When you’re navigating health coverage, one of the first questions many ask is: what does Medicare Part A cover? As of October 2025, this “Hospital Insurance” portion of the federal Medicare program remains a cornerstone for many U.S. seniors and eligible individuals. This article provides an up-to-date, fact-based overview of what Medicare Part A covers, what it doesn’t, how much it costs, and how benefit periods work.

What Medicare Part A Covers

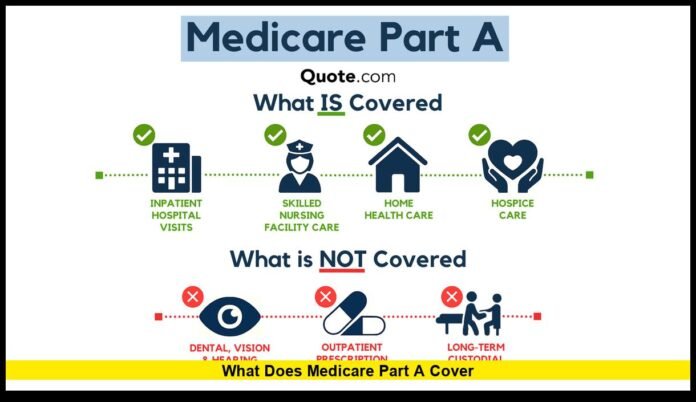

Medicare Part A—often referred to as the hospital insurance component of Original Medicare—helps cover several kinds of inpatient and facility-based care. It primarily covers the following:

- Inpatient hospital stays: If you are formally admitted to a hospital as an inpatient, Part A covers your semiprivate room, meals, general nursing care, drugs and medical supplies provided by the hospital, and other hospital services and supplies.

- Skilled nursing facility (SNF) care: After a qualifying hospital stay (typically three days or more as an inpatient), Part A can cover services in a skilled nursing facility for a limited time. That includes room and board, skilled nursing care, rehabilitation services such as physical, occupational or speech therapy, and medical supplies.

- Hospice care: If you have a terminal illness with a life expectancy of six months or less (and you meet other requirements), Part A covers hospice care, including care provided at home or in an inpatient hospice facility.

- Home health care (limited): Part A may cover home health services if you are homebound, need skilled care, and meet certain conditions, especially after a qualifying hospital inpatient stay.

Costs, Premiums & Deductibles for 2025

Even though Part A covers important services, beneficiaries still face costs in the form of deductibles, coinsurance, and premiums (in some cases). Here are current figures for 2025:

- Monthly premium: Most people pay $0 for the Part A premium if they or their spouse worked and paid Medicare taxes for at least 40 quarters (10 years).

If you don’t qualify for premium-free Part A, in 2025 the premium can be up to $518/month, depending on how many quarters you or your spouse worked and paid Medicare taxes. - Deductible (inpatient hospital stay): For 2025, the deductible per benefit period for an inpatient hospital stay under Part A is $1,676.

- Coinsurance / daily cost sharing:

- Days 1-60 of a hospital stay in a benefit period: after you pay the deductible, you generally pay $0 for each of those days.

- Days 61-90: You pay $419 per day in 2025 after the deductible.

- Days 91 onward (lifetime reserve days): You pay $838 per day for up to 60 lifetime reserve days in your lifetime.

- Skilled Nursing Facility (SNF) stays: For days 1-20, you pay $0; for days 21-100, you pay $209.50 per day in 2025. After day 100 you pay all costs.

Benefit Periods & How Coverage Works

A key concept in Part A is the “benefit period.” A benefit period begins the day you’re admitted as an inpatient in a hospital and ends when you haven’t received inpatient hospital or skilled nursing facility services for 60 consecutive days.

Here’s how it matters:

- Each new benefit period starts fresh for deductible purposes. So if you go into the hospital later (after at least 60 days free of inpatient care), you’ll pay the deductible again.

- For SNF coverage under Part A, you generally must have first had a qualifying hospital stay (three days or more) and enter SNF care within 30 days of leaving the hospital.

- Lifetime reserve days are limited to 60 in your lifetime, and they apply after day 90 of a hospital stay in a benefit period. Once used, they are gone for good.

What Medicare Part A Does Not Cover

It’s equally important to know what Part A doesn’t cover, so you’re not caught off-guard:

- Long-term care, custodial care, or non-medical care services (for example, assisted living purely for custodial needs) are not covered.

- Most outpatient services—visits to doctors’ offices, outpatient surgery, routine preventive care—are covered under Medicare Part B, not Part A.

- Services provided in a skilled nursing facility that are for custodial care (help with daily living activities without skilled medical or rehab services) are not covered.

