As of the first week of 2026, the S and P 500 continues to reflect strong performance among U.S. stock markets following a year of substantial gains, and recent trading shows the benchmark index beginning the new year with positive momentum among major sectors.

This detailed, fact-checked article offers the most current updates on the S and P 500, its recent performance, sector drivers, short- and longer-term trends, key economic influences, and what investors should be watching as 2026 progresses.

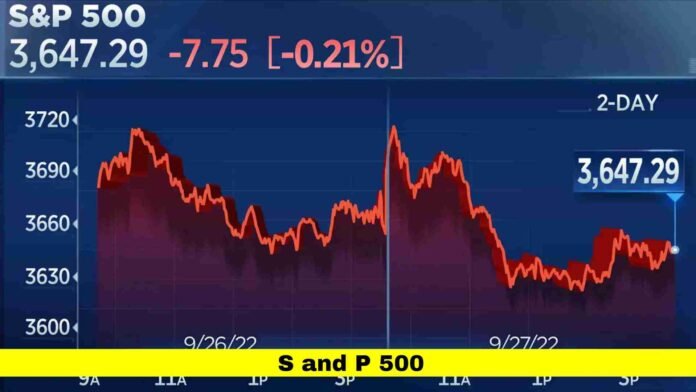

Opening Week 2026: Market Reaction and Sentiment

The S and P 500 started 2026 with gains, carrying over momentum from 2025’s performance which saw the index rise more than 16% for the year, marking a third consecutive annual increase with double-digit growth. Major technology firms, strong corporate earnings expectations, and an optimistic market outlook contributed to this position. In early trading, the index climbed as tech sectors and consumer confidence pushed stocks higher, while broader market breadth improved with more advancing issues than decliners in early sessions. Traders and investors are watching closely as markets seek confirmation of this trend in the first full weeks of January.

2025 Recap: A Strong Year for Broad Market Indices

In 2025, the S and P 500 produced returns that outpaced many historical averages, delivering a performance that placed the index among the stronger annual gains in recent decades. All eleven sectors finished the year in positive territory, a rare outcome that underscored broad participation across industries. This included notable contributions from information technology, communication services, and industrials. The index’s rise reflected continued investor interest in innovation-driven companies, as well as confidence in economic fundamentals heading into 2026.

Key Sector Performance and Leadership

Technology stocks played a substantial role in driving the index’s gains. Companies involved in artificial intelligence, cloud computing, and digital services continued to expand revenue and boost investor optimism. Consumer discretionary stocks also contributed to market strength, supported by strong holiday sales and signs of resilient consumer spending.

Financials and industrials displayed steady performance alongside tech, while energy and utilities showed positive but more modest gains. The diversity of sector strength helped sustain the broad market advance, reducing dependence on any single industry for overall results.

Market Breadth and Underlying Strengths

Market breadth measures the number of advancing stocks relative to decliners and is an important indicator of underlying strength. In early 2026 sessions, breadth improved compared to late 2025, indicating that the rally was supported by a wider range of stocks rather than a narrow set of large-cap leaders.

This development suggests a healthier market environment where gains are not confined to a few headline names but are more broadly distributed across multiple sectors and market capitalizations.

Economic Indicators Influencing the Index

Several economic indicators are influencing the index’s performance this year:

- Interest Rates: Expectations of more accommodative monetary policy later in 2026 have been supportive of stock valuations. Traders are watching Federal Reserve signals closely to gauge the likelihood and timing of potential rate cuts.

- Inflation Trends: Persistent but moderating inflation has maintained consumer purchasing power while giving markets confidence that price pressures may continue to ease.

- Labor Market Strength: Strong labor data has bolstered confidence in consumer spending, though investors remain vigilant for any signs of slowdown that could impact earnings.

These factors combine to shape investor expectations and risk tolerance, and they will continue to be key drivers of performance through the first half of the year.

Earnings Outlook and Company Contributions

Corporate earnings expectations also shape the index’s direction. Analysts anticipate earnings growth among large- and mid-cap companies will rise in 2026 compared to 2025, reflecting improved profitability and revenue expansion plans. Earnings growth, particularly in major technology firms, is expected to sustain market momentum and provide support for valuations.

The earnings landscape will be especially important as companies begin to announce results for the first quarter of 2026. Solid earnings can reinforce confidence, while any disappointments may introduce volatility.

