What is the Medicare Part B premium for 2026 is a critical question for millions of Americans who rely on Medicare to manage their healthcare needs. As of the most current and fully confirmed information available today, the standard Medicare Part B monthly premium for 2026 is $202.90. This amount applies nationwide and directly affects how much beneficiaries pay each month to maintain access to essential outpatient medical services.

Medicare Part B is not optional for most enrollees once they decide to receive comprehensive medical coverage. The premium increase for 2026 reflects higher healthcare costs, increased use of outpatient services, and changes in overall Medicare spending. For retirees, disabled individuals, and those living on fixed incomes, understanding this cost in detail is essential for effective financial planning.

This article provides a complete, factual, and U.S.-focused explanation of the Medicare Part B premium for 2026, including how it works, who pays more, how income affects premiums, and what beneficiaries should realistically expect throughout the year.

Confirmed Medicare Part B Premium Amount for 2026

The standard Medicare Part B premium for 2026 is $202.90 per month. This is the amount most beneficiaries will pay to remain enrolled in Part B coverage from January through December 2026.

This premium represents an increase of $17.90 per month compared to the previous year. Over the course of a full year, that difference adds up to more than two hundred dollars in additional healthcare costs for the average enrollee. The premium is uniform across all states and applies regardless of where a beneficiary lives.

Part B premiums are charged monthly and must be paid consistently to avoid coverage disruptions. In most cases, the premium is automatically deducted from Social Security benefits, making the increase less visible on a month-to-month basis but still impactful over time.

What Medicare Part B Covers and Why the Premium Is Important

Medicare Part B covers medical services that are central to everyday healthcare needs. These services are often used repeatedly throughout the year, making Part B one of the most relied-upon components of Medicare.

Covered services include:

- Visits to primary care doctors and specialists

- Outpatient hospital services

- Preventive care such as screenings and wellness visits

- Diagnostic testing and imaging

- Mental health services

- Durable medical equipment

- Certain home healthcare services

Because these services are essential for managing chronic conditions and preventing more serious health issues, Part B coverage is a cornerstone of healthcare for older adults and individuals with qualifying disabilities. The monthly premium directly determines access to these services.

How the Medicare Part B Premium Is Set Each Year

The Medicare Part B premium is recalculated annually based on projected healthcare costs and enrollment trends. The federal government evaluates expected spending for outpatient care, physician services, and administrative expenses when determining the new premium amount.

Several factors influence premium increases:

- Rising costs of medical services

- Increased use of outpatient care

- Growth in the Medicare population

- Adjustments in provider reimbursement

For 2026, higher projected spending across multiple outpatient service categories contributed to the increase. Once set, the premium applies nationwide and remains unchanged throughout the year.

Who Pays the Standard Medicare Part B Premium in 2026

Most Medicare beneficiaries pay the standard monthly premium of $202.90. This applies to individuals whose income falls below certain thresholds and who are not subject to income-based adjustments.

This group includes:

- Many retirees receiving Social Security

- Disabled individuals enrolled in Medicare

- Beneficiaries with moderate or lower incomes

For these individuals, the premium is predictable and easy to budget for, although the increase still places additional pressure on monthly finances.

Income-Based Adjustments to the Medicare Part B Premium

While most beneficiaries pay the standard premium, some pay more due to income-based adjustments. These adjustments are applied automatically and are based on federal income data from two years prior.

If a beneficiary’s income exceeds specific limits, an additional amount is added to the standard premium. This system ensures that higher-income individuals contribute more toward the cost of Medicare.

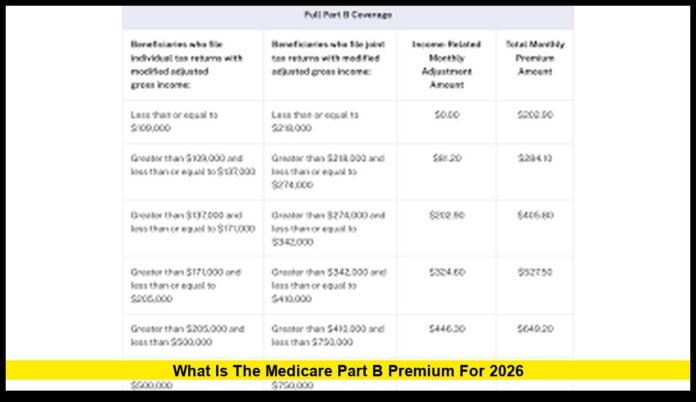

Medicare Part B Premium Levels for Higher-Income Beneficiaries

For 2026, higher-income beneficiaries pay more than the standard premium. Total monthly premiums vary by income tier and can rise significantly above the base amount.

