The irs mileage rate 2026 has not been officially released by the Internal Revenue Service as of today, and no confirmed mileage figures for the 2026 tax year are currently in effect. This status is important for millions of U.S. taxpayers who rely on the standard mileage rate for business deductions, employer reimbursements, and accurate tax reporting. Until the IRS publishes the official update, the most recently approved mileage rates remain valid, and no alternative figures should be used for tax or payroll purposes.

Each year, the IRS mileage rate becomes one of the most closely watched tax updates in the United States. It affects how individuals deduct vehicle expenses, how companies reimburse employees, and how self-employed workers calculate costs tied directly to their income. Understanding where things stand now, why the rate matters, and how to prepare responsibly is essential while waiting for the official 2026 announcement.

Current Status of the IRS Mileage Rate 2026

As of the date of writing, the Internal Revenue Service has not issued the irs mileage rate 2026. This means there are no officially approved mileage figures for business, medical, moving, or charitable driving for the 2026 calendar year. The absence of a published rate is not unusual and does not signal a delay or policy shift. It reflects the IRS’s standard process of reviewing nationwide cost data before finalizing annual mileage figures.

Until the IRS makes a formal announcement, taxpayers are required to continue using the mileage rates currently in effect for the applicable tax year. Any attempt to use unverified numbers, estimates, or unofficial projections may lead to incorrect deductions, reimbursement errors, or compliance issues during tax filing.

Why the IRS Mileage Rate Exists

The IRS mileage rate was created to simplify how taxpayers account for vehicle-related expenses. Rather than requiring individuals to track every gallon of fuel, repair bill, insurance payment, and depreciation calculation, the standard mileage rate offers a streamlined alternative that reflects average vehicle operating costs across the United States.

This system benefits both taxpayers and the IRS. Taxpayers gain a simpler method for claiming deductions, while the IRS benefits from a standardized approach that reduces disputes and administrative burden. The mileage rate is designed to approximate real-world costs fairly, not to maximize deductions or penalize drivers.

Mileage Rates That Remain in Effect

Because the irs mileage rate 2026 has not been released, taxpayers must continue using the currently approved mileage rates. These rates apply to miles driven for qualifying purposes during the applicable tax year and remain authoritative until the IRS publishes new guidance.

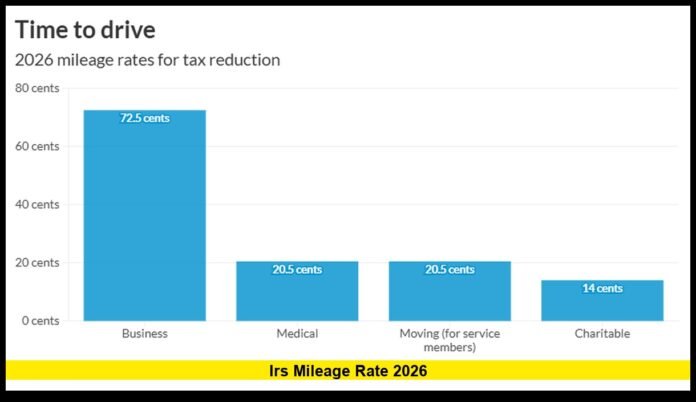

Mileage rates are divided into specific categories:

- Business-related driving

- Medical-related driving

- Qualified moving travel for eligible individuals

- Charitable service driving

Each category serves a distinct purpose, and applying the correct rate is critical for compliance. Mixing categories or applying incorrect rates can result in denied deductions or tax adjustments.

Who Relies on the IRS Mileage Rate

The IRS mileage rate affects a broad segment of the U.S. population, extending far beyond traditional businesses.

Self-Employed Workers

Freelancers, consultants, independent contractors, and gig workers commonly use the standard mileage method to deduct business vehicle use. For many, vehicle-related expenses represent a significant portion of their operating costs.

Small Business Owners

Small business owners often rely on the mileage rate to simplify accounting and avoid the complexity of tracking actual expenses across multiple vehicles or drivers.

Employers and Corporations

Employers use the IRS mileage rate as a benchmark for employee reimbursements. Reimbursements made at or below the IRS rate are generally treated as non-taxable, making the rate essential for payroll compliance.

Nonprofit Volunteers

Volunteers who drive for charitable organizations may use the charitable mileage rate to account for qualifying travel tied to their service.

How the IRS Determines Mileage Rates

The IRS mileage rate is calculated using a comprehensive analysis of vehicle ownership and operating costs. The agency considers both fixed and variable expenses to determine an average cost per mile driven.

Fixed costs include expenses that remain relatively stable regardless of how much a vehicle is used, such as depreciation, insurance premiums, registration fees, and licensing costs. Variable costs include expenses that fluctuate based on usage, such as fuel, maintenance, repairs, oil changes, and tire wear.

By combining these factors, the IRS arrives at a rate intended to reflect national averages rather than individual circumstances. This ensures fairness and consistency across taxpayers.

Economic Factors That Influence Mileage Rates

Mileage rates often reflect broader economic trends. Rising fuel prices, increased insurance premiums, supply chain disruptions, and inflation can all influence annual adjustments. Conversely, periods of cost stabilization may result in smaller changes or unchanged rates.

