Medicare Part D plans 2026 roll out with average premiums hitting a new low, easing the burden on everyday drug expenses for older Americans. From January 1, folks nationwide will see stand-alone plans average $34.50 monthly, a solid cut from last year’s figures. This shift, paired with a $2,100 out-of-pocket limit, means better budgeting for prescriptions without the old coverage pitfalls.

Open enrollment just wrapped on December 7, so many have their 2026 setup locked in. Others might qualify for special windows based on life changes like moving or losing employer coverage. Either way, these updates deliver stability amid rising health needs.

Premium Drops Make Coverage More Accessible

Stand-alone prescription drug plans lead with that $34.50 average monthly cost. It reflects a $3.81 slide from 2025 levels. Insurers bid competitively, and federal tweaks keep hikes in check.

Bundled options shine brighter. Medicare Advantage plans with built-in drug benefits average $11.50 for the drug part alone. After rebates, many hit zero dollars monthly. This combo appeals to those wanting one-stop medical and pharmacy care.

Regional flavors add variety. In sunny Florida, 24 stand-alone choices spread across counties, with premiums dipping below national averages. Texas counters with 22 options, heavy on no-cost picks for low earners. California holds 21 plans, blending urban access with rural reach.

Smaller spots hold their own too. Wyoming offers nine solid selections, all with premiums at or under prior years. Alaska matches that count, ensuring remote residents stay covered without travel hassles.

These trends stem from smart bidding rules. Nearly all current users—over 99%—can snag a cheaper ride without switching drugs or stores. Low-income subsidies amplify this, turning premiums to pennies for millions.

Out-of-Pocket Safeguards Hit $2,100 Mark

Nobody shells out more than $2,100 yearly on covered Part D drugs in 2026. Hit that, and zero costs apply through December. This inflation-tied bump from $2,000 last year still shields high-need users big time.

Think oncology meds or biologics for autoimmune issues. Patients often clear the cap by spring, freeing summer fills. No more scraping for copays on life-savers.

Deductibles cap at $615 too, a $25 nudge up. Yet plenty of carriers waive it outright. Zero-start plans from big names like Aetna or Humana suit frequent fillers best.

Coverage flows smooth across phases. Start with any deductible, then copays kick in by tier. Generics run $1–$10; brands might hit 25% coinsurance. Catastrophic relief snaps on post-cap, full throttle.

Insulin at $35, Vaccines Free—Core Wins Endure

Diabetes management stays simple. Insulin—vials, pens, any type—tops at $35 monthly. This holds pre- and post-cap, no exceptions.

Vaccines follow suit. Flu, pneumonia, shingles, hepatitis B, Tdap—all zero under Part D. Advisory panel picks ensure broad protection without wallet hits.

These perks trace to recent laws, baking affordability into the system. Seniors dodge surprise bills on essentials, focusing on wellness over worries.

Extra Help Unlocks Near-Zero Expenses

Qualify for Extra Help? Full benefits slash costs to basics. Zero premiums on benchmark plans, no deductibles, and copays at $4.90 generics, $12.15 brands.

Partial aid tiers in for modest assets. Yearly apps keep doors open. About 13 million tap this, with 29–33% of stand-alone users per state hitting eligibility.

Rural folks and city dwellers alike access it seamlessly. Pair with food aid or housing support for total relief.

Plan Landscape: Choices Without Corners Cut

Stand-alone tallies hover at 360 nationwide, down a touch but blanket every zip. Medicare Advantage drug bundles top 5,600, edging steady.

Florida’s 24 stand-alones mix with 300-plus Advantage options. Pennsylvania boasts 25 drug-only plans amid dense networks. New York delivers 20, tuned for diverse needs.

Even sparse areas thrive. Montana lists 10 stand-alones; North Dakota 11. Zero-premium baselines cover 100% in most spots.

Star ratings guide quality hunts. Five-star gems allow anytime switches. Humana’s Value Rx and Wellcare’s Script earn top nods for service and savings.

Negotiation Power Trims Drug Prices

Federal talks slash tags on 10 pricey meds this round. Heart failure blockers, blood thinners, rheumatoid arthritis shots—all lighter on ledgers.

Generics flood in too. Patent drops on cholesterol meds and antidepressants push tiers low. Copays shrink to dollars, not dozens.

Formularies refresh annually. Carriers add 50-plus new entries, prioritizing chronic care staples. Diabetes combos, hypertension aids, mental health supports expand access.

