The U.S. student loan system is undergoing its most significant transformation in years, and for millions of borrowers, student loan consolidation has become a critical topic in 2026. New federal laws and finalized regulations are reshaping repayment plans, forgiveness rules, collection policies, and borrowing limits. These confirmed changes affect how loans are combined, how long borrowers may repay, how much they owe each month, and whether forgiven balances could trigger taxes.

For borrowers trying to simplify multiple federal loans or protect access to certain repayment options, understanding how consolidation fits into the new system is essential. Here is a comprehensive, fact-based overview of what is in effect now and what it means for anyone carrying federal student debt.

A New Federal Student Loan Framework Begins

Starting in 2026, the federal government is implementing a restructured lending and repayment system created by legislation passed in 2025 and finalized through Department of Education regulations. These reforms affect both current borrowers and those taking out new loans going forward.

For borrowers with existing loans, many current benefits and repayment options remain available for now. However, key programs are being phased out, replaced, or limited over the next several years. Consolidation decisions made in 2026 can determine which repayment rules apply for decades.

Changes to Repayment Plans

Streamlined Repayment Options for New Loans

Beginning July 1, 2026, newly issued federal student loans are limited to two primary repayment structures:

- Standard Repayment Plan: Fixed monthly payments over a term based on the total balance.

- Repayment Assistance Plan (RAP): A simplified income-based option with payments tied to a percentage of discretionary income and potential forgiveness after long-term repayment.

Older income-driven plans remain available only for borrowers who already hold loans under those systems. Future borrowers and those who consolidate under the new framework will not have access to many legacy plans.

Discontinuation of the SAVE Plan

The SAVE income-driven plan is no longer available. Borrowers previously enrolled are being transitioned to other eligible options under existing repayment rules.

Tax Treatment of Forgiven Student Loans

As of January 1, 2026, the temporary federal tax exemption for most forgiven student loan balances has expired. Under current law:

- Forgiveness through many income-driven repayment programs may now be treated as taxable income.

- Public Service Loan Forgiveness remains exempt from federal taxation.

This change has major implications for borrowers planning long-term repayment strategies and potential consolidation to reach forgiveness eligibility.

Collections and Wage Garnishment Update

The federal government had prepared to resume involuntary collections on defaulted student loans, including:

- Wage garnishment

- Seizure of tax refunds

- Offset of certain federal benefits

However, in early 2026, the Department of Education paused these enforcement actions. The pause gives borrowers additional time to enter repayment plans, pursue rehabilitation, or explore consolidation before automatic collections resume.

This delay affects millions of borrowers who had fallen into default and were at risk of immediate paycheck deductions.

How Student Loan Consolidation Fits Into the 2026 Rules

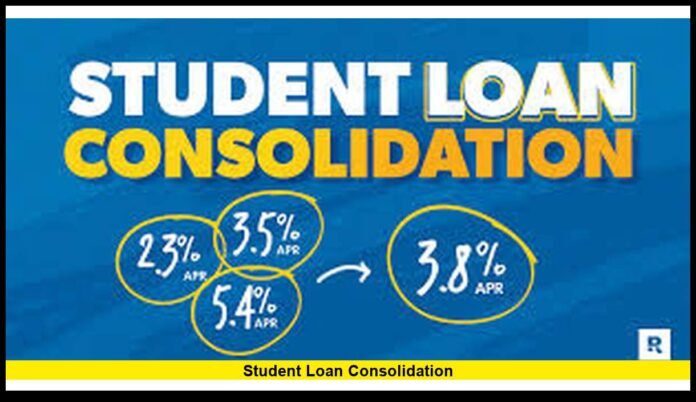

Student loan consolidation allows multiple federal loans to be combined into one Direct Consolidation Loan, resulting in a single monthly payment and unified repayment terms. Under the 2026 reforms, consolidation now carries long-term strategic consequences.

1. Consolidation Timing Is Critical

- Consolidating before July 1, 2026 generally preserves access to existing repayment plans that are no longer available to new borrowers.

- Consolidating on or after July 1, 2026 may place all loans under the new limited repayment system, restricting future plan choices.

This timing can determine whether a borrower keeps access to older income-driven plans or is permanently moved into the new structure.

2. Access to Income-Based Repayment

Certain federal loans, such as Parent PLUS loans, require consolidation to qualify for income-driven repayment options. With some plans being phased out, borrowers who consolidate earlier may retain broader flexibility.

3. Default Resolution Through Consolidation

For borrowers in default, consolidation remains one of the approved methods to return loans to good standing. Once consolidated, borrowers can regain access to deferment, forbearance, and long-term repayment programs.

The current pause on wage garnishment allows time to pursue consolidation without immediate collection actions.

New Borrowing Limits and Loan Program Changes

Federal loan caps are also changing under the new law:

- Annual and lifetime limits are now in place for graduate and professional students.

- Parent PLUS loans are subject to new borrowing caps.

- Graduate PLUS loans are being phased out for future borrowers after July 1, 2026.

These changes affect how much future debt can be added to consolidation balances and may reduce the size of loans available to graduate students going forward.

What Current Borrowers Should Know

- Existing borrowers may keep current repayment plans if they do not consolidate under the new system.

- Consolidating before mid-2026 can help preserve eligibility for legacy income-driven options.

- Forgiven balances outside of specific programs may now create taxable income.

- Involuntary collections remain paused but may resume once implementation of new systems is complete.

Practical Considerations in 2026

Borrowers evaluating consolidation should consider:

- Whether combining loans will reset forgiveness timelines.

- How interest rates are weighted in a consolidation loan.

- Which repayment plans will remain available after consolidation.

- Whether default status or past delinquencies can be resolved through consolidation.

Each of these factors directly affects long-term affordability and eligibility for forgiveness.

With federal policy shifting and long-term repayment structures changing, understanding your options for student loan consolidation in 2026 can make a lasting difference in how much you repay and how long you remain in debt. Join the conversation below and stay informed as borrowers across the country navigate this new era of student loan reform.