Understanding the social security retirement age chart is essential for anyone planning to claim their Social Security benefits in 2025 and beyond. Whether you’re approaching retirement, mapping out your long-term financial future, or helping a family member decide when to claim, knowing your official full retirement age (FRA) is the foundation for smarter planning. Today, the Social Security system operates with a retirement age that increases based on the year you were born, and these changes have significant effects on how much you can receive each month.

As 2025 begins, more Americans are hitting ages where decisions about early, full, or delayed benefits matter more than ever. The retirement age shift that began decades ago is now reaching its final phase, impacting millions of Americans born between the late 1950s and early 1960s. This updated chart—and the rules surrounding it—can make a major difference in your retirement income.

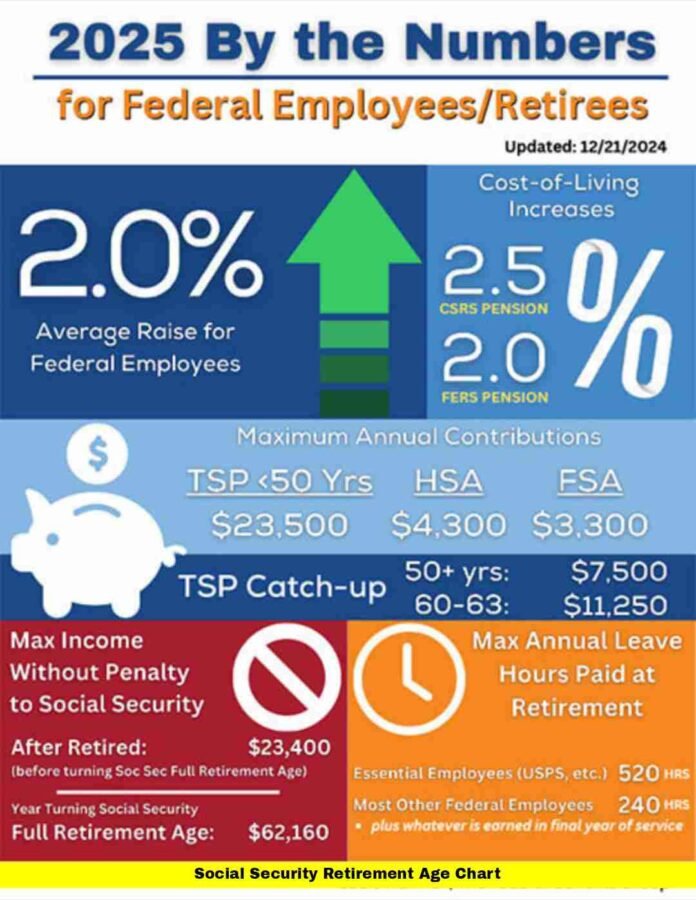

Full Retirement Age Chart by Birth Year

Here is the current social security retirement age chart, outlining the full retirement age based on your birth year:

| Birth Year | Full Retirement Age |

|---|---|

| 1937 or earlier | 65 |

| 1938 | 65 and 2 months |

| 1939 | 65 and 4 months |

| 1940 | 65 and 6 months |

| 1941 | 65 and 8 months |

| 1942 | 65 and 10 months |

| 1943–1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 or later | 67 |

This chart is the basis of how Social Security calculates your standard benefit amount. Your full retirement age is the point at which you are entitled to 100% of your earned Social Security benefits.

Why the Retirement Age Has Increased Over Time

The gradual rise in the full retirement age (FRA) didn’t appear suddenly—it has been decades in the making. Lawmakers introduced these changes long ago to keep Social Security stable in the face of major demographic shifts. As Americans began living longer, healthier lives, retirees spent many more years collecting benefits than previous generations. At the same time, the size and makeup of the workforce changed, altering the balance between how much money was paid into the system and how much was paid out.

To help the program stay financially sound, the FRA was increased from the long-standing age of 65 to a sliding scale between 66 and 67. Importantly, this shift was designed to be gradual. Instead of raising the age all at once, the adjustment rolled out over multiple birth years, spreading the impact across generations.

By 2025, this transition is reaching its final stages. Individuals born in 1959 have a full retirement age of 66 years and 10 months, placing them among the last groups affected by the phased change. Anyone born in 1960 or later now has a full retirement age of 67, marking the completion of the FRA increase first planned decades earlier.

Today, an FRA of 67 is considered the new standard. For all future retirees, this age represents the baseline for receiving full Social Security benefits—and it reflects the program’s ongoing adaptation to a population that continues to live longer and retire differently than generations before.

How Early Retirement Affects Your Benefits

Even though the full retirement age has gradually increased, Americans still retain the flexibility to begin collecting Social Security retirement benefits as early as age 62. But this early start comes with long-lasting financial trade-offs that everyone should understand before making a decision.

When you claim benefits before your full retirement age, Social Security permanently lowers your monthly payment. This isn’t a temporary reduction—it continues for the rest of your life. The earlier you claim, the bigger the cut. For those with a full retirement age of 67, collecting at 62 typically results in a reduction of about 30%. Over the span of a 20–30-year retirement, that difference can add up to tens of thousands of dollars in lost income.

Why do many people still choose early retirement? For some, the need for steady income is immediate—particularly if they’re leaving the workforce earlier than expected or dealing with health issues. Others may simply prefer more free time in their early 60s, even if it means accepting lower monthly checks. On the other hand, individuals who can afford to wait often delay claiming to avoid permanent reductions and secure a stronger financial foundation later in life.

