The 2026 tax brackets are now officially in effect, bringing the most recent changes to federal income taxation that will influence how millions of Americans plan, earn, and pay taxes this year. Updated income thresholds, larger deductions, enhanced tax credits, new benefit rules, and—even more positive personalization for seniors and working families—are reshaping the U.S. tax landscape for 2026 and beyond.

In early 2026, taxpayers across the country are already feeling the impact of new tax withholding tables and the full implementation of the One Big Beautiful Bill Act (OBBBA), which was signed into law in mid-2025. These updates include permanent enhancements to earlier tax reforms, inflation-adjusted bracket boosts, expanded deductions, and other benefits designed to prevent inflation from eroding taxpayers’ buying power while offering strategic opportunities for financial planning.

This comprehensive guide breaks down exactly what’s new, what’s changed, and what it means for your money in 2026—from your paycheck to your refund and beyond.

Why the 2026 Tax Brackets Matter to You

Simply put, the federal government uses tax brackets to determine how your income is taxed. Because the U.S. operates a progressive tax system, each layer of income gets taxed at a different rate. When the IRS updates tax brackets and inflation adjustments, the goal is to:

- Prevent “bracket creep,” where inflation pushes taxpayers into higher tax rates without increasing real income

- Increase take-home pay through updated payroll withholding

- Expand deductions and credits that keep more money in your pocket

- Encourage long-term financial planning and savings

Taxpayers should understand these updates because they influence decisions ranging from retirement contributions and estimated tax payments to daily budgeting and year-end planning.

What Has Changed With 2026 Tax Brackets?

For the 2026 tax year, income tax brackets have been officially adjusted upward. These adjustments are based on annual inflation calculations and are now part of the permanent tax structure under the One Big Beautiful Bill Act. The changes also include enhancements to deductions and credits that go beyond basic bracket adjustments.

2026 Federal Income Tax Brackets

The federal tax system in the U.S. remains structured around seven marginal tax rates. Here’s how the updated 2026 tax brackets are arranged for key filing statuses:

| Tax Rate | Single Filers | Married Filing Jointly |

|---|---|---|

| 10% | $0 – $12,400 | $0 – $24,800 |

| 12% | $12,401 – $50,400 | $24,801 – $100,800 |

| 22% | $50,401 – $105,700 | $100,801 – $211,400 |

| 24% | $105,701 – $201,775 | $211,401 – $403,550 |

| 32% | $201,776 – $256,225 | $403,551 – $512,450 |

| 35% | $256,226 – $640,600 | $512,451 – $768,700 |

| 37% | Over $640,600 | Over $768,700 |

These changes reflect careful inflation indexing so that average income earners do not get shifted into higher tax rates merely because prices have risen. The progressive nature of the tax schedule still applies, meaning only the income within each range is taxed at that tier’s rate, not all income at one flat percentage.

This update applies to income earned in 2026 and will be reflected when taxpayers file their returns in early 2027.

Standard Deduction Increases and What They Mean

One of the most noticeable changes for taxpayers in 2026 is the increase in the standard deduction—the default deduction that most individuals and couples take instead of itemizing.

Here are the updated standard deduction levels:

- Single filers: $16,100

- Married filing jointly: $32,200

- Heads of household: $24,150

For taxpayers 65 or older, there are additional standard deduction increases, providing further reduction in taxable income. These increased deduction amounts are part of the annual inflation adjustment that now comes under the permanent tax code courtesy of the One Big Beautiful Bill Act.

Compared to previous years, these boosted deductions mean that more of your income is shielded from taxation before the brackets even apply, which can lead to lower overall tax bills for millions of Americans.

Expanded Tax Credits and Other Benefits in 2026

Beyond the standard deduction and brackets, the 2026 tax year comes with several key updates that can affect your overall tax burden.

Enhanced Earned Income Tax Credit (EITC)

The Earned Income Tax Credit, which benefits working individuals and families, has seen an increase in the maximum amount allowed. While targeted to lower- and moderate-income households, this change helps many taxpayers reduce what they owe or increase refunds.

Seniors’ Social Security Deduction

A major addition for the 2026 tax year is a $6,000 federal tax deduction for Americans age 65 and older who pay taxes on Social Security income. This new benefit aims to reduce taxable income for retirees and is a welcomed update for older taxpayers.

Employer-Provided Childcare Credit Expansion

The employer-provided childcare tax credit now supports larger amounts, giving both businesses and working families a chance to save more. This includes an increase in the maximum allowable amount for eligible employers, making childcare benefits more affordable and reducing federal tax liability for qualifying businesses.

Higher Adoption and Fringe Credits

The adoption tax credit and employer-provided benefits, like qualified transportation subsidies, have also increased. These adjustments help parents and employees manage the high costs associated with adoption and commuting.

