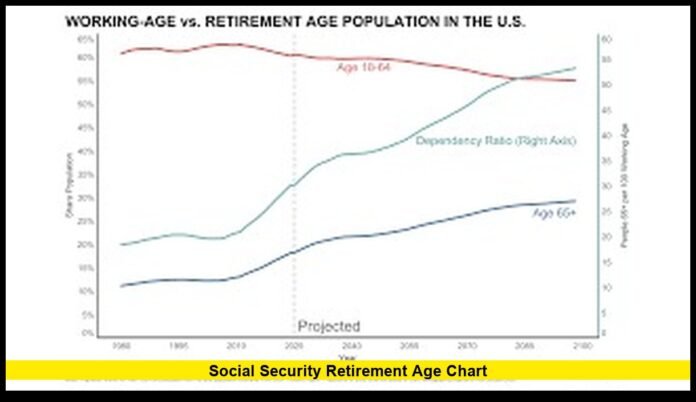

The social security retirement age chart continues to shape how millions of Americans plan their financial futures, especially as 2025 brings new attention to when individuals qualify for full Social Security benefits. With retirement patterns shifting, longevity increasing, and continued discussions surrounding the sustainability of Social Security, understanding the chart has never been more essential.

Many nearing retirement today are navigating a very different landscape from their parents and grandparents. The age of 65 is no longer the default benchmark. Instead, the Social Security Administration uses a gradually rising full retirement age (FRA), linked directly to one’s birth year, to determine when people receive their complete earned benefits.

In this expanded, detailed, and reader-friendly guide, we break down every aspect of the social security retirement age chart, how it affects your benefits, and how Americans in 2025 can use the chart to make smarter decisions. The goal is to give you the clearest, most human, and most practical understanding possible—free of jargon and built around real-life application.

Why the Social Security Retirement Age Chart Matters So Much in 2025

The FRA has become one of the most important numbers in the retirement planning world because it directly affects:

- How much you receive monthly

- The consequences of claiming early

- The bonus for delaying benefits

- Spousal and survivor benefit timing

- Your overall financial stability throughout retirement

Every year, more Americans reach eligibility age, but the benefit rules have become more complex as the chart changes. In 2025, the chart takes on heightened importance for several reasons:

- People born in 1959 are reaching a higher FRA than many expected.

- Those born in 1960 or later must wait until 67 to claim full benefits.

- Younger workers are recognizing the possibility that future FRAs may rise further.

- The difference between early and late filing has never been more financially significant.

The chart is not simply a reference—it’s a strategic tool that determines when retirement begins and how comfortable those retirement years will be.

Understanding the Social Security Retirement Age Chart

The social security retirement age chart assigns a specific full retirement age based on your birth year. That age is when you qualify for 100% of your earned Social Security benefit amount.

Here’s the official breakdown:

| Year of Birth | Full Retirement Age (FRA) |

|---|---|

| 1943–1954 | 66 |

| 1955 | 66 + 2 months |

| 1956 | 66 + 4 months |

| 1957 | 66 + 6 months |

| 1958 | 66 + 8 months |

| 1959 | 66 + 10 months |

| 1960 or later | 67 |

This shift reflects the government’s long-term effort to adjust Social Security eligibility alongside national life expectancy and economic conditions.

For millions of workers, the biggest surprise is that their FRA is not a simple whole number—it may be 66 years plus several months. Those extra months affect filing calculations, penalties, and planning.

What FRA Really Means

Your full retirement age determines several major factors:

1. The Age You Receive 100% of Your Benefits

You receive the exact benefit amount you’ve earned throughout your lifetime.

2. The Percentage Reduction for Early Filing

Claiming before your FRA leads to reduced monthly benefits.

3. The Bonus for Delaying Benefits

If you wait past your FRA—up to age 70—you can receive significantly larger monthly payments.

Understanding these three components is key to optimizing your retirement income.

