If you’re wondering what is a traditional IRA, the answer is that it’s one of the most widely used retirement savings accounts in the United States. A Traditional IRA (Individual Retirement Account) gives people the ability to save money for retirement with significant tax advantages. Contributions may be tax-deductible depending on your income and workplace retirement coverage, and investments grow tax-deferred until you withdraw them in retirement. In 2025, the rules for traditional IRAs remain consistent with prior years, but contribution limits, deduction eligibility ranges, and required minimum distribution ages have important updates that every saver should know.

What Is a Traditional IRA? Understanding the Basics

A Traditional IRA is a personal retirement savings account that you can open with a bank, brokerage firm, or financial institution. The main purpose of the account is to help you save for retirement while giving you tax benefits today.

Here’s how it works:

- You contribute money that you earn from wages, salary, or self-employment income.

- Depending on your income and whether you’re covered by a workplace retirement plan, your contribution may be fully tax-deductible, partially deductible, or nondeductible.

- The money you invest grows tax-deferred. You don’t pay taxes on dividends, interest, or capital gains while the money stays inside the account.

- When you withdraw the funds in retirement, the distributions are taxed as ordinary income.

In short, a Traditional IRA allows you to defer paying taxes until later in life, often when your taxable income may be lower.

Contribution Limits for Traditional IRAs in 2025

The IRS sets annual limits on how much you can contribute to an IRA. For 2025:

- $7,000 for individuals under age 50

- $8,000 for individuals age 50 or older, thanks to a $1,000 catch-up provision

These limits apply to the combined total you can contribute across both Traditional and Roth IRAs. For example, if you put $3,000 into a Roth IRA, you can only put $4,000 into a Traditional IRA if you’re under age 50.

You have until April 15, 2026 (the tax filing deadline) to make contributions for the 2025 tax year.

Who Can Contribute to a Traditional IRA in 2025?

One of the biggest advantages of a Traditional IRA is that anyone with earned income can contribute. There’s no upper income limit that prevents contributions. However, the amount you can deduct on your taxes depends on:

- Your income level

- Your tax filing status

- Whether you or your spouse are covered by an employer-sponsored retirement plan, such as a 401(k)

Even if you can’t deduct your contribution, you can still make nondeductible contributions. These still grow tax-deferred, and you’ll only pay taxes on the earnings when you withdraw them.

Deduction Rules for 2025

Whether your Traditional IRA contribution is deductible in 2025 depends on your Modified Adjusted Gross Income (MAGI) and your workplace retirement plan coverage. Here’s the breakdown:

- If neither you nor your spouse are covered by a workplace plan: Your contributions are fully deductible, no matter your income.

- If you are covered by a workplace plan:

- Single or head of household: Full deduction if your MAGI is under $79,000; partial deduction up to $89,000; no deduction beyond that.

- Married filing jointly: Full deduction if your MAGI is under $126,000; partial up to $146,000; no deduction above that.

- If your spouse is covered by a workplace plan, but you are not:

- Married filing jointly: Full deduction if household MAGI is under $236,000; partial deduction up to $246,000; no deduction above that.

- Married filing separately: Deduction phases out quickly and is eliminated once income reaches $10,000.

These ranges are adjusted annually for inflation, and the 2025 thresholds give slightly more room for savers compared to prior years.

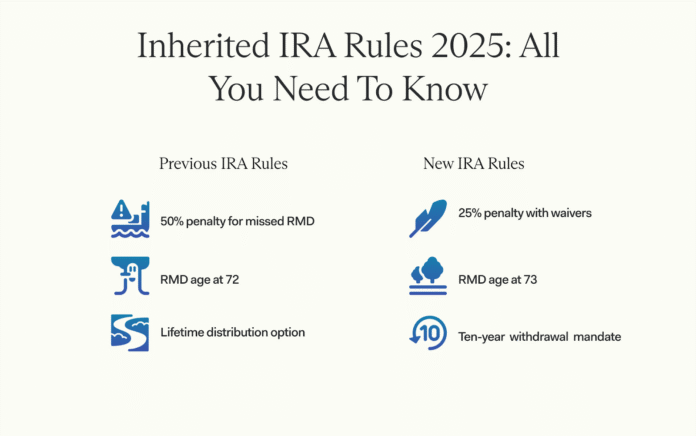

Required Minimum Distributions (RMDs)

Unlike Roth IRAs, which allow money to grow indefinitely, Traditional IRAs come with required minimum distributions.

- In 2025, you must begin taking RMDs starting at age 73.

