The pce release time for the upcoming Personal Consumption Expenditures Price Index report is scheduled for 10:00 a.m. Eastern Time on December 5, 2025, marking one of the most anticipated economic moments of the year as analysts, businesses, and households prepare for fresh insight into U.S. inflation trends. With the country watching how prices have shifted in recent months, the timing of this release carries significant weight and serves as a turning point for understanding the direction of consumer costs, spending behavior, and policy decisions in the months ahead.

Why the PCE Report Matters More Than Ever

The PCE Price Index is the United States’ most comprehensive measurement of consumer inflation. It tracks how much Americans spend on a wide range of goods and services, from food and healthcare to transportation, housing, and recreation. Because it reflects actual consumer behavior rather than a fixed basket of products, it offers a dynamic view of how spending shifts as prices rise or fall.

Unlike other inflation measures, the PCE is widely used by policymakers because it adjusts for changes in consumer habits, giving a clearer picture of how households respond to price movements. The Federal Reserve relies on this index as its preferred tool for measuring underlying inflation pressures. As a result, each monthly release has direct influence on interest rate expectations, economic forecasts, and policy debates.

This upcoming release is especially significant because it arrives after a period of inconsistent federal data reporting earlier in the year. That disruption created a temporary gap in the flow of national economic information, leaving analysts with fewer recent indicators to guide assessments. The return to a normal schedule elevates the importance of this report, making clarity and accuracy essential for understanding where the economy stands.

The Unusual Timing and Its Impact on Financial Markets

Historically, major U.S. economic indicators have been published at 8:30 a.m. Eastern Time, before the stock market opens. This timing allows markets to absorb new information during pre-market trading, creating a structured and predictable period for adjustments.

The December 5 PCE release, however, is scheduled for 10:00 a.m. Eastern, a shift that places the update squarely within active market hours. This adjustment matters for several reasons:

- Traders may react in real time, causing sharper and more immediate market swings.

- Bond yields, currency activity, and interest-rate futures could adjust rapidly as the data becomes public.

- Investors who structure their strategies around early-morning releases will need to adapt to a mid-morning shift.

- Financial commentators and economic analysts will deliver interpretations faster, feeding into live market momentum.

This timing difference may appear small, but within the world of U.S. financial markets, even slight scheduling changes can influence the pace and pattern of trading activity throughout the day.

What the Latest Published Data Revealed

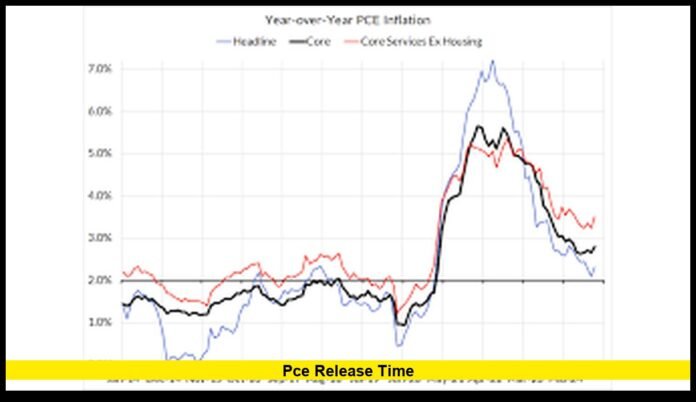

Before the temporary reporting delay, the most recently released inflation figures showed that both headline PCE and core PCE remained above the Federal Reserve’s preferred long-term target.

Key findings included:

- Consumer prices continued rising compared to the previous year.

- Price increases were concentrated in service categories such as healthcare, transportation, and housing-related expenses.

- Core inflation, which strips out food and energy, held at a level suggesting underlying price pressure remained persistent.

These findings set the stage for heightened attention surrounding the upcoming report. Households, analysts, and policymakers will look for clues about whether prices have begun to ease, remain elevated, or have shown renewed acceleration.

How the PCE Index Is Calculated and Why It Offers a Complete Picture

To understand the importance of the next release, it helps to know how the PCE Price Index is constructed.

The index is based on nationwide spending patterns, reflecting what Americans actually buy. It covers thousands of goods and services across the economy, assigning weight based on real consumer expenditures rather than hypothetical or fixed baskets.

