Save program student loans are now entering a decisive period as confirmed federal actions reshape how millions of Americans repay their education debt. The discontinuation of the SAVE repayment plan marks a major structural change in the student loan system, ending a period of unusually generous payment protections and forcing borrowers to reassess their financial strategies. This shift is active, nationwide, and already influencing repayment schedules, interest behavior, and forgiveness timelines for federal borrowers across the United States.

Rather than a temporary adjustment, this moment represents a clear reset in how federal student loans will be managed moving forward.

The Role SAVE Played in the Federal Loan System

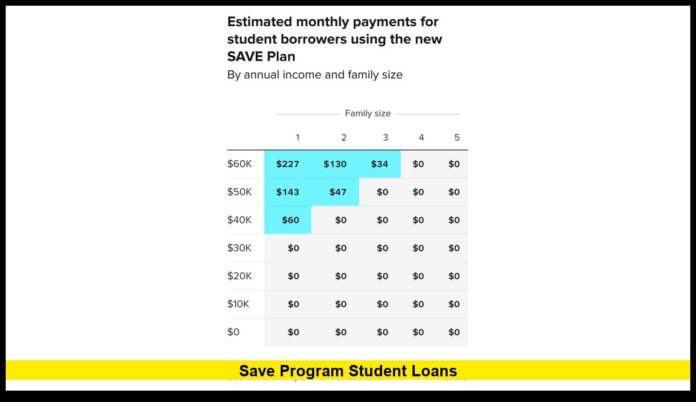

The SAVE plan was designed to directly address long-standing weaknesses in traditional student loan repayment. Many borrowers had struggled for years under fixed payment schedules that failed to reflect real-world income volatility. SAVE changed that dynamic by tightly linking monthly payments to earnings and household size, which helped borrowers maintain stability during periods of lower income.

For a wide range of borrowers, SAVE became more than just a repayment option. It functioned as a financial buffer during early career years, job transitions, family expansion, and periods of economic uncertainty. Its structure reduced the emotional burden of student debt by offering predictability and affordability at the same time.

This broad appeal explains why enrollment grew rapidly and why the program’s exit now affects such a large segment of the population.

Why Federal Authorities Ended the SAVE Plan

The end of SAVE did not occur due to declining usage or administrative failure. Instead, it followed prolonged legal scrutiny that questioned whether the plan exceeded the authority granted to federal education officials under existing law.

After extensive review, the federal government confirmed that continuing the SAVE plan would conflict with statutory limits. Rather than prolonging legal uncertainty, officials chose to formally end the program and redirect borrowers toward repayment options that align with current legal frameworks.

This decision applies uniformly. There are no exceptions based on income, loan balance, or length of enrollment.

What Borrowers Are Experiencing During the Transition

Borrowers currently enrolled in SAVE are not being removed abruptly, but they are no longer able to rely on SAVE as a permanent repayment structure. Instead, they are moving through a managed transition period that will require active participation.

During this phase, borrowers are encountering several changes at once. Interest accrual has resumed under standard rules. Payment calculations are subject to revision. Communication from loan servicers has increased, signaling upcoming deadlines and required actions.

While the system is designed to prevent sudden disruption, borrowers who delay engagement may face outcomes that do not reflect their financial circumstances.

Monthly Payment Changes and Financial Reality

SAVE often produced the lowest monthly payments available under federal programs. For many borrowers, payments were reduced to minimal levels that aligned closely with actual disposable income. The removal of this structure means payment expectations are shifting.

Some borrowers will experience moderate increases that remain manageable. Others, particularly those who previously qualified for very low payments, may face larger adjustments. These changes are not uniform and depend heavily on individual income, household size, and the repayment plan selected.

The key factor is choice. Borrowers who actively select a replacement plan generally have more control over how much their payments change.

Repayment Plans Now Taking Center Stage

With SAVE no longer available, borrowers must rely on repayment options that have long existed within the federal system.

