What is the inheritance tax in California is one of the most searched estate-planning questions in the United States, especially as large wealth transfers continue across generations. As of January 2026, California does not impose any state-level inheritance tax on heirs. Individuals who receive property, money, or other assets from a deceased person in California are not required to pay a tax to the state simply because they inherited it. This legal position remains unchanged and is fully in effect statewide.

This means that beneficiaries, regardless of whether they inherit a modest savings account or a multi-million-dollar estate, do not face a California inheritance tax bill. The state does not reduce the inheritance, withhold a percentage, or require a separate inheritance return. The transfer itself is not taxed by California.

California’s Legal Position on Inheritance in 2026

California law clearly establishes that no inheritance tax exists. When a resident dies, their property passes to heirs through a will, trust, or intestate succession. The state does not charge a transfer tax on the recipient. This applies equally to:

- Cash and bank accounts

- Real estate

- Stocks, bonds, and mutual funds

- Retirement accounts

- Business ownership

- Life insurance proceeds

- Personal property and valuables

The beneficiary keeps the full inherited value, subject only to federal rules and normal income taxation on future earnings from those assets.

This rule applies to all relationships. A surviving spouse, child, grandchild, sibling, domestic partner, friend, or unrelated beneficiary receives the same state tax treatment. California does not use family-based tax brackets or percentage schedules for inheritance.

Inheritance Tax vs Estate Tax: A Crucial Distinction

Many Americans confuse inheritance tax with estate tax. These are separate systems.

Inheritance tax is charged to the person who receives assets.

Estate tax is charged to the estate before distribution.

California applies neither. The state abolished its death-tax structure years ago and has not replaced it. No state filing is required for inheritance tax purposes, and no percentage is withheld from distributions.

However, federal estate tax still exists and may affect very large estates.

Federal Estate Tax and Its Effect on California Heirs

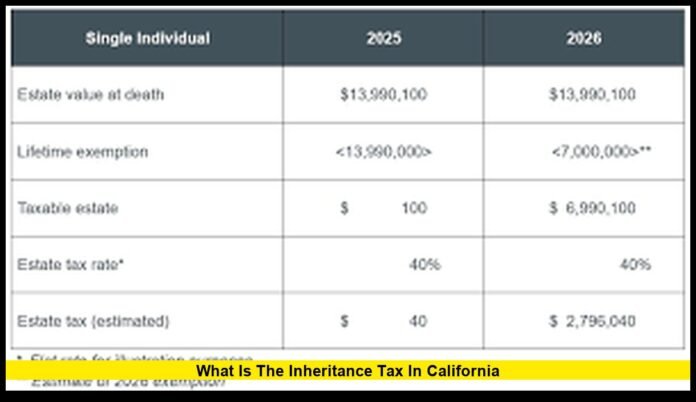

While California imposes no inheritance tax, the federal government taxes estates that exceed the exemption threshold. For 2026, the exemption is approximately:

- $15 million per individual

- About $30 million for married couples using portability

Only the portion above this level is subject to federal estate tax. The tax is paid by the estate, not the heirs. Beneficiaries in California do not file inheritance tax returns, but the value they receive may be reduced if federal estate tax is owed.

The top federal rate remains 40 percent on the taxable portion. Most estates in the U.S. fall far below the exemption and owe no federal estate tax at all.

Why California Does Not Tax Inheritances

California ended its estate and inheritance tax system after federal law changed in the early 2000s. Instead of creating a new standalone death tax, the state chose to eliminate the tax entirely.

Since then, California has relied on other revenue sources and has not reinstated any form of inheritance or estate tax. As of 2026, no enacted legislation creates such a tax, and none is in force.

This places California among the majority of U.S. states that allow inheritance transfers without a state death tax.

Income Tax and Inherited Assets

Although the inheritance itself is not taxed, income generated from inherited property is taxable.

Examples include:

- Rent from inherited real estate

- Dividends from inherited stocks

- Interest from inherited savings or bonds

- Business profits from inherited companies

This income is reported on federal and California income tax returns in the year it is earned.

The original inherited value, however, is not treated as taxable income.

Capital Gains and Step-Up in Basis

Inherited assets receive a basis adjustment to fair market value on the date of death. This rule is critical in reducing future tax exposure.

If a home was purchased decades ago for $100,000 and is worth $900,000 at death, the heir’s starting basis becomes $900,000. If the heir sells shortly after, capital gains tax may be minimal.

California follows federal basis rules. This provides substantial tax efficiency for heirs selling inherited property.

Property Taxes and Inherited Real Estate

Although no inheritance tax exists, property taxes can change after inheritance. California reassesses property when ownership transfers, subject to certain exclusions.

Primary residences may qualify for partial assessment relief if the heir occupies the home. Investment properties and second homes are generally reassessed at current market value.

This can increase annual property taxes even though no inheritance tax is due.

Retirement Accounts and Inheritance

Inherited retirement accounts are not subject to California inheritance tax, but distributions are taxable as income. Federal rules require most non-spouse beneficiaries to withdraw the account over a set period.

These withdrawals are subject to both federal and state income tax, depending on the beneficiary’s tax bracket.

Inheriting From Other States

Some U.S. states still impose inheritance taxes. If a California resident inherits property from a state with such a tax, that state’s law may apply. The beneficiary may owe tax there even though California does not impose one.

This situation most often arises when the deceased lived in or owned real estate in a state that still has inheritance tax laws.

Trusts and Estate Planning in California

Trusts are widely used in California even without an inheritance tax. They help avoid probate, control distributions, protect minors, and manage tax exposure.

For high-net-worth families, trusts are often structured to reduce federal estate tax, preserve step-up in basis benefits, and manage future income taxation.

Business Ownership Transfers

Inheriting a business involves valuation, income taxation, and potential federal estate tax. California does not impose a state transfer tax, but ongoing profits are taxable, and future sales may trigger capital gains.

Proper succession planning helps maintain business continuity and tax efficiency.

Common Myths

Many people believe California taxes inheritance because of its high income tax rates. This is incorrect.

Others think heirs must pay state tax on large inheritances. This is also incorrect.

Some believe inherited property must be reported as income. Only income generated after inheritance is taxable.

Future Outlook

As of January 2026, no California inheritance tax exists and none is scheduled to take effect. Any change would require new legislation and would likely involve extensive public debate.

For now, heirs continue to receive property without a state inheritance tax burden.

Practical Guidance for Heirs

Beneficiaries should:

- Establish date-of-death values

- Understand step-up in basis

- Plan for income taxes on future earnings

- Review property tax reassessment rules

- Consult estate and tax professionals when needed

Final Perspective

What is the inheritance tax in California can be answered with certainty in 2026: there is no state inheritance tax. California does not tax beneficiaries for receiving property from a deceased person. While federal estate tax, income tax, and property tax rules still apply, the state itself imposes no inheritance levy.

Understanding this framework allows families to plan with clarity, protect assets, and transfer wealth with confidence.

Stay connected, share your views, and follow future updates as inheritance and estate laws continue to shape financial planning across the United States.