Approximate monthly premium levels include:

- Standard premium: $202.90

- Lower income adjustment tier: about $284.10

- Middle income adjustment tiers: roughly $405.80 to $527.50

- Highest income tier: up to $689.90

These higher amounts apply for the full year unless income changes qualify for an adjustment.

Why Income Adjustments Exist

Income-based adjustments exist to balance Medicare’s long-term financial sustainability. By requiring higher-income beneficiaries to pay more, the program helps reduce financial pressure on lower-income enrollees while supporting rising healthcare costs.

The adjustments are based strictly on income, not assets. Even a single year of higher earnings can affect premiums two years later.

What Happens If Your Income Drops

If your income has decreased due to retirement, reduced work hours, or other qualifying life changes, it may be possible to request a review of your premium amount. Approved changes can result in lower monthly premiums.

Common qualifying events include:

- Retirement

- Loss of income-producing property

- Divorce or death of a spouse

- Employer settlement payouts ending

Requests must be supported by documentation and reviewed before adjustments are made.

Medicare Part B Deductible for 2026

In addition to the monthly premium, Medicare Part B includes an annual deductible. For 2026, the deductible is $283.

This amount must be paid out of pocket before Medicare begins covering its share of approved outpatient services. After the deductible is met, Medicare generally pays 80 percent of approved costs, leaving the beneficiary responsible for the remaining 20 percent unless they have supplemental coverage.

The deductible increase adds another layer of cost that beneficiaries should factor into their annual healthcare planning.

How Medicare Part B Premiums Are Paid

Most beneficiaries pay their Part B premium through automatic deductions from Social Security benefits. This method is convenient and ensures timely payment.

Other payment options include:

- Direct billing

- Automatic bank withdrawals

- Electronic payments

Failing to pay premiums on time can lead to coverage termination, which may also trigger late enrollment penalties in the future.

The Role of Social Security and the Hold Harmless Rule

Many beneficiaries are protected by a provision that prevents Medicare premium increases from reducing their net Social Security benefit. This protection applies when premium increases exceed Social Security benefit increases.

However, not all beneficiaries qualify for this protection. Those paying higher premiums due to income adjustments are generally not covered by this rule.

Impact of the 2026 Premium on Retiree Budgets

The increase in the Medicare Part B premium for 2026 affects household budgets in meaningful ways. For retirees living on fixed incomes, even modest monthly increases can require spending adjustments.

Some beneficiaries respond by:

- Reviewing supplemental insurance options

- Comparing Medicare Advantage plans

- Adjusting discretionary spending

- Planning withdrawals more carefully

Healthcare costs remain one of the largest expenses in retirement, making awareness and planning essential.

Medicare Advantage and the Part B Premium

Enrollment in a Medicare Advantage plan does not eliminate the Part B premium. Beneficiaries must continue paying the Part B premium even when enrolled in alternative Medicare plans.

Some plans offer rebates that reduce out-of-pocket costs, but the underlying Part B obligation remains unchanged.

Long-Term Outlook for Medicare Part B Costs

While each year’s premium is set independently, long-term trends suggest that healthcare costs will continue to rise. Beneficiaries should expect periodic increases and plan accordingly.

Understanding current costs helps individuals prepare for future adjustments and make informed decisions about coverage options.

Key Points to Remember About the 2026 Medicare Part B Premium

- The standard monthly premium is $202.90

- Premiums apply starting January 1, 2026

- Higher-income beneficiaries pay more

- The annual deductible is $283

- Most premiums are deducted from Social Security

These figures represent confirmed, current information and apply nationwide.

What is the Medicare Part B premium for 2026 remains a central concern for U.S. seniors and disabled individuals. Knowing the confirmed costs and how they affect monthly finances allows beneficiaries to plan with confidence and avoid unexpected expenses.

Share your perspective or questions below and stay connected for continued Medicare updates.