Key features include:

- Broad Coverage: PCE includes spending by both households and nonprofit organizations, offering a wide view of economic activity.

- Dynamic Weighting: When consumers shift purchases in response to rising or falling prices, the index adapts.

- Medical Coverage: Unlike some other indicators, PCE includes employer-paid and government-paid healthcare spending, providing a fuller picture of actual medical costs.

Because of these qualities, the PCE captures inflation trends more accurately than measures that use static assumptions about what households buy. This is why it serves as a central tool for evaluating economic health in the United States.

Why Households Follow PCE Even If They Don’t Realize It

Most Americans don’t track inflation metrics on a daily basis, yet the PCE affects financial life in ways that reach far beyond a single report. Its influence is felt in:

- Interest rates on mortgages and loans

- Savings account yields

- Credit card borrowing costs

- Job market conditions

- Business investment decisions

- Federal policy actions that shape the overall economy

When the PCE shows that inflation is cooling, it may signal potential relief from rising costs. When it remains elevated, it often indicates that household budgets may continue to experience pressure. Even without tracking the numbers directly, Americans live with the consequences of what the index reveals.

Why Businesses and Investors Are Preparing for This Release

For businesses, the upcoming report could influence decisions related to hiring, wages, pricing, and inventory planning. Companies must assess whether consumer demand is rising or weakening as costs shift, and fresh inflation data helps clarify those trends.

Investors, meanwhile, often look to the PCE as a guiding light for understanding future interest rate movements. When inflation appears stubborn, central bank action may become more cautious. When inflation cools, discussions about rate cuts may intensify.

A mid-morning release increases the likelihood of rapid adjustments in:

- Treasury markets

- Equity indexes

- Commodity prices

- Corporate bond yields

- Currency valuations

Because the PCE reading is tied so closely to economic expectations, investors prepare well in advance, structuring their portfolios to respond swiftly when the numbers arrive.

Preparing for the December 5 Release

With the mid-morning publication set, analysts recommend focusing on a few core indicators:

- Year-over-year price changes, both headline and core

- Monthly price changes, which show shorter-term momentum

- Trends in consumer spending, a crucial driver of the U.S. economy

- Shifts in service vs. goods inflation, which indicate changing cost pressures

These elements help clarify whether inflation is responding to broader economic conditions such as wage growth, supply-chain dynamics, housing trends, or consumer confidence.

The return of regularly scheduled federal economic reporting also means that this PCE release will restore continuity to the nation’s statistical record. That restores a level of certainty and transparency that economists rely on to evaluate economic progress and risk.

How the PCE Release Time Shapes Public Understanding

Because the report arrives during the active market session, news coverage will unfold more rapidly than usual. Financial networks, commentators, and analysts will deliver immediate breakdowns of the numbers, shaping public perception minute by minute.

For many Americans, this means that:

- Headlines may shift quickly.

- Social media discussions may accelerate.

- Trading conditions may fluctuate in real time.

- Interpretations of the data may evolve throughout the morning.

This environment makes it more important than ever for households and businesses to understand the structure of the data, the meaning behind the numbers, and the broader significance of inflation trends.

The scheduled pce release time ensures that Americans know exactly when to expect this crucial update and can prepare accordingly.

Looking Ahead: What the Release Could Signal for 2026

While the upcoming report will not include predictions or policy commentary, its numbers will play a decisive role in shaping the national economic conversation heading into 2026. With inflation still a central concern for families and policymakers alike, clarity from this release will guide discussions about wages, interest rates, budgets, and economic growth.

The months ahead will bring further reports, but this release stands out because it reestablishes a steady flow of federal data and offers a fresh reading after an irregular reporting period. Americans across every sector of the economy will look to the new PCE figures to understand how conditions have shifted and what direction prices may take next.

Final Thoughts

This upcoming release carries real significance for households, businesses, and financial markets nationwide. With the report set for 10:00 a.m. Eastern on December 5, Americans will gain essential insight into recent price trends, economic momentum, and the overall cost of living.

Share your thoughts below and tell us how the latest inflation data could impact your plans moving forward.