What is a backdoor Roth IRA? If you’re a high-income earner who’s heard this phrase but isn’t yet sure what it means or how it works, you’re in the right place. This strategy has become a cornerstone of retirement-planning discussions for professionals, dual-income households, business owners and others earning too much to contribute directly to a Roth IRA. The appeal? Tax-free growth, tax-free withdrawals in retirement, no required minimum distributions and estate-planning advantages. For many, a backdoor Roth IRA is the most viable route to access those benefits despite income limitations.

In this comprehensive guide, you’ll learn how the strategy works, why it exists, who should consider it (and who might not), step-by-step instructions, major pitfalls to avoid, and why it remains relevant in 2025 despite evolving laws and tax-policy debates. If you’re planning for retirement and want to keep more of your money working for you, understanding this strategy is key.

Why the Backdoor Roth IRA Became Popular

The Roth IRA was introduced to provide taxpayers with a tax-paid (after-tax) retirement account that grows tax-free and allows for tax-free withdrawals. That changed the retirement savings landscape in important ways. But the IRS capped eligibility for direct Roth contributions at specific income thresholds. This left high-income earners shut out of direct Roth contributions despite the benefits.

Enter the backdoor Roth IRA — a clever, legal workaround that takes advantage of contribution rules for Traditional IRAs and conversion rules for Roth IRAs. Because the IRS allows anyone to contribute to a Traditional IRA (regardless of income), and also allows conversions from Traditional to Roth IRAs (regardless of income), this strategy fills the gap.

According to financial-planning surveys in recent years, more high-income savers report using this strategy as part of their long-term tax-efficient planning. As tax complexity increases and retirement savings goals expand, the backdoor Roth has become a standard discussion in 2025 financial-planning sessions.

Roth IRA Basics: Why the Benefits Are So Strong

Before going deeper into the backdoor mechanism, it helps to clearly understand what makes a Roth IRA stand out:

- Tax-free growth – Because contributions are made with after-tax dollars, investment earnings grow tax-free.

- Tax-free withdrawals – With satisfying the rules (age 59½ and the 5-year clock), you withdraw without paying taxes.

- No RMDs during your lifetime – Unlike a Traditional IRA, you are not forced to begin withdrawing at age 73 (or applicable age) if you don’t want to.

- Estate planning value – Heirs can inherit Roth assets and often withdraw tax-free (depending on rules).

- Flexibility – Roth IRAs offer more control over when and how you withdraw in retirement, maximizing tax diversification.

These features mean that for many, the Roth is one of the most powerful retirement savings vehicles available. But direct access is limited by income.

Income Limits for Direct Roth Contributions

The IRS sets income thresholds that determine whether you can contribute directly to a Roth IRA. For 2025:

- Single filers: the ability to contribute phases out around mid-$140,000 and is eliminated by low-$160,000.

- Married filing jointly: the phase-out begins around mid-$230,000 and ends by mid-$240,000+.

If your income exceeds these ranges, you’re ineligible to contribute directly. That’s where the backdoor route comes into play.

Defining the Backdoor Roth IRA

A backdoor Roth IRA is not a separate account but a method to access Roth IRA benefits despite income limitations. It typically involves:

- Making a non-deductible contribution to a Traditional IRA.

- Converting that contribution to a Roth IRA either immediately or shortly thereafter.

- If no significant investment gains occurred between contribution and conversion, the tax liability is minimal (beyond any pro-rata consideration).

The result: you get the Roth benefit even though your income disqualifies you from direct contribution.

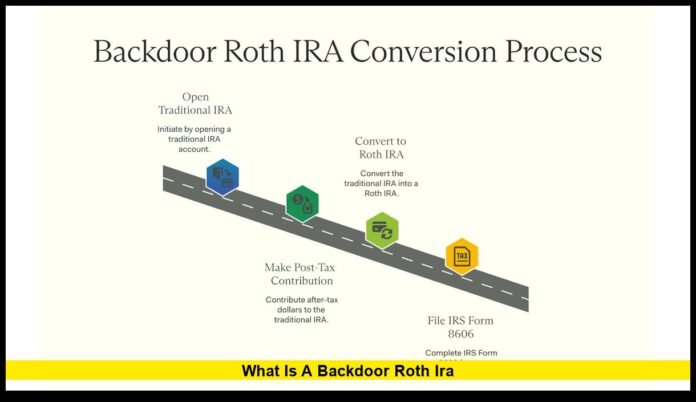

Step-by-Step Process of a Backdoor Roth IRA

Step 1: Contribute to a Traditional IRA

- Deposit up to the annual limit ($7,000 in many cases for 2025, or $8,000 if age 50+).

- Ensure you do not claim a tax deduction for that contribution — it should be after-tax.

Step 2: Convert to a Roth IRA

- Most people perform the conversion soon after the contribution posts.

- Minimizing the time between contribution and conversion helps reduce pre-conversion investment growth (which would be taxable).

- Once converted, you now hold Roth assets that will grow tax-free.

Step 3: File the Appropriate Tax Forms

- Use IRS Form 8606 to report the non-deductible IRA contribution and the Roth conversion.

- This ensures you do not pay tax again on money you already contributed after tax.

- Mistakes or omissions can trigger penalties or unexpected tax bills.

Understanding the Pro-Rata Rule (The Most Common Trap)

One of the biggest issues in executing a backdoor Roth IRA involves the pro-rata rule. The IRS considers all xTraditional IRAs, SEP IRAs and SIMPLE IRAs combined when calculating how much of your conversion is taxable.

