For New Jersey residents, the 2026 filing season has brought renewed attention to how state refunds are calculated, processed, and delivered. While filing an annual return has long been a routine obligation, the experience of waiting for a refund has become a focal point for many taxpayers this year. Processing timelines, online tools, system upgrades, and budget-driven relief programs all play a role in shaping expectations across the state.

As thousands of residents submit returns and monitor their status, understanding how the current system works offers clarity and reduces frustration. The state’s tax administration continues to adapt to technological changes, staffing realities, and increased demand for transparency, making this season a defining moment in how refunds are handled going forward.

How the State’s Refund System Has Evolved

New Jersey’s tax administration has undergone gradual but meaningful transformation over the past several years. The move toward centralized digital systems was designed to replace fragmented platforms that previously handled different tax types independently. These upgrades aimed to create a more unified experience for individuals, businesses, and tax professionals.

The current system allows residents to file returns electronically, track refund progress, and manage tax accounts through a single portal. While the transition period created temporary confusion for some filers, the long-term goal remains efficiency, accuracy, and improved communication. This evolution has directly influenced how refunds are processed and how quickly they reach taxpayers.

What Determines Refund Timing This Year

Refund timelines vary based on how returns are filed and whether they require additional review. Electronic submissions generally move through the system faster than paper filings, which require manual handling and verification. For many filers, refunds begin processing only after returns clear initial validation checks.

Certain returns undergo additional scrutiny due to income discrepancies, credit claims, or identity verification requirements. These reviews are not uncommon and do not necessarily indicate an error. Instead, they reflect safeguards built into the system to ensure accuracy and prevent fraud.

As a result, refund timing can differ significantly from one taxpayer to another, even among those who filed around the same time.

Why Some Filers Experience Extended Delays

Delays often stem from factors beyond simple filing order. Returns that include credits tied to income thresholds or household size may require extra verification. Others are flagged due to mismatched information between state and employer records.

Paper returns remain a leading cause of long wait times, particularly when submitted close to peak filing periods. In some cases, additional documentation is requested before processing can continue, extending timelines further. While these delays can be frustrating, they are part of the state’s effort to maintain accuracy and compliance.

Tracking Refund Status and Understanding Updates

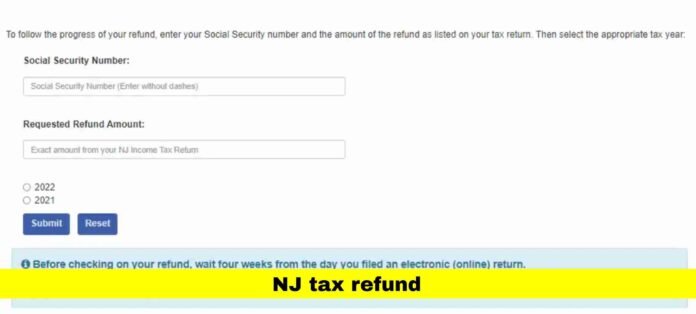

New Jersey offers several reliable ways for residents to monitor the progress of their tax refund, including an official online status tool where you enter your Social Security number (or ITIN), expected refund amount, and tax year to see real-time updates, and automated phone systems (such as the 1-800-323-4400 refund hotline) for those who prefer voice-based status checks; these systems reflect the typical stages of a refund — received, processing, approved, and issued — and New Jersey’s guidelines still recommend waiting at least four weeks after e-filing or 12 weeks after paper filing before checking status, with some returns taking longer if they require additional review such as for Earned Income Tax Credit claims, and a status listed as “processing” simply means the Division of Taxation is completing verification rather than indicating a problem.

How Budget Decisions Influence Refund-Related Benefits

While refunds are tied directly to income tax returns, broader budget decisions affect how and when residents receive other forms of tax relief. New Jersey continues to fund programs aimed at easing property tax burdens and supporting fixed-income households.

These programs operate separately from income tax refunds but influence overall household finances. For many residents, the timing of rebates or credits can affect financial planning, particularly when refunds are delayed or smaller than expected.

Understanding the distinction between refunds and relief programs helps avoid confusion and sets realistic expectations.

Digital Tools Reshape the Filing Experience

The expansion of online tools has reshaped how residents interact with state tax services. Through secure accounts, taxpayers can upload documents, view notices, and manage filings without relying on paper correspondence.