- After your SNF stay exceeds the covered days (typically 100 days in a benefit period), you pay all costs beyond that under Part A.

Eligibility and Enrollment Basics

Eligibility for Part A works generally as follows:

- You’re eligible if you’re 65 or older and either you or your spouse worked and paid Medicare taxes for at least 40 quarters (about 10 years).

- Younger individuals can also qualify if they meet criteria such as receiving Social Security disability benefits for 24 months, having end-stage renal disease (ESRD), or having amyotrophic lateral sclerosis (ALS).

- If you qualify for premium-free Part A (i.e., met the 40 quarters rule) you don’t pay a monthly premium. If you didn’t, you can buy Part A—but you’ll pay a monthly premium and potentially a late enrollment penalty.

Recent 2025 Updates Worth Knowing

Here are the notable updates for 2025 that impact Part A coverage and costs:

- The inpatient hospital deductible increased to $1,676 from $1,632 in 2024.

- The daily coinsurance amount for days 61-90 in the hospital was raised to $419/day in 2025.

- Skilled nursing facility coinsurance for days 21-100 rose to $209.50/day in 2025.

- Approximately 99% of Medicare beneficiaries receive premium-free Part A because they have the required work history (40 quarters) or meet other qualifying conditions.

These cost changes may seem modest but understanding them is crucial for budgeting and planning.

Why the Distinction Matters for Your Coverage

Understanding “what Medicare Part A covers” is more than academic. It helps you:

- Know when you’ll be covered for hospital or skilled-nursing stays, and when you may face significant out-of-pocket costs.

- Identify when you’ll need additional coverage (for example, an outpatient doctor visit that Part B or a Medicare Advantage plan covers instead).

- Make informed decisions about supplemental insurance (for instance, a Medigap plan) or choosing between Original Medicare and a Medicare Advantage plan.

- Plan for benefit-period resets and hospital-stay cost thresholds so you’re not surprised mid-stay by new deductibles or coinsurance.

Summary Table: Key Coverage Facts for Medicare Part A (2025)

| Coverage Element | What It Is | 2025 Amount |

|---|---|---|

| Premium for most people | $0 (if you paid Medicare taxes for 40 quarters) | $0 for most |

| Premium if you don’t qualify | Monthly cost if you didn’t meet work requirement | Up to ~$518/month |

| Hospital inpatient deductible | Per benefit period | $1,676 |

| Hospital coinsurance days 61-90 | Daily cost after deductible in a benefit period | $419/day |

| Hospital coinsurance (lifetime reserve days) | Daily cost for up to 60 days in lifetime reserve | $838/day |

| Skilled Nursing Facility coinsurance days 21-100 | Daily cost after initial 20 days | $209.50/day |

Frequently Asked Questions (FAQ)

1. Who qualifies for Medicare Part A?

Anyone aged 65 or older who worked and paid Medicare taxes for at least 10 years typically qualifies for premium-free Part A. Certain younger individuals with disabilities or medical conditions like ESRD or ALS may also qualify.

2. Does Medicare Part A cover surgery?

Yes, if the surgery requires inpatient hospital admission. Outpatient surgeries are generally covered under Medicare Part B.

3. Does Medicare Part A cover emergency room visits?

Only if you are admitted to the hospital as an inpatient after your emergency room visit. Otherwise, ER services are usually covered by Part B.

4. How long will Medicare Part A cover a hospital stay?

Part A covers up to 90 days in each benefit period, plus an additional 60 lifetime reserve days. After that, you’re responsible for all costs.

5. Does Medicare Part A cover home health care?

Yes, but only under limited conditions—typically after an inpatient stay and when skilled care is medically necessary.

6. Is Medicare Part A free for everyone?

Most beneficiaries do not pay a monthly premium because they’ve paid Medicare taxes for at least 40 quarters. Those who don’t meet this requirement can still buy Part A coverage.

Final Thoughts

“What does Medicare Part A cover” is a question that every Medicare-eligible person should answer clearly for themselves. This coverage offers critical protection for inpatient hospital stays, skilled nursing facility care, hospice, and some home health services—but it has limits and costs. As of 2025, with updated deductibles and coinsurance amounts, staying informed is more important than ever.

If you’ve found this guide helpful, share your thoughts or experiences in the comments below to help others stay informed.

Disclaimer:

This article is for informational purposes only. It summarizes verified, publicly available information from Medicare and related federal agencies as of October 2025. It is not intended as legal, tax, or insurance advice. Always consult Medicare or a licensed professional for specific questions about your situation.