The IRS RMD table 2026 is now one of the most important reference points for retirees who must calculate their required minimum distributions for the year. With the age for mandatory withdrawals now set at 73 and the updated rules still in effect for 2026, Americans using tax-deferred retirement accounts need accurate numbers and clear guidance to stay compliant.

Latest Updates for the IRS RMD Table 2026

The IRS continues to use the updated life-expectancy tables that went into effect in recent years, meaning the distribution periods (or “life-expectancy factors”) shown in the IRS RMD table 2026 remain the current standard for calculation.

Here are the most important verified updates for 2026:

- The RMD age remains 73. Anyone who turns 73 in 2026 must take their first required minimum distribution.

- The Uniform Lifetime Table remains the default table for most IRA and 401(k) account owners.

- The first RMD must be taken by April 1 of the year following the year you turn 73. All later RMDs must be taken by December 31 each year.

- The excise tax penalty for missing an RMD is 25%, which may be reduced to 10% if corrected promptly.

- Roth IRAs still have no RMDs for original owners. Roth 401(k) plans are free from RMDs beginning in 2025 and continuing into 2026.

Understanding How the IRS RMD Table 2026 Works

The IRS RMD table 2026 provides distribution factors based on age. Your RMD for the year is calculated using this simple formula:

Prior Year Account Balance ÷ Distribution Period (from the IRS table) = RMD Amount

Key points:

- Use the December 31 balance from the preceding year.

- Use your age on your birthday in 2026.

- Apply the corresponding life-expectancy factor from the table.

This determines the exact minimum you must withdraw to avoid penalties.

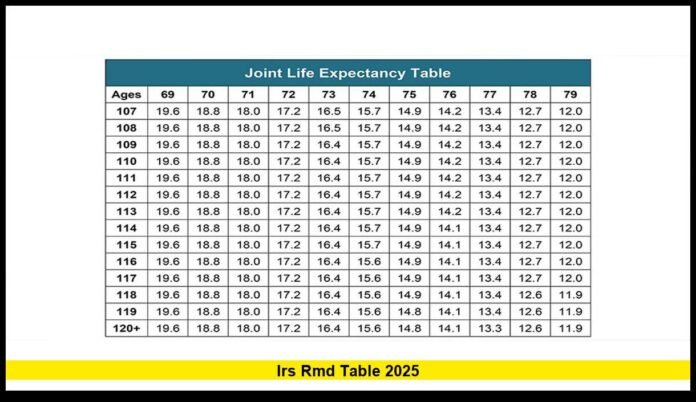

Excerpt of the IRS RMD Table 2026

Below is a clear snapshot of the Uniform Lifetime Table as it applies to common ages:

| Age | Distribution Period (Years) |

|---|---|

| 73 | 26.5 |

| 74 | 25.5 |

| 75 | 24.6 |

| 76 | 23.7 |

| 77 | 22.9 |

| 78 | 22.0 |

| 79 | 21.1 |

| 80 | 20.2 |

| 85 | 16.0 |

| 90 | 12.2 |

| 95 | 9.0 |

| 100 | 6.4 |

These figures allow retirees to calculate withdrawals with precision.

Example: How to Apply the IRS RMD Table for 2026

Suppose you turn 80 in 2026.

Your retirement account balance on December 31, 2025, is $100,000.

According to the IRS Uniform Lifetime Table, age 80 has a distribution period of 20.2 years.

To calculate your Required Minimum Distribution (RMD):

$100,000 ÷ 20.2 = $4,950 (rounded)

That means your required minimum distribution for 2026 would be approximately $4,950.

Why the IRS RMD Table 2026 Matters

The rules governing RMDs are designed to ensure that the government eventually collects taxes on the decades of tax-deferred growth in retirement accounts. Using the correct table matters because:

- It determines the minimum amount you must withdraw.

- Using the wrong distribution factor can result in under-withdrawal.

- Failure to meet the requirement risks substantial penalties.

- Retirees who plan ahead reduce the risk of withdrawing too little or creating unexpectedly high taxable income.

A precise understanding of the IRS RMD table 2025 helps retirees plan their income streams more effectively.

How to Use the Table for Multiple Accounts

Many older adults hold multiple tax-deferred accounts. The rules for applying the IRS RMD table 2026 are:

- Traditional IRAs: You may total the RMDs for all IRA accounts and withdraw from any one or a combination of them.

- 401(k) accounts: RMDs must be taken separately from each 401(k).

- Roth IRAs: No RMDs apply for original owners, even in 2026.

Being aware of these distinctions avoids costly compliance mistakes.

What Has Not Changed for 2026

There are no changes to the RMD denominators for 2026.

There are no new regulations affecting:

- The life-expectancy factors,

- The calculation method,

- The order or timing of RMD withdrawals.

The existing rules remain stable and in place.

Additionally:

- The upcoming change to raise the RMD age to 75 does not begin until 2033 and does not affect 2025 withdrawals.

- Beneficiaries of inherited IRAs must follow an entirely separate set of rules depending on their classification (eligible designated beneficiary vs. designated beneficiary).

Tips for Managing RMDs in 2026

To make the most of the IRS RMD table 2026:

- Double-check your year-end balances.

- Plan early in the year, not in December.

- Avoid taking two RMDs in the same tax year unless necessary.

- Consider withholding taxes directly from the RMD to simplify tax filing.

- Review your situation if your spouse is more than 10 years younger, since a different IRS table may reduce your RMD.

- Consult a financial professional for complex situations, such as inherited accounts or multiple employer plans.

Small mistakes can lead to big penalties. Planning ahead ensures compliance and smoother withdrawals.

Final Thoughts

The IRS RMD table 2026 remains a vital tool for U.S. retirees managing tax-deferred retirement accounts. Understanding the table, keeping track of deadlines, and calculating withdrawals accurately help you stay compliant while protecting your retirement income strategy.

If you have questions about using the IRS RMD table 2026 for your own retirement planning, feel free to share them in the comments below.