which states have inheritance tax matters a lot if you’re planning your estate or may inherit property, because only a handful of states impose this tax—versus estate tax—and rules vary widely. Knowing where these taxes apply can help protect your heirs.

Latest Insight: Which States Have Inheritance Tax

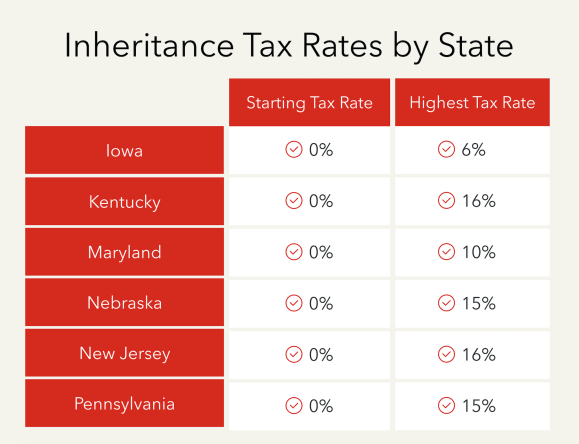

Inheritance tax exists in only a few U.S. states today. This tax falls on the recipient, not the estate. As of now, six states impose inheritance tax: Kentucky, Maryland, Nebraska, New Jersey, Pennsylvania, and Iowa—though Iowa is phasing it out by 2025.

Each state treats different beneficiaries differently. Spouses are universally exempt. In some states, children and grandchildren also pay little or no tax, while distant relatives and non-relatives face higher rates.

Key Points Summary (Quick Highlights for Fast Readers)

- States with inheritance tax: Six (Kentucky, Maryland, Nebraska, New Jersey, Pennsylvania, Iowa)

- Iowa’s phase-out: Ending inheritance tax by 2025

- Unique case: Maryland imposes both inheritance and estate tax

- Universal exemption: Surviving spouses always exempt

- Beneficiary tiered rates:

- Close relatives often tax-exempt or lower rates

- Distant heirs taxed at higher percentages

- Estate tax vs inheritance tax:

- Estate tax paid by estate before distribution

- Inheritance tax paid by heirs on amount received

Breakdown of States with Inheritance Tax

Kentucky

Inheritance tax applies to transfers except to spouses, parents, children, grandchildren, and siblings. Others may pay up to 16%, depending on their relation to the decedent.

Maryland

Unique among states, Maryland imposes both an estate tax and an inheritance tax. Spouses and many close relatives are exempt from inheritance tax (10%), while estates also face a separate estate tax before distribution.

Nebraska

Beneficiaries in Nebraska face varying rates:

- Close relatives: 1% over a set exemption

- More distant family: Up to 15% on inheriting above thresholds

New Jersey

New Jersey abolished its estate tax but retains an inheritance tax, generally up to 16%. Direct descendants and spouses are usually exempt; more distant heirs face higher rates.

Pennsylvania

Pennsylvania’s inheritance tax scales by relationship:

- Spouses and minor children: 0%

- Adult children and lineal heirs: 4.5%

- Siblings: 12%

- Others: 15%

Iowa

Iowa had inheritance tax but has been phasing it out. It is scheduled to be fully repealed by 2025, making it one of the few states to fully eliminate this tax recently.

How These Taxes Compare: Estate Tax vs Inheritance Tax

| Tax Type | Who Pays | Tax Trigger | Example Payer |

|---|---|---|---|

| Estate Tax | Estate itself | Estate value | Executor |

| Inheritance Tax | Beneficiary (heir) | Amount received | Heir (e.g., child) |

Only inheritance tax is being discussed here. Remember, estate tax applies to estates above exemption levels; inheritance tax hits beneficiaries based on relationship and amount inherited.

Why Knowing This Matters

Understanding which states have inheritance tax helps in several ways:

- Estate planning: You can design bequests to minimize tax burden.

- Real estate in different states: Even if you live in a tax-free state, inheriting property elsewhere may trigger inheritance tax in that state.

- Relationship matters: Beneficiaries closer to the decedent often pay little or no tax.

- Tax policy shifts: Iowa’s phase-out shows that legislative changes can affect planning.

Financial Planning Tips If You’re Affected

- Check beneficiary exemptions based on relationship and state law.

- Consider life insurance or liquid assets in jurisdictions with inheritance tax to help heirs pay liabilities.

- Plan bequests strategically to shift assets to untaxed-benefit vehicles or exempt beneficiaries.

- Coordinate with estate tax planning, especially in Maryland where both taxes apply.

- Stay alert to legal changes, like Iowa’s repeal timeline.

A Broader View: What Most States Do

Most states do not impose an inheritance tax. Some impose estate tax only; others have neither. For instance, states like California, Texas, Florida, and many others impose no inheritance or estate tax.

Real Estate and Out-of-State Taxes

If you own property in one of the inheritance tax states but live elsewhere, your heirs may still owe tax in the property’s location state. Coordinate with advisors to avoid surprises.

Conclusion

Now you know which states have inheritance tax, how rates vary by relationship, and why planning matters. With only six states imposing this tax (and one phasing it out), most Americans won’t face it—but if it could affect you, it’s crucial to plan carefully.

Have you or someone you know navigated inheritance tax complexities? Share your insights below—we’d love to hear how you’ve dealt with these varying state rules.

FAQs

Q1: Which states currently impose inheritance tax?

Kentucky, Maryland, Nebraska, New Jersey, Pennsylvania, and Iowa—but Iowa is phasing it out by 2025.

Q2: Who pays inheritance tax?

The beneficiary (heir) pays it and the rate depends on their relationship to the deceased and the state law.

Q3: Are spouses taxed under inheritance tax?

No. Spouses are universally exempt from inheritance tax in all states that impose it.