Small business owners across the country continue to search for clarity about sba eidl loan forgiveness as repayment obligations remain in full effect in 2026. The Economic Injury Disaster Loan (EIDL) program delivered billions in relief during the COVID-19 crisis, but today the focus has shifted from emergency funding to long-term repayment and compliance. Many borrowers are asking whether forgiveness is available, what happens in default, and what relief options still exist.

Here is a comprehensive, up-to-date breakdown of where the program stands and what it means for borrowers right now.

No Broad Loan Forgiveness for COVID EIDL Loans

As of February 2026, there is no federal program providing blanket forgiveness for COVID-19 EIDL loans. Borrowers remain legally responsible for repaying the full balance of their loans under the terms they originally agreed to.

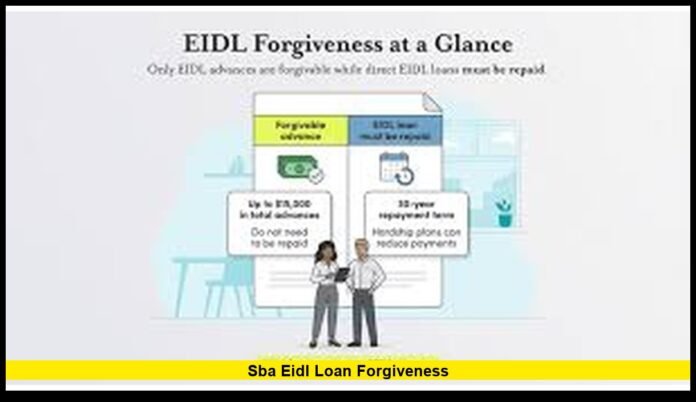

It is important to distinguish between EIDL loans and EIDL advances. Advances functioned like grants and did not require repayment. However, the loan portion of the program was never structured as forgivable debt.

Despite ongoing online speculation, there has been no legislative action creating new forgiveness authority for these loans. The repayment obligation remains intact nationwide.

Deferment Periods Have Expired

During the height of the pandemic, borrowers received extended deferment periods that allowed them to postpone payments for up to 30 months from the date of the loan.

Those deferments have now expired for the vast majority of borrowers.

This means:

- Regular monthly payments are due.

- Interest has continued to accrue during deferment.

- Failure to resume payments can trigger delinquency status.

Borrowers who relied on deferment as a temporary cushion must now plan for full repayment under the original amortization schedule.

Hardship Accommodation Plan Has Ended

The SBA previously offered a Hardship Accommodation Plan that temporarily reduced monthly payments for eligible borrowers facing financial strain.

That program concluded in March 2025 and is no longer available for new enrollments.

Borrowers currently making reduced payments under prior approval must transition back to standard payment terms once their hardship period ends. There are no announced extensions or replacements for that specific relief program.

Servicing and Payment Expectations in 2026

EIDL loans are serviced through the SBA’s loan management system. Borrowers are expected to:

- Maintain current payment status.

- Update contact information.

- Respond to servicing notices.

- Communicate promptly if financial challenges arise.

For loans that are current or only slightly delinquent, borrowers may still request temporary payment adjustments. Approval depends on financial documentation and review. These adjustments reduce payment pressure but do not eliminate debt.

It is critical for borrowers to remain proactive. Ignoring payment notices or falling behind without communication increases the risk of default and collection activity.

What Happens if You Default?

Defaulting on an EIDL loan can carry serious financial consequences.

If a borrower fails to make required payments, the loan may move into default status. From there:

- The federal government may initiate collection efforts.

- The debt may be referred to the Treasury for further action.

- Federal payments owed to the borrower may be offset.

- Collection partners may become involved.

Some borrowers assume that if a loan is “charged off,” it disappears. That is incorrect. A charge-off is an accounting classification and does not erase the debt. The borrower remains responsible.

For loans that included a personal guarantee, personal assets may be exposed depending on the loan size and structure.

Increased Oversight and Enforcement

Federal authorities continue to investigate pandemic-era loan misuse and fraud. In early 2026, enforcement activity remains active across several states, including borrower suspensions and restrictions from future federal lending programs.

These enforcement actions primarily target suspected fraudulent activity. However, they highlight the importance of accurate documentation and proper use of loan funds.

Borrowers should retain records showing how EIDL funds were used for eligible business expenses. Maintaining documentation helps protect against misunderstandings during audits or reviews.

Is There Any Path Toward SBA EIDL Loan Forgiveness?

At this time, there is no structured or automatic sba eidl loan forgiveness program available for standard COVID EIDL borrowers.

However, there are limited legal mechanisms that may reduce debt in severe hardship situations.

These include:

Offer in Compromise

An Offer in Compromise allows borrowers experiencing genuine financial hardship to propose a settlement for less than the full balance owed.

Approval requires:

- Full financial disclosure

- Proof of inability to repay

- Documentation of assets and liabilities

- SBA review and determination

This option is not guaranteed and is evaluated case-by-case.

Bankruptcy Proceedings

In certain cases, EIDL debt may be addressed through federal bankruptcy proceedings. Treatment depends on the bankruptcy chapter filed and whether a personal guarantee applies.

Bankruptcy is a serious legal process and requires qualified legal counsel. It is not automatic forgiveness but may result in structured repayment or discharge depending on the circumstances.

Interest Rates and Loan Terms Remain Fixed

One aspect of EIDL loans that remains unchanged is the fixed interest structure.

- Businesses typically received a 3.75% interest rate.

- Nonprofit organizations received a 2.75% rate.

- Loan terms may extend up to 30 years.

Because rates are fixed and relatively low compared to many commercial loans, some borrowers continue making payments without refinancing.

However, for businesses that have not recovered revenue since the pandemic, long repayment terms still create significant strain.

Refinancing and Private Lending Options

Some borrowers explore refinancing options through private lenders to restructure debt. Refinancing may:

- Combine multiple debts into one payment.

- Adjust monthly payment amounts.

- Shorten repayment timelines.

However, private refinancing often involves higher interest rates than original EIDL terms. Borrowers should compare total repayment costs before moving forward.

Federal EIDL loans cannot simply be converted into forgivable instruments through private refinancing.

How Borrowers Should Protect Themselves Now

In 2026, the most effective strategy for EIDL borrowers includes:

- Staying current on payments whenever possible.

- Communicating early if financial challenges arise.

- Keeping detailed financial records.

- Reviewing loan documents to understand guarantee obligations.

- Consulting qualified legal or financial professionals if default risk increases.

Avoid relying on unofficial claims circulating online about widespread cancellation programs. No federal announcement has created new forgiveness pathways for standard COVID EIDL loans.

The Financial Impact on Small Businesses

For many small businesses, EIDL debt remains one of the largest long-term liabilities from the pandemic period.

Businesses in industries that experienced prolonged shutdowns — such as hospitality, food service, and live events — continue to feel the impact.

While economic conditions have improved overall, not every business fully recovered revenue levels from 2019. For those owners, repayment can feel overwhelming.

At the same time, many borrowers have successfully integrated repayment into stabilized operations, treating the loan like long-term working capital debt.

The experience varies widely depending on industry, revenue recovery, and loan size.

What to Expect Moving Forward

Looking ahead through 2026:

- Repayment enforcement will remain active.

- Fraud investigations will continue.

- No blanket forgiveness program is scheduled.

- Debt resolution pathways will remain limited and case-specific.

The focus has clearly shifted from emergency distribution to fiscal accountability.

For borrowers, awareness and proactive management remain the best defenses against financial complications.

Have questions about your loan situation or repayment options? Share your thoughts below and stay informed as new developments unfold.