Other IRS Adjustments Affecting 2026 Taxes

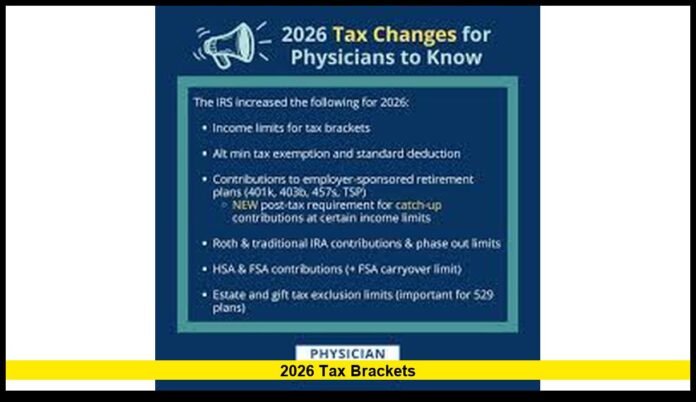

In addition to the bracket and deduction updates, the IRS widened several other parameters that impact taxpayers:

- Alternative Minimum Tax (AMT) exemptions have increased, helping more taxpayers avoid the AMT.

- Estate tax exclusion amounts are higher, providing larger threshold limits for estate planning.

- Foreign earned income exclusion and health savings account limits have been raised, which can help freelancers, expats, and savers.

- Qualified transportation fringe benefit limits have been adjusted to reflect current commuting costs.

These seemingly smaller adjustments can add up to significant savings or planning considerations for applicable taxpayers.

How 2026 Tax Bracket Changes Affect Your Paycheck

When your employer calculates withholding for your paychecks, they use IRS tables that reflect current tax brackets and deductions. Because the IRS updated its 2026 withholding tables, many workers across the country will see slightly higher take-home pay throughout the year. These changes help ensure that less money is withheld than in prior years, meaning your net pay remains closer to what you take home rather than being held until you file.

This doesn’t necessarily change your overall tax bill but spreads tax savings out during the year instead of seeing a large refund after filing.

State Income Tax and You

While this guide focuses on federal tax brackets, there are also important developments at the state level. Several states have enacted income tax reductions effective for 2026, which may interact with your federal tax picture and overall financial planning.

Keep in mind that state tax systems vary widely, with some states having flat tax rates, others progressive systems like the federal brackets, and some having no income tax at all. If you live in a state with a newly lowered rate or adjusted bracket, your combined federal-plus-state tax burden could look very different than in prior years.

Planning Strategies to Maximize 2026 Tax Benefits

Now that you understand the new brackets and deductions, here are practical steps you can take:

1. Review and Update Your Withholding

With updated withholding tax tables, many taxpayers should check their W-4 forms to ensure withholdings align with their expected 2026 tax liability.

2. Maximize Retirement Contributions

Contributing more to retirement accounts like 401(k)s or IRAs helps reduce taxable income and may help keep you in a lower bracket.

3. Take Advantage of Credits

Credits like the EITC, childcare credits, and others can directly reduce your tax bill. Review eligibility carefully and plan to claim what you qualify for.

4. Plan Deductions Strategically

If you’re close to itemizing, knowing where your income falls in the bracket structure can help determine if itemizing or standard deduction use makes more sense.

Controversies and Future Proposals

Tax policy remains a lively topic in American politics. Some leaders have proposed even more radical changes, like eliminating federal income tax altogether or replacing it with alternative revenue mechanisms. While such proposals are not currently law, they signal ongoing debates that could influence future tax years.

What is clear heading into 2026 is that the current updates are meant to soften the impact of inflation while providing long-term stability and predictability for taxpayers.

The Bottom Line

The 2026 tax brackets and associated updates represent some of the most substantial changes in recent years. With higher bracket thresholds, increased standard deductions, expanded credits, and beneficial adjustments for retirees and working families, many Americans can expect real advantages from the new tax structure.

Understanding these changes now—before the 2027 filing season—gives you an edge in planning and optimizing your finances. Whether you aim to boost your refund, lower your taxable income, or manage withholdings more effectively, knowledge is your best financial tool.

Feel free to explore these topics further, share your experience, or ask questions in the comments below to stay informed on the latest 2026 tax developments.

FAQ

1. When do the 2026 tax brackets take effect?

The 2026 tax brackets apply to income earned during the 2026 calendar year and will be used for tax returns filed in early 2027.

2. Will most Americans owe less tax in 2026 compared to prior years?

Many taxpayers may see lower effective tax rates and higher refunds due to bracket adjustments and increased deductions, but individual results vary based on income, filing status, and eligible credits.

3. Do the 2026 federal changes affect state income tax?

Federal changes don’t directly change state tax law, but many states align their tax definitions with federal income, and several states have enacted their own income tax rate changes for 2026.

Disclaimer:

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Individual tax situations vary. Consult a qualified tax professional for guidance specific to your circumstances.