shift to liquidation when revenue does not stabilize. In these situations:

- The business may continue operating temporarily.

- A plan is developed outlining how assets will be sold.

- The court must approve the liquidation plan.

This route can sometimes provide better returns for creditors because assets may be sold strategically rather than quickly.

How Bankruptcy Works Without Liquidation

Not all bankruptcies involve selling assets. Many reorganizations lead to successful recovery.

Businesses May Recover by:

- Reducing operating costs

- Renegotiating leases or supply contracts

- Consolidating debt

- Obtaining temporary financing

- Selling nonessential divisions

- Restructuring management or operations

Bankruptcy gives companies tools to survive downturns and adapt to changing markets.

Why the Liquidation vs Bankruptcy Decision Matters for Americans

Impact on Jobs

In liquidation, employment usually ends quickly.

In bankruptcy reorganization, many positions may remain.

Impact on Customers

Consumers may lose access to services, warranties, or refund opportunities if a business closes during liquidation.

Impact on Investors

Equity often becomes worthless in liquidation but may retain value in a successful reorganization.

Impact on Creditors

Suppliers and lenders closely track whether a partner business chooses recovery or closure, as their financial return depends on the outcome.

Understanding the distinction prepares Americans for how corporate decisions can influence their finances, their community, and their daily life.

Frequently Asked Questions (FAQ)

1. Is liquidation the same as bankruptcy?

No. Bankruptcy is a legal process, while liquidation is the sale of assets. Bankruptcy may include liquidation, but they are not the same thing.

2. Can a business continue after liquidation?

No. Liquidation ends operations permanently because assets are sold and the company dissolves.

3. Can a business survive Chapter 11 bankruptcy?

Yes. Many companies reorganize successfully and continue operating with a healthier financial structure.

4. Do employees lose their jobs in liquidation?

Most do. Liquidation generally means immediate or near-term shutdown.

5. Which option gives creditors higher recovery?

It varies, but creditors often receive more through reorganization than liquidation, depending on asset value and business viability.

6. Can liquidation happen without going to bankruptcy court?

Yes. Businesses may use state procedures or voluntary agreements to liquidate outside federal bankruptcy.

7. How long does liquidation take?

It depends on the size and complexity of the business. Some cases finish within months; others take several years.

8. What debts can bankruptcy eliminate?

Unsecured debts are the most commonly eliminated, though specifics vary based on the chapter filed.

9. Does bankruptcy always include selling assets?

No. Many reorganizations allow businesses or individuals to keep assets while restructuring debt.

10. What determines whether a company files Chapter 7 or Chapter 11?

The choice depends on the business’s ability to continue operating. If recovery is impossible, Chapter 7 becomes the likely path.

If you have thoughts or experiences related to liquidation vs bankruptcy in today’s financial climate, feel free to share your perspective in the comments.