Each tax season brings a familiar question for millions of Americans: when will the money arrive? As households finalize their returns, expectations around refund timing play a major role in budgeting, planning, and financial decisions. The 2026 filing cycle follows established federal processing rules while reflecting ongoing changes in filing behavior, refund delivery methods, and review procedures.

This detailed guide walks through how refunds move through the system, what affects timing, why some payments take longer than others, and how filers can avoid common delays. Whether you file early or closer to the deadline, understanding how the process works can help set realistic expectations and reduce uncertainty.

When the 2026 Tax Season Officially Began

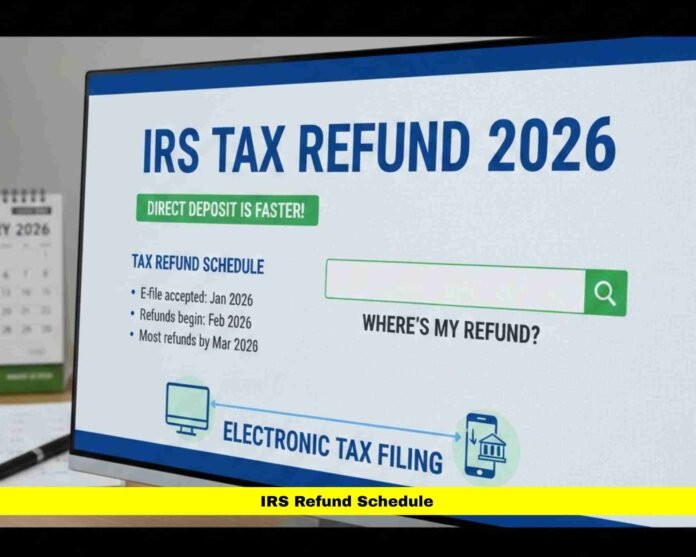

The federal filing window opened in late January, allowing taxpayers to submit returns for the prior tax year. Once the system began accepting submissions, processing started immediately for returns filed electronically. The earlier a return is accepted, the sooner it enters the review pipeline.

The April filing deadline remains unchanged, but submitting earlier in the season often helps returns move faster, especially before peak volumes build in March and April. That said, timing alone does not guarantee quick payment, as other factors influence how long processing takes.

How Refund Processing Works Behind the Scenes

Once a return is submitted, it goes through several stages before money is released. First, the system checks the return for basic completeness and matching records. This includes verifying income data, identity information, and filing status.

After initial acceptance, automated systems review the return for accuracy. Most returns pass through without issue, but some are flagged for manual review. This does not necessarily mean something is wrong; it may simply indicate the need for confirmation.

Only after these checks are completed can a refund be approved and scheduled for delivery. Each of these steps affects how long the process takes.

Electronic Filing Versus Paper Submission

Electronic filing continues to be the fastest and most reliable option. Returns submitted digitally move directly into automated processing, reducing errors and shortening review time.

Paper returns require manual handling, which adds weeks to the process. Data must be entered by hand before any verification can begin. As a result, refunds tied to paper submissions often take significantly longer to arrive.

For taxpayers who want speed and predictability, digital submission remains the preferred choice.

Why Direct Deposit Is Now the Default Option

Refund delivery has changed significantly in recent years. Direct deposit has become the standard method, offering faster access and greater security. Payments sent electronically reach bank accounts quickly once approved, often within days.

Paper checks, while still available in limited cases, take longer to process and carry additional risks such as loss or delay in the mail. Errors in mailing addresses can further slow delivery.

Providing accurate banking information is critical. Even small mistakes can cause refunds to be rejected and reissued, extending wait times.

Typical Refund Timeframes for Most Filers

For electronically filed returns with no issues, refunds often arrive within about three weeks after acceptance. This timeline applies to the majority of straightforward filings that do not require additional verification.

However, this is an estimate rather than a guarantee. Processing times vary depending on return complexity, filing volume, and review requirements. During peak periods, even error-free returns may take slightly longer.

