The max IRA contribution is one of the most important benchmarks for retirement savers in 2025. Each year, the IRS adjusts contribution limits to account for inflation, and these numbers directly impact how much individuals can save in tax-advantaged accounts. Whether you use a Traditional IRA, a Roth IRA, or a combination of both, staying informed about the maximum contribution helps you make the most of tax benefits and long-term growth.

For 2025, the max IRA contribution gives savers more opportunities to strengthen retirement portfolios. This detailed guide explains the exact limits, eligibility rules, tax impacts, strategies for maximizing contributions, and how hitting the maximum year after year can transform your financial future.

What Is the Max IRA Contribution in 2025?

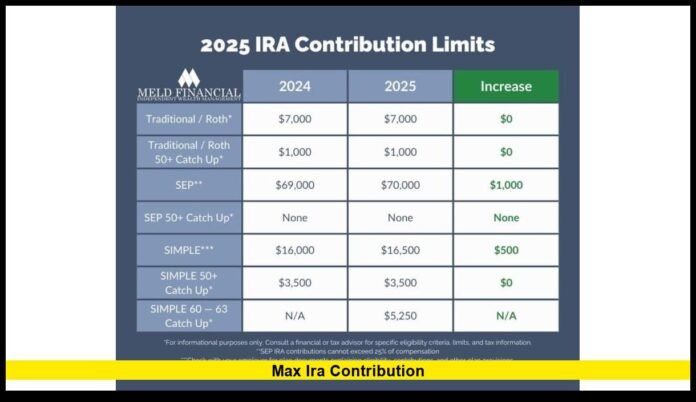

The IRS has set the max IRA contribution for 2025 at:

- $7,500 for individuals under age 50

- $8,500 for individuals aged 50 and older (including a $1,000 catch-up contribution)

This annual limit applies to the total contributions made to both Traditional IRAs and Roth IRAs. For example, you can split contributions between both types, but the combined amount cannot exceed the yearly maximum.

Why the Max IRA Contribution Matters

The IRA limit might look like just a number, but it represents your opportunity to build long-term wealth with tax advantages.

Key Reasons It Matters

- Tax Reduction: Traditional IRA contributions may be deductible, lowering your taxable income.

- Tax-Free Growth: Roth IRA contributions don’t provide upfront deductions but allow tax-free withdrawals in retirement.

- Catch-Up Flexibility: Older savers can contribute extra, giving them a chance to boost balances late in their careers.

- Compounding Advantage: Even a few thousand dollars more each year can add hundreds of thousands of dollars by retirement.

If you consistently hit the max IRA contribution, you dramatically increase your chances of financial independence in retirement.

Traditional IRA vs. Roth IRA: Contribution Rules

Both account types share the same max IRA contribution limits but differ in tax treatment.

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contribution Source | Pre-tax (potentially deductible) | After-tax |

| Tax Benefit | Lowers taxable income now | Tax-free withdrawals later |

| Growth | Tax-deferred | Tax-free |

| Withdrawals | Taxed as income | Tax-free (if qualified) |

| Required Minimum Distributions (RMDs) | Yes, at age 73 | None during lifetime |

Choosing between the two depends on your income, tax bracket, and retirement goals. Some savers split contributions between both to diversify tax exposure.

Income Limits for IRA Contributions

Not everyone can take full advantage of IRA contributions, especially at higher incomes.

Traditional IRA Deduction Phaseouts

- If neither you nor your spouse is covered by a workplace retirement plan, contributions are fully deductible.

- If covered by a plan, deductibility phases out at higher incomes, with thresholds in the mid-$70,000s for singles and around $120,000 for married couples.

Roth IRA Income Limits

- High earners may see contribution limits phased out above certain thresholds.

- Those exceeding the limit often use the backdoor Roth IRA strategy, contributing to a Traditional IRA and then converting it to Roth.

These rules make income level an essential factor in how you approach the max IRA contribution.

How to Reach the Max IRA Contribution

Contributing the maximum may feel challenging, but several strategies make it achievable.

1. Automate Contributions

Set up monthly or biweekly contributions from your bank account to spread the amount across the year.

- Example: $7,500 ÷ 12 months = $625/month.

- Example: $8,500 ÷ 12 months = ~$708/month for those 50+.

2. Start Early Each Year

Contributing early gives your money more time to grow. Even a few months of extra compounding adds up over decades.