The IRS evaluates these trends carefully before issuing updates. This cautious approach helps maintain credibility and ensures the mileage rate remains grounded in verified data rather than short-term fluctuations.

Business Mileage and Tax Deductions

Business mileage remains the most commonly used category under the IRS mileage system. It applies to miles driven for work-related purposes, excluding commuting between home and a regular workplace.

Qualifying business mileage may include travel to client meetings, job sites, temporary work locations, or business errands. Accurate classification is essential, as personal or commuting miles do not qualify for deductions under IRS rules.

Using the standard mileage method allows eligible taxpayers to multiply their business miles by the approved rate to calculate deductible expenses.

Actual Expense Method vs. Standard Mileage Method

Taxpayers typically choose between two methods for deducting vehicle expenses.

The standard mileage method offers simplicity and consistency. It reduces recordkeeping requirements and eliminates the need to track individual costs.

The actual expense method requires detailed tracking of all vehicle-related expenses and calculating the percentage attributable to business use. While this method may result in higher deductions for some taxpayers, it also increases complexity and documentation requirements.

Once a taxpayer selects a method for a specific vehicle, switching methods later may be restricted. This makes the mileage rate especially important when placing a vehicle into service for business use.

Importance of Mileage Records

Regardless of the method used, mileage records are essential. The IRS expects taxpayers to maintain contemporaneous records that clearly document:

- Dates of travel

- Destinations

- Business purpose

- Miles driven

Incomplete or reconstructed records may be challenged during audits. Consistent tracking from the start of the year provides the strongest protection.

Employer Mileage Reimbursement Policies

Many employers structure reimbursement programs around the IRS mileage rate. This approach simplifies compliance and ensures reimbursements remain non-taxable when properly administered.

Until the irs mileage rate 2026 is officially released, employers typically continue using the existing rate. Once the new rate is announced, companies may update policies prospectively rather than retroactively, unless otherwise specified.

Clear communication with employees is essential during this transition to avoid confusion or disputes.

Medical and Moving Mileage

Medical mileage applies to qualifying travel related to medical care, while moving mileage applies only to eligible active-duty military members under specific conditions.

These categories are governed by separate IRS rules and rates. They should not be confused with business mileage, as eligibility requirements differ significantly.

Applying the correct rate to the correct category is critical for compliance and accuracy.

Charitable Mileage and Volunteer Work

Charitable mileage applies to miles driven in service of eligible charitable organizations. This category supports volunteerism while maintaining strict eligibility criteria.

Only qualifying charitable activities count, and personal travel does not qualify. Volunteers should maintain records similar to business mileage logs to support deductions.

What Taxpayers Should Avoid While Waiting

While waiting for the irs mileage rate 2026, taxpayers should avoid relying on unofficial estimates, predictions, or social media claims. Using unverified figures can lead to incorrect filings and potential penalties.

Tax planning should always be based on confirmed IRS guidance rather than assumptions about future changes.

Timing of IRS Mileage Rate Announcements

Historically, the IRS releases mileage rates near the end of December, with the new rates becoming effective on January 1 of the following year. Once announced, the rates apply to all qualifying miles driven during that calendar year.

Taxpayers should monitor official IRS communications for confirmation rather than relying on secondary interpretations.

Impact of Mileage Rate Changes on Real-World Finances

Even small changes in the mileage rate can have meaningful financial effects. For drivers logging tens of thousands of miles annually, a one-cent adjustment can translate into hundreds of dollars in deductions or reimbursements.

Businesses with large mobile workforces feel these changes even more acutely, as mileage costs scale across multiple employees.

Audit Risk and Compliance

Mileage deductions remain a common audit focus. The IRS examines whether miles were properly classified, adequately documented, and calculated using the correct rate.

Using the wrong mileage rate, even unintentionally, can result in disallowed deductions or adjustments. Staying current with official IRS guidance is the best defense.

Technology and Mileage Tracking

Digital mileage tracking tools have become increasingly popular. These tools can help automate recordkeeping and reduce errors, but they do not replace IRS requirements.

Taxpayers remain responsible for ensuring records are accurate, complete, and properly categorized.

Long-Term Perspective on Mileage Rates

Mileage rates reflect long-term economic patterns rather than short-term market swings. Understanding this helps taxpayers view changes as part of an ongoing adjustment process rather than sudden disruptions.

This perspective encourages responsible planning and reduces reliance on speculation.

What Will Happen Once the Rate Is Released

When the irs mileage rate 2026 is officially announced, taxpayers can expect clear guidance outlining the approved rates and effective date. The announcement will confirm how the rates apply for the entire 2026 calendar year.

Until then, no changes should be assumed.

Final Considerations for U.S. Taxpayers

The irs mileage rate 2026 remains officially unreleased as of today, and taxpayers should continue using the currently approved rates. Patience and accuracy remain essential during this waiting period.

By maintaining proper records, avoiding speculation, and staying informed, taxpayers and businesses can transition smoothly once the IRS issues its official update.

Share your thoughts or questions below and stay engaged as the new tax year approaches.