- The first distribution must be taken by April 1 of the year after you turn 73.

- After that, RMDs must be taken annually by December 31.

The amount is based on your account balance and life expectancy tables published by the IRS. Failure to take the correct RMD can result in penalties. Recent law changes reduced the penalty to 25% of the amount not withdrawn (down from 50%), and if corrected promptly, it can be lowered further.

Benefits of a Traditional IRA

- Tax deduction today: Contributions may reduce your taxable income for the current year.

- Tax-deferred growth: Investments grow without being taxed annually.

- Flexibility with investments: You can choose stocks, bonds, ETFs, mutual funds, CDs, and more.

- Available to everyone with earned income: Unlike Roth IRAs, there’s no income cap to make a contribution.

- Great complement to employer plans: Even if you max out your 401(k), you can add a Traditional IRA to save more.

Drawbacks of a Traditional IRA

- Taxed withdrawals: All deductible contributions and earnings are taxed as ordinary income in retirement.

- RMDs required: You must begin withdrawing at age 73, even if you don’t need the money.

- Early withdrawal penalties: Withdrawals before age 59½ may incur a 10% penalty in addition to regular income tax, unless an exception applies.

- Deduction limits: If you or your spouse are covered by a retirement plan at work, deductions may be phased out based on income.

Traditional IRA vs. Roth IRA in 2025

Here’s a comparison to help clarify how a Traditional IRA stacks up against a Roth IRA this year:

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contribution limit (under 50) | $7,000 | $7,000 |

| Contribution limit (50+) | $8,000 | $8,000 |

| Tax break | Tax deduction may apply | No deduction, contributions after-tax |

| Growth | Tax-deferred | Tax-free |

| Withdrawals in retirement | Taxable as income | Tax-free if qualified |

| Required minimum distributions | Yes, starting at 73 | None during account owner’s lifetime |

| Income limits to contribute | None | Yes, phases out at higher incomes |

This side-by-side view highlights that Traditional IRAs are best suited for those who want tax breaks now, while Roth IRAs favor those who want tax-free withdrawals later.

How to Open a Traditional IRA in 2025

- Choose a financial institution — banks, brokerages, or robo-advisors.

- Decide on your contribution amount — up to $7,000, or $8,000 if age 50+.

- Select your investments — choose based on your risk tolerance and time horizon.

- Contribute before the deadline — April 15, 2026, for the 2025 tax year.

- Track eligibility for deductions — know whether you qualify for a full, partial, or no deduction.

Strategies for Using a Traditional IRA in 2025

- Combine with a 401(k): Max out your employer plan, then add an IRA for more savings.

- Use nondeductible contributions if phased out: Even if not deductible, they still grow tax-deferred.

- Consider conversions: Some savers use nondeductible contributions and later convert them into Roth IRAs (backdoor Roth).

- Plan for RMDs: If you don’t need the money, coordinate withdrawals with tax planning to reduce burdens.

Why Traditional IRAs Still Matter in 2025

Even with newer rules and the growing popularity of Roth accounts, Traditional IRAs remain an essential retirement planning tool. The upfront tax savings can be powerful, especially for those in higher tax brackets today. With steady contribution limits and adjusted deduction thresholds, many Americans still rely on Traditional IRAs to balance out their retirement savings strategies.

Conclusion

Understanding what is a traditional IRA in 2025 comes down to knowing the rules on contributions, deductions, withdrawals, and distributions. It remains one of the most reliable retirement accounts available, offering tax benefits today and growth potential for tomorrow. Whether you’re just starting your retirement journey or supplementing other accounts, a Traditional IRA can be a valuable tool to secure your financial future.

Do you use a Traditional IRA, or are you considering opening one this year? Share your thoughts and experiences below to help others make informed choices.

FAQs

Q1: Do I need earned income to contribute to a Traditional IRA?

Yes. You must have wages, salary, or self-employment income. Investment income or pensions don’t count as earned income for contributions.

Q2: Can I contribute to both a Traditional IRA and a Roth IRA in the same year?

Yes, but the combined contributions cannot exceed the annual limit of $7,000 (or $8,000 if you’re 50 or older).

Q3: What happens if I don’t take my Required Minimum Distributions?

If you fail to take your RMDs, the IRS imposes a penalty. The penalty has been reduced in recent years but can still be significant, so timely withdrawals are essential.

Disclaimer

This article is for informational purposes only and does not constitute tax or financial advice. Consult a qualified tax professional for advice tailored to your personal situation.