These tools also improve communication by allowing faster responses to requests for information. While digital systems are not immune to technical challenges, they generally offer greater transparency and faster resolution compared to traditional mail-based processes.

As more residents adopt online filing and account management, the state continues refining these platforms to address user feedback and system performance.

Responding to Notices and Requests for Information

Notices requesting additional documentation remain a routine part of the New Jersey refund review process in 2026, particularly as the Division of Taxation continues using enhanced identity-verification filters and fraud-prevention systems. These notices may request clarification on reported income, proof of New Jersey residency, confirmation of withholding amounts, or eligibility documentation for credits such as the Earned Income Tax Credit or property tax relief programs. In some cases, taxpayers may be asked to upload documents through secure online portals rather than mailing paper copies, reflecting the state’s increased reliance on digital processing.

Responding promptly — and using the specific method outlined in the notice, whether online submission, fax, or mail — is essential to prevent extended delays. Many notices include response deadlines, and failure to reply within the required timeframe can result in refunds being placed on hold or adjusted. Taxpayers are encouraged to keep copies of W-2s, 1099s, residency documents, and prior correspondence readily available to speed up verification. Ignoring notices or submitting incomplete documentation can significantly extend processing times, while clear communication, accurate records, and timely follow-up typically lead to faster resolution and release of refunds.

Support Options When Problems Persist

For residents facing prolonged delays or unresolved issues, additional assistance is available through specialized taxpayer support channels. These services exist to help individuals who have already attempted standard resolution methods without success.

Such support can be especially helpful in cases involving financial hardship or systemic issues. While not every situation qualifies, these resources provide an extra layer of advocacy for taxpayers navigating complex circumstances.

Common Mistakes That Slow Refunds

Even minor errors can disrupt processing. Incorrect identification numbers, inconsistent income reporting, and missing signatures are among the most frequent issues. Bank information errors can also delay refunds once approved.

Reviewing returns carefully before submission reduces the likelihood of mistakes. Using electronic filing systems with built-in error checks further minimizes risk, helping returns move through processing more smoothly.

Why Early Filing Still Matters

Submitting returns early offers advantages beyond faster refunds. Early filing reduces exposure to identity theft, as fraudulent submissions are less likely to succeed once a legitimate return is on file.

It also provides more time to address issues if they arise. Taxpayers who wait until the deadline may face limited support availability and heightened system congestion, increasing stress and potential delays.

Managing Expectations During the Waiting Period

Waiting for a refund can be stressful, especially when timelines extend beyond initial estimates. Understanding that processing varies by case helps manage expectations. Monitoring status updates regularly and responding promptly to requests keeps returns moving forward.

Financial planning that accounts for potential delays reduces reliance on expected refunds and helps households maintain stability during the waiting period.

The Role of Transparency in Tax Administration

Transparency has become a key focus for New Jersey’s tax administration. Clear status updates, accessible online tools, and expanded communication channels aim to reduce uncertainty and build trust.

While challenges remain, ongoing improvements reflect a commitment to modernizing services and addressing taxpayer concerns. Feedback from residents continues to shape future enhancements.

What This Season Signals for the Future

The 2026 filing season highlights the direction of state tax administration. Increased reliance on digital systems, enhanced verification measures, and broader relief initiatives signal a long-term strategy focused on efficiency and accountability.

As these systems mature, taxpayers can expect continued refinement and gradual improvements in processing speed and clarity.

Preparing for the Rest of the Year

Residents who have not yet filed still have time to prepare carefully. Gathering documentation, reviewing eligibility for credits, and choosing the appropriate filing method remain essential steps.

Staying informed about processing timelines and available tools helps reduce surprises and ensures a smoother experience.

A Year of Adjustment for New Jersey Taxpayers

This year represents a period of adjustment rather than disruption. While the fundamentals of filing remain familiar, the systems supporting refunds continue to evolve. For many residents, adapting to these changes requires patience and awareness.

By understanding how the process works and using available resources, taxpayers can navigate the season with greater confidence.

Looking Ahead With Clarity

As the filing season progresses, experiences will continue to vary across households. Some will receive refunds quickly, while others may encounter delays requiring follow-up. Staying informed remains the most effective way to manage expectations and outcomes.

How has your experience been this year, and what questions do you still have about the refund process? Share your thoughts below or keep checking back for timely updates.