How Early Retirement Affects Your Benefits

You can file for Social Security as early as age 62, but doing so results in a permanent reduced benefit. The reduction is based entirely on the social security retirement age chart.

If your FRA is 66

- Claiming at 62 reduces benefits by about 25%

If your FRA is 67

- Claiming at 62 reduces benefits by about 30%

This reduction stays for life. It doesn’t disappear when you reach your FRA.

Many people underestimate just how large this reduction becomes over decades. A 25–30% cut in monthly income can add up to tens of thousands—or even hundreds of thousands—lost over the course of retirement.

How Delaying Beyond FRA Increases Benefits

Delaying benefits beyond your full retirement age results in delayed retirement credits.

These credits increase your monthly benefit by about 8% per year, up to age 70.

This means:

- FRA 66 → Wait to 70 = around 32% increase

- FRA 67 → Wait to 70 = around 24% increase

That boost can significantly impact income later in life, particularly in cases of longevity.

Why People Are Paying More Attention to the Chart in 2025

This year, the chart is in the spotlight for three major reasons:

1. The 1959 Birth Cohort Hits a Higher FRA

This group faces an FRA of 66 years and 10 months.

Even a slight shift in FRA changes early filing penalties and planning timelines.

2. The 1960-and-Later Group Is Approaching the FRA of 67

This is the first generation required to wait until 67 for full benefits.

For these individuals, early filing penalties are larger.

3. Ongoing National Discussions Surrounding Social Security Solvency

Although there are no new laws increasing FRA, public conversations continue about potential adjustments in the future.

These factors make the chart more relevant than ever.

Using the Chart to Make Smart Retirement Decisions

Understanding the chart is the first step. The next step is figuring out how it applies to your specific situation.

Here’s a practical breakdown of how to read and use the social security retirement age chart effectively.

Step 1: Identify Your Full Retirement Age

Find your year of birth in the chart.

This is the cornerstone of your benefit planning.

For example:

- Born in 1958 → FRA 66 years + 8 months

- Born in 1960 → FRA 67

Knowing this lets you calculate early penalties and delayed bonuses.

Step 2: Determine Whether You Plan to File Early, On Time, or Late

Every choice comes with trade-offs:

- Early filing → More years of payments, but lower monthly amounts

- On-time filing → Balanced approach, full benefits

- Delayed filing → Highest monthly amount but fewer years of payment

Your decision may depend on:

- Health

- Life expectancy

- Employment status

- Marital considerations

- Financial obligations

- Retirement savings

Step 3: Consider How Long You Expect to Live

Life expectancy is a key factor.

For many Americans, living beyond 85 is increasingly common.

If you expect a long retirement, delaying benefits may result in more lifetime income.

If you expect a shorter retirement, filing earlier may be more beneficial.

Step 4: Evaluate Your Savings and Other Income Sources

Ask yourself:

- Do you have 401(k) or IRA savings?

- Will you continue working past 62?

- Do you have a pension?

- Do you need to bridge an income gap?

Someone with strong savings may benefit from delaying to 70.

Someone relying primarily on Social Security may claim earlier.

Step 5: Think About Spousal or Survivor Benefits

The social security retirement age chart affects:

- Couples who coordinate benefits

- Widows and widowers

- Divorced spouses who qualify based on a former partner’s record

In some cases, delaying one spouse’s benefit increases survivor benefits later.

Real-Life Scenarios Demonstrating the Chart

Scenario A: Born in 1958

- FRA: 66 + 8 months

- Filing at 62: Roughly 28% reduction

- Filing at 70: Roughly 24% increase

A person in this situation needs to weigh the difference between reduced early benefits and boosted late benefits.

Scenario B: Born in 1960

- FRA: 67

- Filing at 62: Roughly 30% reduction

- Filing at 70: 24% increase

For this group, the stakes are higher because the percentage reduction for early filing is larger.