Income-Based Repayment as the Primary Alternative

Income-Based Repayment now serves as the main destination for borrowers seeking income-adjusted payments. Payments under IBR are recalculated annually, ensuring they respond to changes in earnings and household size.

Although IBR does not mirror every feature SAVE offered, it continues to provide meaningful relief compared to fixed repayment plans. For many borrowers, it remains the most practical option available.

Standard Repayment for Predictability

Standard repayment plans offer consistency through fixed payment schedules. While these plans lack income sensitivity, they appeal to borrowers with stable earnings who prefer predictable timelines.

Borrowers placed into standard repayment without planning may find the payments challenging, underscoring the importance of proactive selection.

Interest Behavior After SAVE

One of SAVE’s most significant features was its approach to unpaid interest. Under SAVE, interest accumulation was limited in ways that helped prevent balances from growing uncontrollably during low-payment periods.

After transitioning away from SAVE, interest behavior changes. Interest accrues based on traditional federal rules, and unpaid interest may increase overall balances depending on the repayment plan.

This shift makes payment consistency more important than ever. Borrowers who understand how interest applies under their new plan can better manage long-term costs.

Forgiveness Timelines and Strategic Planning

SAVE included forgiveness pathways that benefited certain borrowers, particularly those with smaller balances or long repayment histories. With SAVE ending, forgiveness eligibility must now be evaluated under the terms of the replacement plan.

This has important implications. Payment history may not transfer seamlessly. Forgiveness timelines may extend. Borrowers nearing forgiveness thresholds should prioritize timely action to protect progress already made.

Strategic planning during this period can make a meaningful difference over the life of the loan.

Administrative Deadlines and Borrower Responsibility

Loan servicers are managing the operational side of the transition, but responsibility ultimately rests with borrowers. Notifications outlining deadlines and required actions are being issued in stages.

Failure to respond can result in automatic placement into repayment plans that may not align with a borrower’s financial situation. This makes attentiveness essential.

Borrowers who stay engaged with communications are better positioned to make informed decisions.

How the End of SAVE Reflects Broader Policy Direction

The removal of SAVE signals a shift in federal student loan policy. The emphasis is moving away from rapid expansion of executive-designed relief programs and toward repayment structures that align strictly with legislative authority.

For borrowers, this suggests fewer experimental programs and greater reliance on established frameworks. Understanding this direction helps borrowers set realistic expectations for future changes.

Who Is Most Impacted by the Change

While all SAVE participants are affected, some groups feel the impact more strongly.

These include borrowers with low or fluctuating incomes, individuals early in their careers, households balancing student debt with rising living costs, and borrowers pursuing forgiveness.

For these groups, proactive planning is especially important.

Financial Planning in the Post-SAVE Landscape

The end of SAVE reinforces the importance of active financial management. Borrowers are encouraged to review repayment options regularly, monitor income changes, and adjust plans when circumstances shift.

Those who approach repayment strategically tend to experience fewer surprises and greater financial stability over time.

Common Borrower Questions Clarified

Many borrowers share similar concerns during this transition.

SAVE will not be reinstated under current rules. Payments do not stop automatically. Forgiveness is not automatic and depends on the replacement plan chosen.

Clear understanding reduces stress and helps borrowers make confident decisions.

Long-Term Outlook for Federal Student Loans

Federal student loan policy will continue to evolve, but borrowers should base decisions on confirmed rules rather than anticipated changes. The end of SAVE represents a clear policy boundary.

Future adjustments may occur, but they will operate within tighter legal constraints.

Why Staying Informed Matters More Than Ever

Student loans influence long-term financial health. Missed deadlines, incorrect plan selection, or inaction can lead to higher costs and delayed milestones.

Staying informed empowers borrowers to protect their finances and adapt effectively.

Final Perspective on Save Program Student Loans

The conclusion of save program student loans marks a defining moment for federal borrowers across the country. While the transition may introduce challenges, it also offers an opportunity for borrowers to reassess repayment strategies and build a more sustainable financial future.

As repayment rules continue to evolve, informed decisions and timely action remain the strongest tools borrowers have to stay in control.