Prior auths linger on some. Step therapy tests generics first. Pharmacists flag swaps at counters, saving steps.

Payment Spreading Eases Quarterly Crunch

New auto-enroll hits for the Payment Plan. Opt once, and costs divide evenly monthly—no lump January shocks.

Heavy users love it. Spread that $2,100 over 12 months, and budgets breathe. No fees, full flexibility.

Light takers skip if copays stay small. But for multi-script routines, it smooths the ride.

Penalty Traps: Enroll Timely or Pay Forever

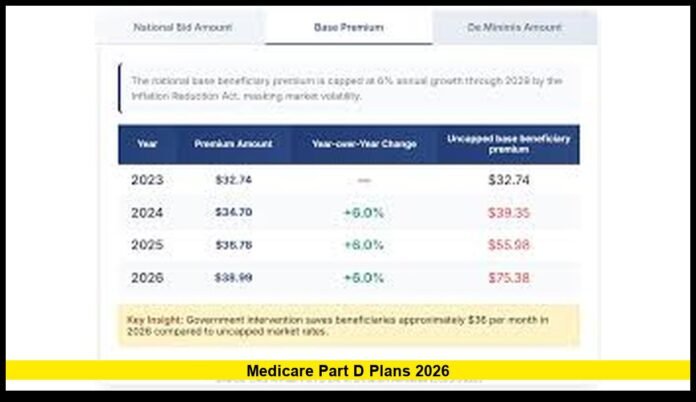

Base premium sets at $38.99. Late gaps trigger 1% hits per month uncovered—lifelong add-ons.

Three months out? Add $1.17 monthly forever. Skip a year? $4.68 sticks.

Creditable shields exist. Retiree wraps, VA scripts, union benefits count. Verify with HR or docs.

Special periods rescue qualifiers. Job loss, divorce, interstate moves open doors. Dial 1-800-MEDICARE for scans.

High-Income Adjustments Layer On

IRMAA kicks for top earners. Singles over $109,000 add $14.50 to Part D premiums. Couples past $218,000 match.

Tiers climb to $91 extra at $500,000-plus. Separate filers face stiffer from $109,000.

These fund the pot, but most dodge. Median households stay base-line.

Pharmacy Picks: Preferred Paths Pay Off

Networks matter. Preferred chains like Walmart, CVS, Kroger slash copays 50%. Mail-order triples supplies for double the fee—90 days, two hits.

Indies join too. Corner drugstores in networks beat big-box sometimes.

Tools simplify. Plan Finder inputs zips, scripts, doses. It crunches yearly totals: premiums plus out-of-pockets.

Sort by savings, not just monthly. A $20 plan might total $500 yearly; zero-premium hits $700 if tiers spike.

Special Plans for Complex Lives

D-SNPs blend Medicare and Medicaid. Dual eligibles get OTC bucks, rides, meals atop full drugs.

Chronic SNPs target diabetes, ESRD, lungs. Extra layers like podiatry or nutrition counseling.

These coordinate care. One call handles scripts and checkups, cutting chaos.

Regional Spotlights: Tailored to Your Turf

Alabama keeps 12 stand-alones, all cheaper or flat. Extra Help aids 29%. Arizona’s 10 plans match, 23% subsidized.

Arkansas mirrors: 12 options, 29% helped. Colorado adds 11, with mountain-town focus.

Illinois lists 15; Indiana 14. Kansas holds 10 steady. Every state guarantees one, most dozens.

Urban hubs like Chicago overflow choices; rural Kansas prairies link via mail.

Forward Momentum: Sustainability in Sight

Stabilization demo wraps subsidies at $10 per head, upping increase caps to $50. It bridges to market norms by 2027.

Bids fund richer perks. National average monthly bid climbs to $239.27, boosting copay cushions.

This setup saves thousands. A family on chemo pays capped, not crippling.

Action Steps for Peak Value

Grab your med list. Note strengths, frequencies. Punch into Medicare.gov.

Hunt zero-deduct, low-tier matches. Test preferred spots.

Chat SHIP advisors—free, local pros. They decode estimates.

Track via apps. Plans send quarterly tallies toward that $2,100.

These moves turn policy into power. Medicare Part D plans 2026 hand control back to users, blending cost cuts with care depth.

How do Medicare Part D plans 2026 fit your routine? Tell us in the comments—your story could steer someone else’s smart pick!