Impact of Tariff Policies and Global Trade

Trade policies and tariff decisions have influenced market sentiment, particularly toward import-dependent sectors. Delayed tariff increases on certain goods have eased pressure on related stocks and boosted retail and consumer stocks. Continued clarity regarding trade relations and tariff policies will remain important for maintaining market confidence and supporting corporate planning.

Inflation, Interest Rates, and Monetary Policy

Monetary policy remains a central theme influencing valuations across all major indices. With inflation moderating from its peak but still above historical averages, markets have priced in expectations of potential rate adjustments later in the year. Fed communications and economic data releases such as inflation readings, employment reports, and GDP growth will continue to shape trading patterns and risk appetite.

Lower interest rates generally support higher equity valuations by reducing borrowing costs and encouraging investment in growth assets. Investors will be attentive to the Federal Reserve’s statements for any signals about pacing and future moves.

Investors’ Risk Considerations and Cautionary Signals

Despite strong performance, some cautionary signals exist. Valuation levels across equities remain elevated relative to historical norms, and some investors have discussed the possibility of prolonged periods of muted returns following strong runs. Discussions about “valuation risk” reflect concerns that future growth might moderate if earnings fail to keep pace with elevated market multiples.

Additionally, global economic uncertainties and geopolitical risks have the potential to introduce volatility. Trade tensions, supply chain disruptions, and global policy shifts can influence investor sentiment and market direction.

Market Corrections and Historical Context

The S and P 500 has experienced corrections in recent years, during periods when prices declined more than 10% from recent highs before resuming upward movement. Corrections can serve as healthy market adjustments, clearing excesses and providing opportunities for reassessment. While pullbacks can be unsettling for short-term traders, many long-term investors view them as part of normal market cycles.

Historical data has shown that markets often rebound from corrections if underlying economic conditions remain intact and corporate earnings continue to grow.

Comparison With Other Major Benchmarks

While the S and P 500 captures a broad range of large-cap U.S. stocks, comparing it with other major benchmarks like the Dow Jones Industrial Average and the Nasdaq Composite can offer additional perspective. In 2025, all three major indices posted double-digit gains, with the Nasdaq often reflecting stronger growth driven by large technology and innovation-led stocks.

However, the S and P 500’s broader composition makes it a key indicator of overall market health, as its performance reflects movement across diverse industry groups, not just a few headline sectors.

Market Liquidity and Investment Flows

Liquidity conditions in financial markets have remained favorable, with investors continuing to allocate capital to equity funds. U.S. equity funds experienced strong inflows late in 2025, signaling ongoing demand for exposure to large-cap stocks. This trend has helped support price levels and maintained positive investor engagement.

While bond funds and money market instruments also attracted attention for risk mitigation, the preference for equity exposure highlights confidence in continued economic expansion and earnings potential.

What to Watch in 2026

Investors tracking the S and P 500 in 2026 should focus on several key developments:

- Quarterly earnings reports and company guidance for growth prospects.

- Federal Reserve communications regarding interest rates.

- Inflation trends and their impact on consumer spending and business costs.

- Geopolitical developments influencing market confidence.

- Sector rotations that may shift performance leadership among industries.

Closely monitoring these indicators will help investors contextualize market moves and make more informed decisions.

Expert Perspectives and Market Expectations

Market analysts continue to emphasize the importance of earnings growth and innovation investment as drivers of long-term performance. While short-term volatility remains possible, many believe that strong fundamentals and continued technological progress support a favorable outlook for broad market indices.

Market participants also recognize the role of economic data and policy decisions in shaping near-term direction, reinforcing the value of staying informed about macroeconomic trends.

Conclusion

The S and P 500’s performance through the end of 2025 and into early 2026 reflects sustained investor confidence, solid corporate earnings expectations, and a diversified market landscape. While risks and uncertainties persist, recent gains and underlying strength in multiple sectors underscore resilience in U.S. equity markets.

Disclaimer

This article is provided for informational purposes only and does not constitute financial, investment, or trading advice. Market conditions can change rapidly, and past performance does not guarantee future results. Readers should conduct their own research or consult with a qualified financial professional before making investment decisions related to market indices.

What are your thoughts on the S and P 500’s outlook for 2026? Share your views in the comments or stay tuned for ongoing market updates.