Choosing when to start Social Security is deeply personal. Understanding the real impact of early benefits is the first step toward making an informed, confident retirement decision.

How Delaying Retirement Increases Your Benefits

On the opposite end of the retirement spectrum is delayed claiming, a strategy that rewards patience with significantly higher monthly income. If you wait beyond your full retirement age (FRA) to start collecting Social Security, the system grants you delayed retirement credits, which boost your benefit amount every year you postpone.

These credits are substantial. For each year you delay past your FRA—up to age 70—your monthly benefit increases by roughly 8%. That’s a guaranteed return few investments can match. By waiting until 70, retirees often receive 24%–32% more per month than they would at their full retirement age, depending on their birth year.

This higher monthly payment continues for life, which can result in significantly greater total income if you live into your late 70s, 80s, or beyond. The strategy becomes especially valuable for people with longer life expectancies, those still earning income, or individuals who want to maximize the survivor benefit a spouse may rely on later.

It’s important to note, however, that the increases stop at age 70. After that point, delaying further provides no additional benefit, making 70 the latest age at which waiting makes financial sense.

For many Americans, delaying Social Security is one of the most effective ways to strengthen long-term retirement security—helping ensure larger, more predictable income throughout their later years.

How Working Before Full Retirement Age Impacts Your Benefits

Many Americans continue working even after they begin receiving Social Security—especially those who claim early. But if you choose to collect benefits before reaching your full retirement age (FRA), your earnings can temporarily affect the amount you receive each month.

Here’s how it works:

There is an annual earnings limit for people who claim Social Security early and continue working. If your income goes above this threshold, the Social Security Administration withholds a portion of your benefits. The goal is not to penalize workers, but to balance early claims against ongoing earnings.

Once you reach your full retirement age, these rules disappear. At FRA, you can earn any amount of income—full-time or part-time—without affecting your Social Security payments. Your benefits are no longer reduced, and your monthly check stabilizes.

It’s essential to understand that the withholdings before FRA are not permanent losses. Social Security recalculates your benefit once you reach full retirement age, adjusting it upward to account for the months in which payments were withheld due to earnings. This recalculation can lead to slightly higher checks later on, helping ensure your lifetime benefit remains fair.

For workers considering early benefits, knowing how earnings can shape your Social Security payments can make a big difference in planning the best time to retire—or the best time to keep working.

Why the Social Security Retirement Age Chart Matters in 2025

The Social Security retirement age chart has become more than a simple reference table—it’s a roadmap for navigating one of the most important financial decisions of your life. As the full retirement age (FRA) reaches the final stage of its long-planned increase, understanding where you fall on the chart is essential for choosing the right claiming strategy and optimizing long-term income.

In 2025, the chart carries greater relevance than ever for several key reasons:

- The phased FRA increase is essentially complete.

Everyone born in 1960 or later now has a full retirement age of 67, marking the end of a transition that began decades ago. - Baby Boomers born in 1959 face a unique FRA.

Their full retirement age is 66 years and 10 months, a detail that significantly affects timing decisions for those still finalizing retirement plans. - Gen X and early Millennials now share a universal FRA.

With 67 firmly established as the standard, younger generations are planning their retirement around a consistent timeline—one that will shape saving habits, pension strategies, and investment goals. - Income planning relies on knowing your FRA.

Whether coordinating with a pension, determining when to tap retirement accounts, or budgeting long-term expenses, your FRA anchors every projection. - Workers must understand earnings limits before FRA.

Claiming early while still working can temporarily reduce benefits, making the chart key for anyone balancing employment with Social Security.

Ultimately, the retirement age chart is the foundation of every Social Security decision. It helps retirees and future retirees align their expectations, choose the right claiming age, and build a retirement strategy that maximizes lifetime income.

How to Decide the Best Time to Claim Benefits: How to Decide the Right Time to Claim Social Security

Choosing when to claim Social Security benefits is one of the most impactful financial decisions you’ll make in retirement. While the retirement age chart helps you quickly identify your full retirement age (FRA), the actual timing of your claim depends on far more than a simple number. It requires a thoughtful look at your personal circumstances, long-term goals, and financial readiness.

Several key factors influence the ideal time to file:

- Your health and family longevity history

If you expect a longer-than-average lifespan, waiting for a higher monthly benefit may provide more lifetime income. Conversely, health challenges may make earlier benefits more practical. - Your immediate financial needs

Some retirees claim early to bridge income gaps, cover living expenses, or replace lost wages. Others delay because they have savings or other resources to support them for a few more years. - Whether you plan to keep working

If you will continue working before reaching FRA, earnings limits may reduce your benefits temporarily, making delayed claiming more appealing. - Your retirement income mix

Savings, investments, pensions, part-time work, and spousal income all affect when claiming Social Security makes the most strategic sense. - The long-term impact of reduced or increased payments

A permanently reduced benefit at 62 or a significantly increased benefit at 70 shapes your financial stability for the rest of your life.

In reality, deciding between early, full, or delayed benefits is rarely a simple yes-or-no choice. It often involves balancing current financial needs with long-term security, as well as aligning benefits with the lifestyle you envision for your retirement years. When approached thoughtfully, the right claiming age can help you unlock a retirement that is both comfortable and sustainable.

The Bottom Line

The social security retirement age chart for 2025 marks the end of a long transition toward a higher full retirement age. With most younger Americans now facing a full retirement age of 67, understanding the impact of claiming early or delaying benefits is more crucial than ever. Whether you’re planning to retire soon or simply organizing your long-term financial strategy, knowing your exact FRA can help you avoid costly mistakes and make informed decisions.