3. Use Bonuses and Refunds

Allocate work bonuses, tax refunds, or side income toward IRA contributions to hit the max without straining your monthly budget.

4. Prioritize Catch-Up Contributions

If you’re 50 or older, the $1,000 catch-up is invaluable. Over 10 years, it adds $10,000 plus growth.

5. Split Contributions for Tax Balance

Use both Traditional and Roth IRAs (if eligible) to balance current tax deductions and future tax-free withdrawals.

Long-Term Impact of Max IRA Contributions

The numbers speak for themselves:

- Contributing $7,500 annually from age 25 to 65, with 7% growth, yields over $1.5 million.

- Starting at 40, the same contributions for 25 years still grow to $500,000+.

- Starting at 55 with $8,500 annual contributions for 10 years can add over $120,000 before retirement.

The earlier and more consistently you max out, the more powerful the compounding effect.

Coordination with 401(k) Plans

The IRA contribution limit is separate from the 401(k) contribution limit. This allows savers to combine both for greater overall retirement savings.

- 2025 401(k) limit: $23,500 for under 50, higher with catch-ups.

- 2025 IRA limit: $7,500 (or $8,500 for 50+).

Together, workers can save over $31,000 annually in tax-advantaged accounts. This combination is one of the most powerful ways to secure retirement.

Planning for Different Life Stages

Young Professionals

- Best suited for Roth IRA contributions due to lower current tax brackets.

- Even small contributions have decades to grow.

Mid-Career Employees

- Can benefit from splitting between Roth and Traditional IRAs.

- Often in higher income years, so tax deductions matter.

Near-Retirees (50+)

- Should take full advantage of catch-up contributions.

- May consider Roth conversions for tax flexibility.

Common Mistakes with IRA Contributions

- Exceeding the Limit: Over-contributing triggers a 6% penalty until corrected.

- Missing the Deadline: Contributions must be made by Tax Day of the following year.

- Not Coordinating with Spouse: Couples can each contribute, even if one doesn’t work, using a Spousal IRA.

- Ignoring Income Rules: Roth contributions can be limited at high incomes.

- Procrastinating: Waiting until year-end reduces the compounding period.

Example Savings Journeys

Saver A (Age 25): Contributes $7,500 every year for 40 years → $1.5M+ at retirement.

Saver B (Age 40): Contributes $7,500 for 25 years → $500,000+.

Saver C (Age 55): Contributes $8,500 with catch-up for 10 years → $120,000+.

Even late starters see meaningful results by maxing out contributions.

How to Avoid Over-Contributing

- Track contributions across all accounts (Traditional + Roth).

- Confirm employer payroll systems don’t misreport IRA deposits.

- Withdraw excess contributions before the tax deadline to avoid penalties.

Contribution Deadlines

IRA contributions for a given year can be made until Tax Day of the following year. For 2025, the deadline is April 15, 2026. This flexibility allows savers to adjust based on taxes and income.

Tips to Stay Consistent

- Increase contributions by 1–2% annually until hitting the max.

- Treat IRA contributions as non-negotiable, like a monthly bill.

- Use financial apps or planners to track progress.

- Combine with an HSA (Health Savings Account) for extra tax-advantaged savings.

FAQs

1. What is the max IRA contribution for 2025?

The max IRA contribution is $7,500 for those under 50 and $8,500 for those 50 and older.

2. Can I contribute to both a Roth and Traditional IRA?

Yes, but the combined total cannot exceed the annual max IRA contribution.

3. What happens if I exceed the limit?

Excess contributions are subject to a 6% penalty each year until corrected. Withdraw the excess by the tax deadline to avoid penalties.

Final Thoughts

The max IRA contribution is a critical number for anyone serious about retirement planning. For 2025, the ability to save up to $7,500 (or $8,500 with catch-up) in a tax-advantaged account provides tremendous potential. By contributing consistently, using catch-up provisions, and coordinating with 401(k) savings, individuals can build meaningful wealth over time.

Even if you can’t contribute the maximum every year, working toward that goal and increasing contributions gradually can put you on track for long-term success.

Have you reviewed your IRA contributions for 2025 yet? Now is the perfect time to plan and make sure you’re maximizing your retirement potential.

Disclaimer

This article is for informational purposes only. It does not provide financial, tax, or legal advice. Always consult a financial advisor or tax professional before making retirement planning decisions.