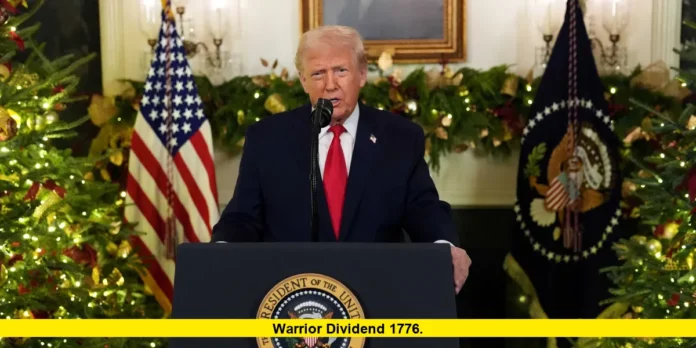

The announcement of warrior dividend 1776 marked a rare moment of direct financial recognition for America’s uniformed service members, as President Donald Trump confirmed a one-time $1,776 holiday bonus for eligible troops nationwide. Timed to arrive before Christmas, the payment is designed to honor military service while offering immediate economic relief during a season when household expenses often rise.

The initiative quickly became a focal point of national attention, not only because of the amount involved but also because of its symbolism. The figure $1,776 references the year the United States declared independence, reinforcing the administration’s message of patriotism, service, and national identity.

A One-Time Payment With Strong Symbolism

The holiday bonus is structured as a single, lump-sum payment rather than a recurring benefit. Officials emphasized that it does not replace base pay, housing allowances, or other existing military compensation. Instead, it stands apart as a special year-end distribution intended to acknowledge the sacrifices made by those currently serving.

By tying the dollar amount to the nation’s founding year, the administration framed the bonus as both a financial reward and a symbolic gesture. The message focused on gratitude for military readiness, global deployments, and the personal strain service members and their families often face.

Who Qualifies for the Bonus

Eligibility criteria were clearly outlined to ensure payments reached active participants in the nation’s defense. Those eligible include:

- Active-duty members of the Army, Navy, Air Force, Marine Corps, Space Force, and Coast Guard

- Reserve and National Guard personnel serving on qualifying active-duty orders during the eligibility window

- Officers up to the rank of O-6, along with enlisted personnel

The payment does not apply to retirees, veterans no longer serving, or civilian defense employees. Officials stated that limiting eligibility ensured the funds went directly to those currently fulfilling military obligations.

Automatic Distribution Through Military Pay Systems

One of the most notable aspects of the program is its simplicity. Eligible service members are not required to submit applications or complete additional paperwork. The payment is issued automatically using existing military payroll infrastructure.

Funds are delivered through direct deposit to the same accounts used for regular pay. This approach minimizes administrative delays and ensures consistency across branches. Distribution was scheduled so that recipients receive the full amount before December 25.

Because the payment arrives as a single deposit, families can immediately decide how to use it based on their own priorities.

Tax Treatment and Financial Impact

The bonus is classified as a non-taxable payment at the federal level. As a result, recipients receive the full $1,776 without deductions for federal income tax. The payment does not alter taxable income calculations tied to regular wages or allowances.

For many households, the non-taxable status increases the practical value of the bonus. Military families often manage tight budgets due to frequent relocations and deployment-related costs, making unrestricted funds especially valuable.

Funding and Fiscal Context

Administration officials stated that the funds for the holiday bonus came from higher-than-expected federal revenues tied to tariff collections and existing fiscal measures. By emphasizing that the payment relied on available revenue rather than long-term borrowing, the administration sought to frame the initiative as financially responsible.

The payment does not create an ongoing obligation in future budgets. Instead, it stands as a one-time allocation tied to current fiscal conditions, limiting its impact on long-term defense spending plans.

Why the Timing Matters

The announcement arrived during a period of ongoing economic pressure for many Americans. Inflation, housing costs, and everyday expenses continue to shape public sentiment nationwide. Military families, who often live on fixed income structures and face unique logistical challenges, have felt these pressures acutely.

Delivering the bonus before Christmas amplifies its immediate usefulness. Families can apply the funds toward travel, gifts, savings, debt reduction, or essential expenses without restrictions. The timing also reinforces the message of appreciation during a season traditionally associated with service and sacrifice.

Public and Political Response

Reaction to the holiday bonus has been swift and wide-ranging. Supporters describe it as a meaningful acknowledgment of military service and a welcome financial boost at a critical time of year. Many service members have expressed appreciation for both the monetary support and the symbolic recognition.

Critics, meanwhile, have raised questions about process and precedent, particularly regarding how similar initiatives might be handled in the future. Despite differing opinions, the payment itself has proceeded as planned, with funds reaching eligible accounts across the country.

What the Bonus Means for Military Families

For many households, the $1,776 payment provides flexibility rather than obligation. Unlike benefits earmarked for housing, education, or healthcare, this bonus carries no spending restrictions.

Families have indicated they plan to use the funds in diverse ways, including:

- Covering holiday-related expenses

- Paying down credit card or personal debt

- Building emergency savings

- Managing costs tied to relocation or deployment

The unrestricted nature of the payment allows each household to decide what matters most, a feature that has resonated strongly with recipients.

Broader Implications for Military Compensation

While the holiday bonus is significant, it does not alter base pay tables or long-term compensation structures. Military salaries and allowances remain governed by existing legislation and annual budget processes.

However, the initiative has sparked renewed discussion about how the nation recognizes military service beyond standard pay increases. Some observers note that one-time payments, while impactful, differ from structural changes that address long-term affordability concerns for service members.

Looking Ahead

The warrior dividend stands as a distinctive moment in recent military compensation history, blending symbolism with direct financial support. Its one-time nature ensures it remains a targeted gesture rather than a permanent policy shift.

As service members receive their payments and families put the funds to use, attention will likely turn to whether similar initiatives emerge in the future or remain tied to specific economic and political conditions. Regardless, the program has already left a visible mark on the year’s closing weeks.

Later in the article, discussions around warrior dividend 1776 have continued to highlight broader questions about recognition, fiscal policy, and how the nation supports those who serve.

For now, the focus remains on the immediate impact: a timely holiday bonus that delivers both financial relief and a symbolic nod to the country’s founding ideals.