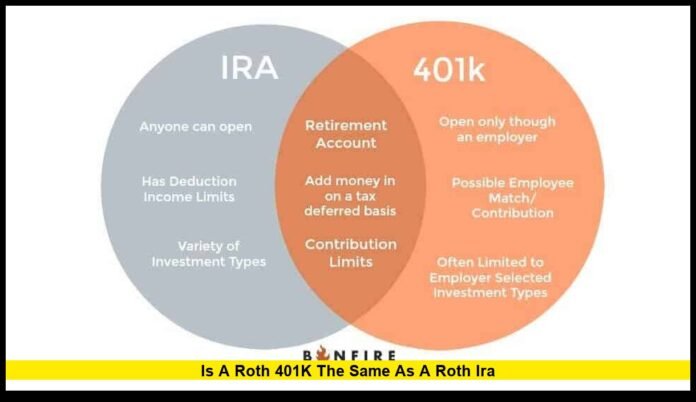

When asking “is a Roth 401(k) the same as a Roth IRA,” the short answer is no — while they share similarities, they differ in several crucial ways. As of late 2025, updates from the IRS and the SECURE 2.0 Act have made these differences even more important for U.S. savers. Below is a complete, factual breakdown of how each account works, what’s changed recently, and how the two compare in 2025.

What Are They?

Roth IRA

A Roth IRA is an individual retirement account funded with after-tax dollars. Qualified withdrawals—typically after age 59½ and if the account has been open for at least five years—are tax-free.

However, contributions are subject to income limits and annual contribution caps.

Roth 401(k)

A Roth 401(k), also known as a designated Roth account within an employer’s 401(k) plan, allows employees to make after-tax contributions. Withdrawals that meet the IRS’s qualified distribution rules are tax-free.

It’s an employer-sponsored plan, meaning your workplace must offer a 401(k) with a Roth option. Roth 401(k)s also have much higher contribution limits and no income restrictions on eligibility.

Major Similarities

- Both are funded with after-tax dollars, so there’s no immediate tax deduction.

- Both offer tax-free withdrawals in retirement once eligibility rules are met.

- Both help build tax-diversified retirement savings for future flexibility.

Key Differences

| Feature | Roth 401(k) | Roth IRA |

|---|---|---|

| Income eligibility | No income limit — anyone with access to a plan can contribute. | Income limits apply; high-income earners may be restricted. |

| Contribution limits (2025) | Up to $23,500 (under age 50); $30,000 if age 50 or older with catch-up. | Up to $7,000 (under age 50); $8,000 if age 50 or older. |

| Employer match | Employers may match contributions (usually into the traditional 401(k) side). | Not available — IRAs are individually managed. |

| Required Minimum Distributions (RMDs) | RMDs eliminated starting 2024 under the SECURE 2.0 Act. | No RMDs during the original owner’s lifetime. |

| Investment options | Limited to the employer’s plan menu. | Broad selection of investments — stocks, ETFs, mutual funds, etc. |

| Control & access | Plan rules determine access, loans, and withdrawals. | Complete control by the account holder. |

| Contribution deadlines | Made via payroll during the tax year. | Can be made until the tax filing deadline (typically mid-April of the following year). |

Recent Updates and 2025 Highlights

1. Contribution Limits for 2025

- Roth 401(k): The employee deferral limit for 2025 is $23,500. Those age 50 and older can contribute up to $30,000 (including catch-up).

- Roth IRA: The annual limit for 2025 is $7,000, with an $8,000 limit for those age 50 and older.

2. Income Phase-Out for Roth IRAs

- For 2025, single filers can make full Roth IRA contributions if their modified adjusted gross income (MAGI) is below approximately $150,000, with phase-outs starting thereafter.

- Married couples filing jointly can make full contributions below $236,000 MAGI.

3. Required Minimum Distributions (RMD) Changes

Under the SECURE 2.0 Act, Roth 401(k) accounts will no longer require RMDs beginning in 2024 and beyond. This change aligns them more closely with Roth IRAs, which have never required RMDs for the original account holder.

4. Catch-Up Contributions and Future Adjustments

Starting 2026, individuals earning over $145,000 and making catch-up contributions must do so on a Roth basis. For those between ages 60–63, the “super catch-up” provision allows an additional $11,250 in 2025 in some plans.

So, Is a Roth 401(k) the Same as a Roth IRA?

No — a Roth 401(k) is not the same as a Roth IRA. They operate under different sets of rules, limits, and eligibility conditions. While both accounts allow you to contribute after-tax dollars and withdraw funds tax-free in retirement, the key differences include contribution limits, employer participation, income thresholds, and investment flexibility.

That said, the two can work together to help maximize retirement savings. Many individuals use both: contributing to a Roth 401(k) at work for higher limits and employer matches, while also funding a Roth IRA for broader investment flexibility.

Which One Should You Choose?

It depends on your goals, income, and access:

- Choose a Roth 401(k) if:

- Your employer offers it, especially with a match.

- You earn above the Roth IRA income limit.

- You want to save larger amounts annually.

- Choose a Roth IRA if:

- You want total control over investments.

- You may change jobs frequently.

- You want to avoid RMDs entirely.

In many cases, using both is the optimal strategy — maxing out your Roth 401(k) contributions first to get any employer match, and then funding a Roth IRA (if eligible) for added flexibility.

Frequently Asked Questions (FAQ)

Q1: Can I contribute to both a Roth 401(k) and a Roth IRA in the same year?

Yes. You can contribute the maximum amount to your Roth 401(k) through your employer and also fund a Roth IRA (subject to income limits).

Q2: Do Roth 401(k) employer matches go into the Roth account?

Typically not. Employer matches are usually made on a pre-tax basis and placed into the traditional side of your 401(k).

Q3: When can I withdraw money from a Roth 401(k) or Roth IRA tax-free?

You must be at least 59½ and have held the account for at least five years. Early withdrawals may incur penalties or taxes on earnings.

Q4: What happens to my Roth 401(k) if I leave my job?

You can leave it with your former employer’s plan (if allowed), roll it into a new employer’s Roth 401(k), or move it into a Roth IRA. Rolling over preserves your Roth status and avoids taxation.

Q5: Can I convert a traditional 401(k) or IRA to a Roth?

Yes, through a Roth conversion. You’ll pay taxes on the converted pre-tax amount but benefit from tax-free growth afterward.

Q6: What if I earn too much to contribute to a Roth IRA?

High-income earners may use a backdoor Roth IRA, which involves contributing to a traditional IRA and converting it to a Roth IRA.

Important Takeaway

A Roth 401(k) and a Roth IRA are both powerful tools for building tax-free retirement income — but they’re not identical. The main distinctions revolve around income limits, contribution caps, employer involvement, and investment flexibility. With new 2025 rules, Roth 401(k)s now more closely mirror Roth IRAs by removing RMDs, yet they remain distinct accounts under IRS law.

For most savers, combining both accounts offers the strongest balance between high contribution limits and long-term tax-free flexibility.

Disclaimer

This article is for educational and informational purposes only. It does not constitute tax, legal, or investment advice. Individual circumstances vary, and readers should consult a qualified financial or tax advisor before making any decisions related to retirement accounts.

Bottom line: A Roth 401(k) is not the same as a Roth IRA — but understanding both can help you build a smarter, more tax-efficient retirement strategy. Stay informed and make choices that best fit your financial goals.