Scenario C: Born in 1955

- FRA: 66 + 2 months

- Early filing reductions are slightly smaller

- Many in this group are actively adjusting plans based on rising life expectancy and financial needs

Common Mistakes People Make When Using the Chart

Mistake 1: Assuming FRA Is 65

It hasn’t been 65 for decades.

Mistake 2: Assuming Benefits Automatically Increase at FRA

If you filed early, the reduction stays forever.

Mistake 3: Assuming Delaying Always Makes Sense

Delaying is beneficial only when financial and medical conditions allow.

Mistake 4: Misreading FRA by a Few Months

This small mistake can lead to incorrect planning and inaccurate benefit expectations.

Mistake 5: Claiming Early Without Considering Long-Term Needs

This is especially risky for those who may outlive their savings.

How the Chart Influences Spousal and Survivor Benefits

The social security retirement age chart impacts more than just individual benefits.

For Spousal Benefits:

- A spouse can receive benefits based on their partner’s earnings record.

- FRA determines whether the spouse receives full or reduced benefits.

- Early filing by either spouse affects the household’s overall benefit level.

For Survivor Benefits:

- Widows or widowers receive a percentage of the deceased spouse’s benefit.

- If the deceased spouse delayed benefits, survivor benefits may be higher.

- FRA affects both the deceased’s benefit base and the survivor’s benefit amount.

Understanding the chart is crucial for couples choosing coordinated retirement strategies.

Why More Americans Are Working Beyond FRA

A clear trend has emerged: more people are continuing to work past full retirement age.

Reasons include:

- Desire to increase Social Security benefits

- Rising cost of living

- Longer life expectancies

- Employer demand for experienced workers

- Access to employer-provided health insurance

- Personal preference and lifestyle

For many, waiting until 70 to maximize benefits is becoming a realistic strategy.

How Younger Workers Should Think About the Chart

While nothing has changed legally for workers born after 1960, many younger individuals are planning with the expectation that their FRA may rise beyond 67 someday.

Younger workers today can use the chart to:

- Estimate benefits decades in advance

- Understand how early filing penalties work

- Build retirement savings strategies that complement Social Security

- Avoid relying solely on government benefits

Practical Tips for Using the Social Security Retirement Age Chart

1. Look at the Chart Every Time Your Plan Changes

A job change, illness, divorce, or early retirement can alter your strategy.

2. Use the Chart With Your Earnings Record

Your estimated benefit is based on your highest 35 years of earnings.

3. Compare Early vs. Late Filing Scenarios

Run multiple projections to see the full picture.

4. Coordinate With Your Spouse

The chart becomes even more important in two-income households.

5. Revisit Your Plan Annually

Retirement planning is not a one-time decision.

Final Thoughts

The social security retirement age chart is one of the most important tools in modern retirement planning. As 2025 unfolds, more Americans are recognizing how crucial it is to understand their FRA, the penalties for early filing, and the benefits of delayed filing.

Whether you plan to retire early, claim exactly at your FRA, or delay to maximize your lifetime income, the chart helps guide every major decision. To stay financially prepared, take time to review your birth-year category, consider how long you plan to work, evaluate your savings, and think carefully about the timing that best aligns with your goals.

If you’re thinking about your own retirement timing, feel free to share your thoughts or ask questions—your experience may help others navigating the same decisions.

FAQs

1. Can the Social Security retirement age change again in the future?

While the current chart is fixed, lawmakers continue to discuss potential adjustments for younger generations. No change has been enacted yet.

2. Does filing early permanently reduce my benefits?

Yes. Any reduction from early filing remains in place for the rest of your life.

3. Is delaying to age 70 always the best decision?

Not for everyone. Delaying benefits increases your check, but your health, financial needs, and job situation should guide your choice.

Disclaimer: This article is for informational purposes only and does not constitute financial, tax, or legal advice. Individuals should consult a qualified professional before making decisions related to Social Security or retirement planning.