Understanding what is considered a good credit score is essential for anyone looking to buy a home, finance a car, or qualify for favorable loan terms. In 2025, lenders, credit bureaus, and financial institutions continue to use the same scoring ranges to evaluate creditworthiness, though the weight of individual factors can vary slightly across models.

Credit Score Ranges Explained

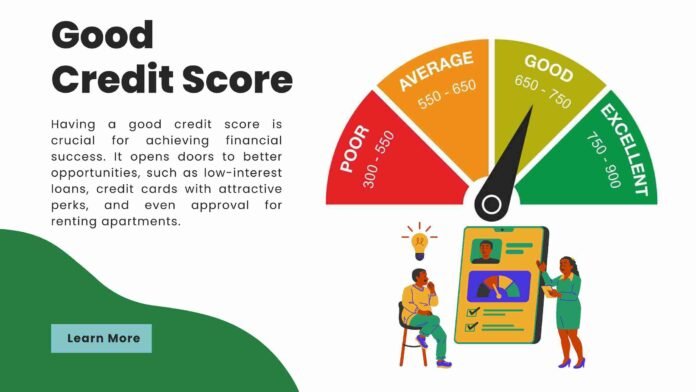

Credit scores are typically measured on a scale of 300 to 850. The higher the score, the lower the risk a borrower poses to lenders. While different models exist, such as FICO and VantageScore, their ranges are broadly similar:

- 300 – 579: Poor

- 580 – 669: Fair

- 670 – 739: Good

- 740 – 799: Very Good

- 800 – 850: Excellent

From a lender’s perspective, a score of 670 or above usually opens the door to better financial opportunities.

What Lenders See as ‘Good’

For most lenders, a good credit score starts at 670. At this level, borrowers are more likely to receive approval for credit cards, mortgages, and personal loans with reasonable interest rates. Scores above 740, often labeled “very good,” can result in even lower rates, while those above 800 are considered “excellent” and often qualify for premium financial products.

Why a Good Credit Score Matters

Having a good score goes beyond approval odds. It directly impacts the cost of borrowing and financial flexibility. Here’s how it plays out:

- Lower Interest Rates: Higher scores translate to reduced borrowing costs.

- Better Loan Terms: Longer repayment periods or higher credit limits may be available.

- Easier Approval: Applications for mortgages, auto loans, or credit cards are more likely to succeed.

- Stronger Negotiating Power: Lenders are more willing to offer favorable terms to borrowers with solid scores.

A good credit score essentially acts as a financial safety net, giving borrowers access to opportunities that might otherwise be out of reach.

Key Factors That Shape Your Score

Credit scores are not random; they reflect years of financial behavior. The main factors include:

- Payment History (35%) – Timely payments build trust with lenders.

- Credit Utilization (30%) – Keeping balances low compared to credit limits helps.

- Length of Credit History (15%) – Older accounts add strength.

- New Credit Inquiries (10%) – Too many applications can reduce a score.

- Credit Mix (10%) – A blend of credit cards, loans, and mortgages adds diversity.

Monitoring these areas consistently can prevent dips and help maintain or grow a score.

How to Improve Your Credit Score

If your score is below “good,” improvements are possible with consistent habits. Steps include:

- Paying bills on time, every month.

- Reducing credit card balances below 30% of the limit.

- Avoiding unnecessary new credit applications.

- Keeping old accounts open to lengthen credit history.

- Checking credit reports for errors and disputing inaccuracies.

Small improvements can make a big difference, especially when moving from “fair” to “good,” where loan terms become more favorable.

Credit Score Trends in 2025

In 2025, more lenders are using enhanced data analytics, including alternative payment histories such as rent, utilities, and streaming service bills. This expansion allows individuals with limited credit history to build stronger scores. It also highlights why staying consistent with all forms of payment, not just loans and credit cards, is increasingly important.

Closing Thoughts

Knowing what is considered a good credit score provides clarity for anyone aiming to improve their financial standing. While 670 remains the general benchmark, aiming for 740 or higher ensures stronger borrowing power. By practicing healthy financial habits, borrowers can unlock better rates, smoother approvals, and more long-term security.

What do you think—should schools teach credit score management as part of financial education? Share your thoughts below.