The social security age change in 2026 marks the completion of a long-scheduled shift in the full retirement age for Americans, confirming that 67 is now the standard age to receive unreduced Social Security retirement benefits. This update affects workers across the country and shapes when millions can claim their full monthly payments without permanent reductions.

For people born in 1960 or later, the full retirement age is now officially 67. This is not a sudden policy decision. It is the final step of a gradual increase that began decades ago and has now fully taken effect. While benefits can still be claimed as early as age 62, doing so results in a lower monthly payment for life.

What the Social Security Age Change Means

The social security age change refers to the completion of the full retirement age increase from 65 to 67. The full retirement age is the point at which a worker becomes eligible for 100 percent of their earned retirement benefit.

Here is how it now stands:

| Birth Year | Full Retirement Age |

|---|---|

| 1954 or earlier | 66 |

| 1955–1959 | 66 plus 2 to 10 months |

| 1960 or later | 67 |

This means anyone turning 62 in 2026 or later will have a full retirement age of 67.

Claiming Early Versus Waiting

Although the full retirement age is 67, Americans may still claim benefits starting at age 62. The trade-off is a permanent reduction in monthly income.

Key points to understand:

- Claiming at 62 can reduce benefits by up to about 30 percent.

- Claiming at 63, 64, or 65 results in smaller but still permanent reductions.

- Waiting until full retirement age allows access to the full benefit amount.

- Delaying beyond 67 increases monthly payments through delayed retirement credits, up to age 70.

Each year of delay after full retirement age adds roughly 8 percent to the monthly benefit, making waiting an attractive option for those in good health with other income sources.

Why the Retirement Age Reached 67

The increase to age 67 was designed to reflect longer life expectancy and the financial realities of the Social Security system. When the program began in the 1930s, most Americans did not live long past 65. Today, many retirees spend two decades or more collecting benefits.

Raising the full retirement age:

- Reduces lifetime benefit costs.

- Encourages longer workforce participation.

- Helps stabilize long-term program funding.

The change does not affect Medicare eligibility, which still begins at age 65.

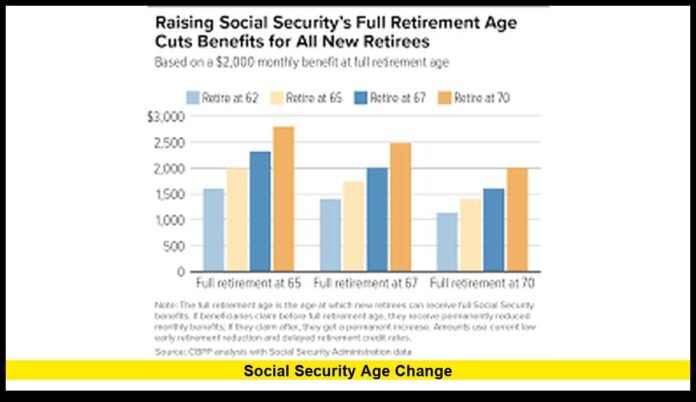

How the Social Security Age Change Affects Monthly Payments

The age at which benefits are claimed has a major impact on monthly income.

Example scenario:

- A worker eligible for $2,000 per month at age 67.

- Claiming at 62 may reduce that to around $1,400.

- Waiting until 70 could increase it to more than $2,400.

Over a long retirement, the difference can total tens of thousands of dollars.

Working While Claiming Benefits

The social security age change also interacts with work rules.

Before reaching full retirement age:

- Annual earnings above a set limit cause temporary benefit reductions.

- A portion of benefits is withheld when income exceeds the threshold.

In the year a person reaches full retirement age:

- A higher earnings limit applies.

- Only income earned before the month of reaching FRA counts.

After full retirement age:

- There is no earnings limit.

- Benefits are paid in full regardless of work income.

Any benefits withheld due to earnings are not lost permanently. They are recalculated into higher monthly payments after full retirement age.

Impact on Different Generations

The change to age 67 affects groups differently:

Workers in Their 60s

Many are now planning to work longer or delay claiming to avoid benefit cuts.

Workers in Their 40s and 50s

Retirement planning now assumes 67 as the standard target for full benefits.

Younger Workers

Full retirement age is firmly set at 67, with no current law raising it higher.

Common Myths About the Social Security Age Change

Myth 1: Retirement age is now 70.

Fact: Age 70 is the maximum age for delayed credits, not the full retirement age.

Myth 2: You cannot retire before 67.

Fact: You can claim at 62, but benefits are reduced.

Myth 3: Medicare moved to 67.

Fact: Medicare eligibility still begins at 65.

Planning Strategies Under the New Age Rules

Smart planning can help maximize lifetime benefits.

Consider the following:

- Review your Social Security statement regularly.

- Estimate benefits at 62, 67, and 70.

- Factor in health, savings, and employment plans.

- Coordinate spousal benefits for married couples.

- Understand tax implications of retirement income.

Delaying benefits can provide a form of guaranteed, inflation-adjusted income for life, which is difficult to replicate with private investments.

Will the Retirement Age Rise Again?

There are ongoing policy discussions about the long-term future of Social Security. Some proposals suggest linking retirement age to life expectancy or gradually raising it beyond 67.

As of today, no law has been passed to increase the full retirement age above 67. Any future change would require new legislation and would likely be phased in over many years.

What the Social Security Age Change Means for the Future

The completion of the shift to age 67 closes a chapter that began more than 40 years ago. It sets a new baseline for retirement planning in the United States.

For millions of Americans, this means:

- Longer working lives.

- Greater importance of personal savings.

- More strategic timing of benefit claims.

Understanding how the system now works is essential for making informed financial decisions in retirement.

The social security age change is now a reality, and knowing how it affects your benefits can make a lasting difference—share your thoughts below and stay tuned for future updates on retirement policy.