Why this matters

If you have any pre-tax funds in a Traditional IRA (including roll-overs from 401(k)s, previous deductible contributions, etc.), a portion of your conversion becomes taxable — even if you’re only converting after-tax contributions.

Example Scenario

- Pre-tax IRA funds: $100,000

- New non-deductible contribution: $7,000

- Total IRA balance pre-conversion: $107,000

- If you convert $7,000, only around 6.5% is tax-free; the rest is taxable.

Solution Strategy

Move or roll your pre-tax IRA funds into a qualified 401(k) (if the plan allows). Then your IRA holds only after-tax contributions, making your conversion tax-free. Many advisors refer to this as “clearing the path” before conversion.

Who Should Consider a Backdoor Roth IRA?

This strategy is most appropriate for individuals who:

- Earn above the Roth income limits

- Want tax-free income options in retirement

- Expect to be in a similar or higher tax bracket in the future

- Value flexibility and control over retirement withdrawals

- Are comfortable with some added tax-filing complexity

Occupations where it’s widely used

- Physicians and surgeons

- Attorneys and law firm partners

- Tech executives and engineers

- Entrepreneurs and business owners

- Dual high-income households, especially in major metro areas

Benefits of the Strategy

Why is a backdoor Roth IRA so widely discussed among savvy savers?

- Tax-free growth and withdrawals provide massive long-term benefit.

- No RMDs during your lifetime gives control.

- Estate-planning advantages allow heirs to receive assets without tax drag.

- Budget certainty: Because withdrawals are tax-free, you reduce retirement-income uncertainty.

- Tax-diversified retirement: Having a combination of tax-deferred, tax-free and taxable sources gives flexibility.

In many projections, the long-term difference in outcomes between tax-free vs tax-taxed growth can be hundreds of thousands of dollars—especially for younger high-income savers.

Common Pitfalls and When It Might Not Make Sense

Despite its appeal, a backdoor Roth IRA is not perfect. Consider these scenarios:

- Large pre-tax IRA balances without ability to move them into a 401(k) can create tax complications.

- If you expect to be in a much lower tax bracket in retirement, traditional tax deduction strategies may be more appealing.

- If you prefer simplified tax compliance, the extra documentation and form-filling may be burden.

- If you already have max-ed out 401(k) and IRA options, and you’re comfortable with current tax exposure, the incremental benefit may be modest.

Recognizing when the strategy does not add meaningful value is just as important as understanding when it does.

Backdoor Roth vs. Mega Backdoor Roth vs. Regular Roth

Regular Roth

- Direct contribution up to income limits.

- Easiest path but limited to lower or moderate income.

Backdoor Roth

- Uses IRA contribution + conversion to access Roth for high incomes.

- Most widely used workaround.

Mega Backdoor Roth

- Uses after-tax 401(k) contributions plus in-plan conversion or rollover to Roth.

- Allows very large amounts (e.g., $30K+ a year depending on plan).

- Dependent on employer plan design and trustee/administrator rules.

Understanding which route fits your situation is key.

Tax Planning Tips and Timing

Conversion Timing

Most planners recommend converting as soon as the traditional contribution posts to avoid taxable gains.

Tracking Contributions

Keep accurate records of non-deductible contributions — failure to track can result in paying tax twice.

Year-End Review

Perform a year-end IRA and 401(k) review to ensure no unwanted balances are left in pre-tax IRAs.

Future Tax Law Risk

A potential legislative risk: Congress may propose curbing or eliminating backdoor conversions. Many advisors suggest executing the strategy sooner rather than later, if eligible.

How to Implement in Practice

- Select a low-cost brokerage or robo-advisor that supports IRA contribution and conversion.

- Contribute to Traditional IRA using after-tax dollars.

- Immediately—or shortly after—convert to the Roth IRA.

- Immediately file IRS Form 8606 with your tax return the following April.

- Keep documentation — copies of forms, broker statements, conversion confirmations.

- Annually review the strategy, especially if your income, employment or retirement savings status changes.

Real-Life Case Illustration

Meet Jane & Dan, married filing jointly, combined income $350,000.

- Both earn too much for direct Roth contributions.

- No pre-tax IRA balances.

- Annual IRA limit each: $7,000 → total $14,000.

They execute a backdoor Roth: contribute $14,000 to Traditional IRAs (non-deductible), convert the full amount to Roth IRAs, pay minimal tax (assuming immediate conversion). Over 30 years, tax-free growth at average market returns can give them a substantial advantage versus tax-deferred savings alone.

How Advisors View the Strategy in 2025

Financial advisors increasingly list the backdoor Roth IRA as a standard planning move for eligible clients. Key reasons:

- With rising tax deficits and future tax-rate uncertainty, tax-free growth is more appealing.

- Traditional tax deduction limits are being evaluated, so backward strategies gain traction.

- Retirement-income planning is shifting to focus not only on accumulation but tax control.

Advisors warn: Do it carefully. The IRS doesn’t disallow the strategy—but messing up the execution is costly.

Frequently Asked Questions

1. Is a backdoor Roth IRA legal?

Yes — the strategy is fully legal when executed correctly and documented.

2. Do I owe taxes when I convert?

If the contribution was after-tax and you had no pre-tax IRA balances, you typically owe minimal or no tax. Pre-tax balances complicate this.

3. Can I undo a backdoor Roth IRA conversion later?

No – once converted, Roth funds cannot be recharacterized into a traditional account. The IRS eliminated recharacterization in recent years.

Disclaimer

This article is for educational purposes only and does not constitute financial, tax, investment or legal advice. Individuals should consult qualified financial advisors or tax professionals to determine if a backdoor Roth IRA fits their specific circumstances.