Mandatory Waiting Periods for Certain Credits

Some refunds are subject to legally required delays. Returns that include specific refundable credits cannot be released until after a set date in February. This rule exists to prevent fraud and ensure accurate payments.

Even if the rest of the return processes quickly, the full refund remains on hold until the waiting period ends. Once released, these refunds typically move quickly through the system.

Filers who claim these credits should plan accordingly and avoid assuming early arrival.

Why Early Filing Still Makes a Difference

Submitting a return early helps secure a place in the processing queue. When mandatory delays end, earlier filings are often released first, assuming no other issues exist.

Early filing also reduces the risk of identity theft, as fraudulent returns are less likely to be accepted when a legitimate return is already on file.

Even when delays apply, filing early positions the return for faster movement once restrictions lift.

How Refund Amounts Are Calculated

Refund amounts depend on several factors, including income, withholding, deductions, and credits. Changes in tax brackets or deduction limits can cause refund amounts to vary from year to year.

A larger refund does not necessarily mean faster processing. Timing depends on accuracy and review requirements, not dollar value.

Understanding how refund amounts are calculated helps set expectations and avoid surprises when funds arrive.

Tracking Refund Progress Online

Refund tracking tools allow filers to monitor progress once a return has been accepted. Status updates typically appear within a day for electronic submissions.

These tools show whether the return has been received, approved, or sent. Updates occur periodically, not continuously, so checking once a day is usually sufficient.

If a refund is delayed, the tracking system often provides guidance on next steps or indicates whether further review is underway.

Common Errors That Cause Delays

Mistakes remain one of the biggest reasons refunds take longer than expected. Incorrect Social Security numbers, mismatched names, inaccurate income reporting, and bank account errors are among the most common issues.

Even small discrepancies can trigger manual review. Double-checking all information before submission greatly reduces the risk of delay.

Using digital filing software helps catch errors early, as many platforms include built-in validation checks.

Identity Verification and Security Reviews

Some returns are selected for identity verification to protect against fraud. When this happens, the filer must confirm their identity before processing can continue.

This step adds time but helps ensure refunds are issued to the correct person. Responding promptly to verification requests helps minimize delays.

Ignoring notices or waiting too long to respond can significantly extend processing time.

How Filing Status Affects Processing

Married couples filing jointly, heads of household, and single filers all follow the same processing framework. However, returns with multiple dependents or complex income sources may require additional review.

Changes in filing status from the prior year can also prompt verification, especially if dependents differ from previous filings.

Accuracy and consistency help keep returns moving smoothly.

Peak Season Backlogs and What to Expect

As the filing deadline approaches, submission volume increases sharply. High volume can slow processing, even for simple returns.

Filing earlier avoids this congestion and improves the likelihood of faster refund delivery.

Those who file closer to the deadline should anticipate longer wait times and plan finances accordingly.

What to Do If a Refund Takes Longer Than Expected

If a refund extends beyond the typical window, checking the status tool is the first step. In many cases, the delay resolves without action.

If additional information is needed, the system will indicate next steps. Responding promptly helps prevent further delay.

Calling or submitting duplicate returns should be avoided, as this can complicate processing.

Planning Finances Around Expected Refund Timing

For many households, refunds play a key role in financial planning. Knowing approximate arrival windows helps with budgeting and major expenses.

Relying on confirmed timelines rather than assumptions reduces stress and improves financial decision-making.

Setting realistic expectations is especially important for filers subject to mandatory delays or additional review.

What Makes the 2026 Season Different

This filing season reflects continued emphasis on digital processing, fraud prevention, and electronic payments. While core timelines remain familiar, enforcement of accuracy checks and identity protection continues to shape refund delivery.

Understanding these dynamics helps filers navigate the season with confidence.

Final Thoughts on Refund Timing This Year

Refund processing follows a structured system designed to balance speed, accuracy, and security. Most filers who submit accurate returns electronically and choose direct deposit can expect timely payment, while others may experience delays due to required reviews or legal waiting periods.

Knowing how the system works removes much of the uncertainty and allows filers to plan with clarity.

Have questions about your refund or insights to share from this filing season? Join the conversation below and stay informed as processing continues.