The latest PCE report has emerged as a central moment for U.S. inflation watchers, investors, and everyday households. As the newest data from the Bureau of Economic Analysis (BEA) drops, it delivers the freshest view of price changes across the economy — shedding light on whether inflation is cooling, holding steady, or creeping up again.

What Is the PCE Report — And Why It Matters

The PCE Price Index tracks the prices U.S. consumers pay for goods and services. Unlike other inflation measures, the PCE covers not only what households pay directly but also what is spent on their behalf (for example, employer-provided healthcare or government-sponsored benefits). That broad scope captures more accurately how money flows across consumption in America.

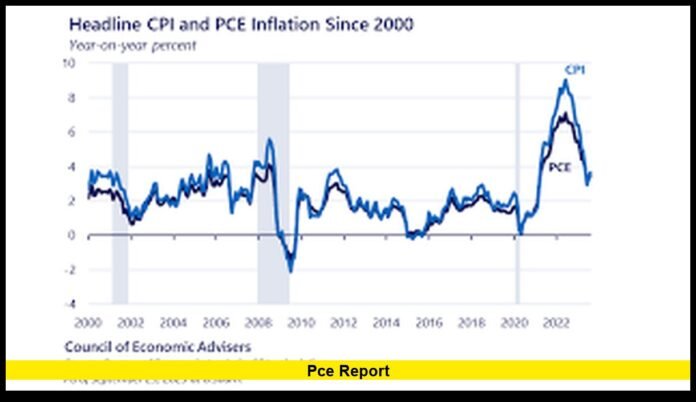

Since 2000 the Federal Reserve has used PCE as its preferred inflation benchmark. It reflects changing consumer behavior — including substitutions (e.g., buying cheaper alternatives when some prices climb). This dynamic weighting and comprehensive basket make PCE especially effective at forecasting long-term inflation trends and guiding interest-rate policy.

What the Recent PCE Data Says

The most recent available PCE readings — before the current release — already indicated price pressures higher than the Fed’s long-term 2% target. The “core PCE” (which excludes volatile food and energy costs) remained elevated, suggesting underlying inflation remained sticky across many sectors.

With the new report now arriving after a delay in the official economic calendar, attention is on whether the trend continues or shifts. This update provides fresh data for consumers, markets, and policymakers.

What Economists and Markets Are Watching

With so much at stake, analysts and investors are examining several key figures in the new PCE release:

- Headline inflation — the overall change in prices for the typical basket of goods and services.

- Core inflation — removes food and energy, providing a clearer view of persistent inflation pressures.

- Monthly versus year-over-year changes — month-over-month helps detect recent shifts, while the 12-month change shows longer-term trends.

- Category breakdowns — how much prices changed for essentials like housing, healthcare, transportation, and services.

Expectations ahead of the release have pointed to modest gains — enough to reflect ongoing inflation, but not dramatic enough to derail rate-cut hopes among investors.

What Could Different Readings Mean

Soft or Cooling Inflation Reading

If the PCE report shows slower growth — especially in core inflation — it could signal easing price pressures. That might:

- Increase odds that the Fed will cut interest rates in upcoming meetings.

- Ease borrowing costs over time, benefiting mortgages, auto loans, and credit cards.

- Offer relief to households feeling the squeeze on everyday expenses.

- Boost confidence among consumers and investors.

Sticky or Rising Inflation Reading

If inflation remains elevated or ticks upward again, the consequences may include:

- A potential pause or delay in anticipated rate cuts.

- Continued pressure on borrowing costs.

- Household budgets remaining strained, especially for essentials.

- Greater uncertainty in markets, possibly weakening stocks and pushing up bond yields.

Mixed Signals — Headline Soft, Core Sticky (or vice versa)

Such a result could create uncertainty: headline prices might look manageable, but persistent core inflation could keep rate decision-makers cautious. That scenario often leads to a “wait and see” approach, which could maintain current interest rates for longer.

Why PCE Holds More Weight Than Other Inflation Measures

People often hear about the Consumer Price Index (CPI) when inflation is discussed in media or headlines. But PCE has a few core advantages:

- It captures a wider array of spending — including expenses paid on behalf of households.

- Its weighting method adjusts to actual consumer behavior and reflects substitution when people shift spending to cheaper items.

- It tends to produce smoother, more stable readings over time.

Because of this, the PCE index often shows lower or more moderate inflation than CPI, even when public sentiment based on retail prices feels more acute.

What the PCE Report Means for Everyday Americans

For households across the U.S., the PCE report has real-world implications:

- Cost of living: Persistent inflation keeps everyday expenses — housing, groceries, medical care, transportation — higher than expected.

- Loan and mortgage rates: Interest rates on mortgages, auto loans, and credit cards track closely with what the Fed does. If inflation stays high, those rates likely stay elevated too.

- Savings and income planning: Inflation erodes buying power. Even if income remains stable, what it buys may shrink.

- Long-term budgeting: For families planning major purchases — homes, education, renovations — understanding inflation trends helps with financial planning.

What to Watch in the Coming Weeks

- Fed leadership statements after the PCE release. Comments could signal how the central bank plans to respond.

- Market reactions — bond yields, stock movements — which often respond sharply to inflation changes.

- Category-specific inflation data — housing, healthcare, services — which affect households more directly than aggregate inflation numbers.

- Consumer sentiment and spending behavior — if prices remain high, spending may slow, with implications for the broader economy.

Final Thought

The new PCE report offers more than just numbers. It paints a real picture of how inflation is evolving for Americans now. As data lands and markets react, households will feel the ripple effects — in everything from grocery bills to mortgage rates.

What do you expect? Will inflation finally start to ease, or are price pressures here to stay? Share your thoughts below — the outlook affects us all.