Medtronic, a titan in the medical device industry, is making headlines with its latest financial and strategic moves. Today, the company announced it expects a $200 million hit from tariffs in 2026, while also missing Wall Street’s earnings outlook for the same year. This news, coupled with a major restructuring plan, signals a pivotal moment for the company as it grapples with global trade uncertainties and repositions for growth. Let’s dive into the latest developments shaping Medtronic’s path forward, exploring how these changes could impact its future and why they matter to investors, healthcare professionals, and patients alike.

Medtronic’s Tariff Troubles and Earnings Miss

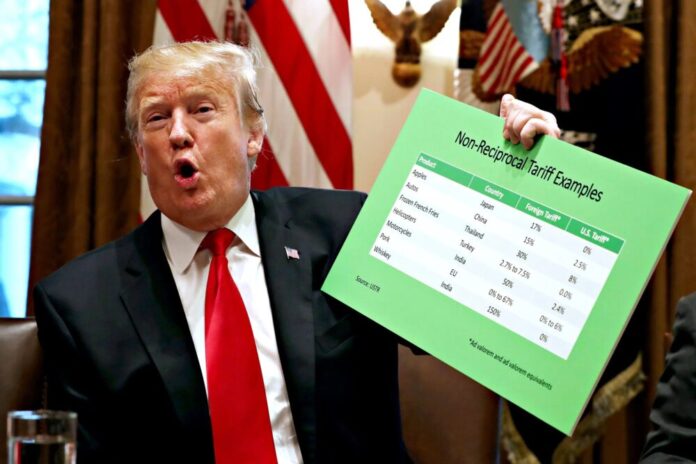

The medical device giant is bracing for a significant financial impact from U.S.-China trade tensions. Medtronic estimates tariffs will increase its cost of goods sold by $200 million to $350 million in fiscal 2026, even after mitigation efforts. This forecast assumes a resumption of higher tariff rates following a 90-day pause in bilateral trade agreements. The company’s fiscal 2026 earnings per share projection of $5.50 to $5.60 also fell short of Wall Street’s expectations of $5.83, sending shares down 1.3% in pre-market trading. Despite this, Medtronic reported a solid fourth-quarter performance, posting an adjusted profit of $1.62 per share, surpassing estimates of $1.58, driven by strong sales in heart and diabetes devices.

What does this mean for Medtronic? The tariff hit underscores the vulnerability of global supply chains in the medical device sector. With 2% of its business tied to China, the company is navigating a delicate balance. Mitigation strategies, like optimizing supply chains and adjusting pricing, are in play, but the uncertainty of trade policies keeps investors on edge. This development highlights the broader challenge of operating in a volatile geopolitical landscape, where policy shifts can ripple through corporate earnings.

Medtronic’s Bold Move: Spinning Off Its Diabetes Business

In a strategic pivot, Medtronic announced plans to spin off its $2.5 billion diabetes business into a standalone public company within the next 18 months. This unit, which includes insulin pumps and wearable devices, has faced hurdles, including regulatory scrutiny over quality management and cybersecurity concerns. By separating this segment, Medtronic aims to sharpen its focus on high-growth areas like cardiovascular devices and surgical technologies. The new California-based company will be led by the current diabetes division chief, signaling continuity in leadership.

This move is a game-changer. The diabetes unit, while innovative, has struggled to keep pace with Medtronic’s more profitable segments. Spinning it off allows the company to streamline operations and double down on areas driving revenue, like heart devices, which remain its biggest earner. For patients and healthcare providers, this could mean a more focused diabetes company, potentially accelerating innovation in insulin delivery systems. However, the transition carries risks—establishing a new public entity in a competitive market is no small feat.

Key Impacts of Medtronic’s Strategic Shift

- Financial Flexibility: Shedding the diabetes unit could free up resources for investment in high-margin areas like cardiac ablation and robotic surgery systems.

- Market Positioning: A standalone diabetes company might attract new investors and partners, boosting its ability to compete with rivals like Dexcom.

- Regulatory Relief: Separating the unit could reduce regulatory pressure on Medtronic’s core operations, allowing faster approvals for new devices.

- Tariff Mitigation: While tariffs hit hard, a leaner Medtronic may better absorb costs by focusing on domestic manufacturing and optimized supply chains.

Why This Matters for Medtronic’s Future

The tariff hit and earnings miss are more than just numbers—they reflect the broader challenges Medtronic faces in a shifting global economy. The company’s proactive response, including the diabetes business spin-off, shows a willingness to adapt. Investors are watching closely, as the stock’s 1.3% pre-market dip suggests cautious sentiment. Yet, Medtronic’s strong Q4 performance and FDA approval for innovations like the Simplera Sync sensor signal resilience. The company is also eyeing growth in emerging markets like India and advancing technologies like renal denervation, which could drive future revenue.

For healthcare stakeholders, Medtronic’s moves could reshape access to cutting-edge medical devices. A standalone diabetes company might innovate faster, potentially expanding approvals for type 2 diabetes treatments, which affect 95% of diabetic patients. Meanwhile, Medtronic’s focus on cardiovascular and surgical tech could lead to breakthroughs in minimally invasive procedures, benefiting patients worldwide. The road ahead is complex, but Medtronic’s ability to navigate tariffs and strategic restructuring will define its legacy in the medical device industry.

Want to stay ahead of Medtronic’s evolving story? Follow the latest updates on its tariff strategies and diabetes spin-off to understand how these changes could impact healthcare and investments. Share your thoughts below—what do you think Medtronic’s next move should be?