Understanding what is the difference between an IRA and a 401k is essential for anyone planning for retirement. Both are popular retirement accounts in the United States, but they operate differently in terms of contributions, tax treatment, investment options, and employer involvement. Choosing the right option—or a combination of both—can significantly impact your retirement savings growth and tax liability.

As retirement planning becomes increasingly important in 2025, it is critical to know the distinctions between these accounts to make informed decisions. This guide breaks down all relevant details and helps investors optimize their retirement strategy.

KEY POINTS SUMMARY

For readers seeking a fast overview:

- IRA (Individual Retirement Account): Managed individually, offers flexible investment choices, with contribution limits based on income.

- 401k: Employer-sponsored, may include matching contributions, higher contribution limits, and limited investment options.

- Tax Treatment: Both accounts can be traditional (pre-tax) or Roth (after-tax), affecting withdrawal taxes differently.

- Withdrawals: IRAs offer more flexible withdrawal options but can incur penalties; 401ks have stricter rules but offer loans in some cases.

- Contribution Limits 2025: IRA up to $7,000 (age 50+), 401k up to $23,000 (age 50+).

This summary provides a snapshot of the primary distinctions for quick understanding.

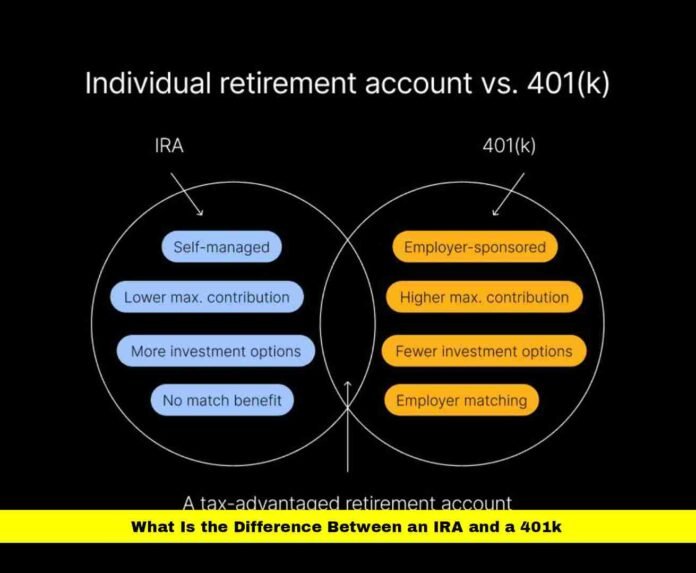

IRA VS 401K: FUNDAMENTAL DIFFERENCES

The main differences between an IRA and a 401k involve account ownership, contribution limits, and investment flexibility:

- Ownership:

- IRA accounts are individually owned and managed.

- 401k accounts are employer-sponsored and tied to your workplace.

- Contribution Limits 2025:

- Traditional and Roth IRAs: $7,000 per year for individuals aged 50 and older.

- 401k: $23,000 per year for individuals aged 50 and older.

- Investment Options:

- IRAs offer a broad selection, including stocks, bonds, ETFs, and mutual funds.

- 401ks often limit choices to employer-selected mutual funds or target-date funds.

- Employer Contributions:

- IRAs do not include employer matches.

- 401ks may include matching contributions, which can significantly boost savings.

Understanding these differences helps determine which account—or combination—maximizes retirement growth.

TRADITIONAL VS ROTH OPTIONS

Both IRAs and 401ks offer Traditional and Roth versions with distinct tax implications:

- Traditional: Contributions are pre-tax, reducing taxable income in the year contributed. Withdrawals in retirement are taxed as ordinary income.

- Roth: Contributions are made with after-tax dollars, providing tax-free withdrawals in retirement if conditions are met.

Strategic Consideration: Choosing between Traditional and Roth accounts depends on current income, expected future tax rate, and retirement goals.

TAX ADVANTAGES AND CONSIDERATIONS

Taxes play a critical role in retirement planning:

- Traditional IRA/401k: Lowers current-year taxable income; taxes owed on withdrawals after retirement.

- Roth IRA/401k: No immediate tax benefit, but withdrawals are tax-free if rules are met.

- Required Minimum Distributions (RMDs): Traditional accounts require withdrawals starting at age 73 in 2025; Roth IRAs have no RMDs.

Choosing accounts strategically can optimize long-term tax savings and retirement security.

CONTRIBUTION LIMITS AND CATCH-UP RULES

Contribution limits are higher for 401ks, making them attractive for aggressive savers:

| Account Type | Standard Limit 2025 | Catch-Up Limit (50+) | Total Contribution Limit |

|---|---|---|---|

| IRA | $7,000 | $1,000 | $8,000 |

| 401k | $23,000 | $7,500 | $30,500 |

Maximizing contributions is a key strategy for those planning early retirement.

INVESTMENT FLEXIBILITY

Investment flexibility is one of the main differences between IRAs and 401ks:

- IRAs: Investors can select individual stocks, bonds, mutual funds, ETFs, and alternative investments.

- 401ks: Employers typically limit choices to curated mutual funds or target-date funds.

- Implication: IRAs allow tailored strategies, while 401ks offer convenience and lower administrative burden.

Investors should weigh the benefits of flexibility versus simplicity when deciding how to allocate funds.

WITHDRAWAL RULES AND PENALTIES

Both accounts impose rules and penalties for early withdrawals:

- IRA: Withdrawals before age 59½ may incur a 10% penalty plus taxes (except for certain exceptions such as first-time home purchase, qualified education expenses, or disability).

- 401k: Early withdrawals also incur penalties but may allow loans in some cases. Employer approval is required, and failure to repay may result in taxes and penalties.

Understanding withdrawal rules is crucial to avoid unexpected tax liabilities.

EMPLOYER MATCHING CONTRIBUTIONS

401ks often include employer matching contributions, which act as “free money” for retirement:

- Typical Match: 50% of employee contribution up to 6% of salary.

- Benefit: Immediate boost to retirement savings and compounding growth.

- IRA Limitation: No employer matching; only personal contributions are allowed.

Employer contributions can make 401ks particularly attractive for employees seeking to maximize retirement assets.

ROLLING OVER ACCOUNTS

Account rollovers offer flexibility when changing jobs or consolidating retirement funds:

- IRA Rollovers: Can combine multiple employer 401k accounts into one IRA for easier management.

- 401k Rollovers: Can roll into a new employer’s 401k or an IRA.

- Benefits: Avoid taxes and penalties when executed properly.

Properly managing rollovers ensures continuity in retirement savings and investment growth.

FEES AND EXPENSES

Fees can vary significantly and impact long-term returns:

- IRA Fees: Typically low if using online brokerage; may include account maintenance or fund expense ratios.

- 401k Fees: Can include plan administrative fees, fund expense ratios, and investment management costs.

- Impact: Even small fees compound over decades, reducing retirement savings.

Investors should compare fee structures carefully before choosing where to invest.

STRATEGIES FOR MAXIMIZING RETIREMENT SAVINGS

Combining IRAs and 401ks can maximize growth:

- Contribute Enough to Get Employer Match: Prioritize 401k to capture free contributions.

- Supplement with IRA: Take advantage of broader investment options and potential Roth benefits.

- Diversify Tax Treatment: Use both Roth and Traditional accounts to manage tax exposure in retirement.

- Max Out Contributions: Aim to reach annual contribution limits when possible.

These strategies optimize retirement savings while leveraging the benefits of both account types.

FREQUENTLY ASKED QUESTIONS

1. Can I have both an IRA and a 401k?

Yes, you can contribute to both in the same year, but contribution limits apply individually to each account.

2. What happens if I withdraw from a 401k early?

Early withdrawals may incur a 10% penalty plus income taxes unless specific exceptions apply.

3. Which is better for retirement: IRA or 401k?

It depends on your goals. 401ks offer employer matches and higher limits, while IRAs offer broader investment choices and flexibility.

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, or financial advice. Consult a qualified professional before making decisions regarding retirement accounts.