How to take advantage of no tax on tips and overtime has become a major concern for millions of American workers after federal tax law changes created new deductions for certain types of earnings. These rules, now in effect for the 2025 through 2028 tax years, allow eligible employees to reduce their federal taxable income when they receive qualified tips or earn overtime premium pay. The result can be a lower tax bill and a higher take-home benefit, provided the income is reported correctly and the limits are understood.

The policy does not mean tips and overtime are completely untaxed. Instead, it creates targeted income tax deductions that apply under specific conditions. Knowing how the system works is essential for workers in restaurants, hospitality, healthcare, manufacturing, transportation, and other industries where tips and overtime make up a large share of annual earnings.

Understanding What “No Tax” Really Refers To

The wording often used in public discussions can be confusing. Under current federal law:

- Tips are still considered taxable income.

- Overtime wages are still considered taxable income.

- Social Security and Medicare taxes still apply.

- State and local taxes may still apply.

The benefit comes from deductions that reduce federal income tax, not from an exemption that removes the income from the tax system entirely. When you qualify, the allowed amount of tip income and overtime premium pay is subtracted from your taxable income before the final tax calculation is made.

How the Tip Deduction Works

What Counts as Qualified Tips

Only certain tips qualify for the deduction. These include:

- Voluntary cash tips given directly by customers

- Credit card and digital payment tips

- App-based tips from delivery or ride services

- Tips that are properly reported and appear on tax documents

Tips that do not qualify include:

- Mandatory service charges

- Automatic gratuities added by employers

- Tip pools that are reclassified as wages

- Undeclared or unreported cash tips

For the deduction to apply, the income must be documented. Accurate reporting protects workers and allows them to legally benefit from the tax rule.

Annual Deduction Limits

There is a maximum amount of tip income that can be deducted each year. The limit applies per taxpayer and is fixed by law for the duration of the program. Any tip income above that limit remains fully taxable at the federal level.

How the Overtime Deduction Works

What Part of Overtime Qualifies

The deduction applies only to the premium portion of overtime pay, not the entire overtime check.

When an employee earns time-and-a-half:

- The regular hourly rate remains fully taxable.

- The extra half-time premium is the qualifying amount.

Example:

A worker earning $24 per hour who works overtime at $36 per hour receives:

- $24 regular pay (fully taxable)

- $12 overtime premium (potentially deductible)

Only the premium portion counts toward the deduction, subject to annual limits.

Annual Deduction Limits for Overtime

Just like tips, there is a cap on how much overtime premium pay can be deducted each year. Once that ceiling is reached, any additional overtime earnings are taxed normally.

Income Thresholds and Phase-Out Rules

The deductions are designed primarily for working- and middle-income households. As income rises, the benefit is gradually reduced.

Key points include:

- A modified adjusted gross income threshold where the deduction begins to shrink

- A complete phase-out once income exceeds the upper limit

- Separate thresholds for single filers and married couples filing jointly

- Joint filing required for married workers to receive the full benefit

Workers near the phase-out range should pay special attention to year-end income planning, as even small increases can reduce or eliminate eligibility.

How the Deduction Affects Your Tax Return

Reducing taxable income can create several advantages:

- Lower federal income tax owed

- Potential movement into a lower tax bracket

- Increased eligibility for income-based credits

- Reduced exposure to alternative minimum tax calculations

For many workers, the impact is most noticeable at filing time when refunds are larger or balances due are smaller than in prior years.

Payroll Taxes Still Apply

It is important to understand that:

- Social Security tax continues to apply to tips and overtime.

- Medicare tax continues to apply to tips and overtime.

- Employer matching contributions remain unchanged.

The benefit is strictly an income tax adjustment, not a payroll tax exemption.

Employer Reporting and Pay Stub Accuracy

To make the system work smoothly, employers now separate:

- Regular wages

- Tip income

- Overtime premium pay

This breakdown allows tax software and preparers to correctly apply the deduction without relying on estimates. Workers should review their pay stubs and year-end forms to ensure:

- Tips are clearly listed

- Overtime hours are accurately recorded

- Premium pay is shown separately from base wages

Errors should be corrected before filing.

How to Prepare Throughout the Year

1. Maintain Personal Records

Even with improved employer reporting, personal tracking is valuable. Workers should:

- Log daily tips

- Keep copies of weekly pay stubs

- Record overtime hours and rates

2. Monitor Annual Earnings

Knowing your projected income helps determine whether you may approach phase-out thresholds. This allows for better planning around:

- Additional shifts

- Bonus timing

- Retirement contributions

- Flexible spending accounts

3. Adjust Withholding If Needed

A lower federal income tax bill may justify updating your withholding to avoid overpaying during the year. This can increase regular take-home pay instead of waiting for a refund.

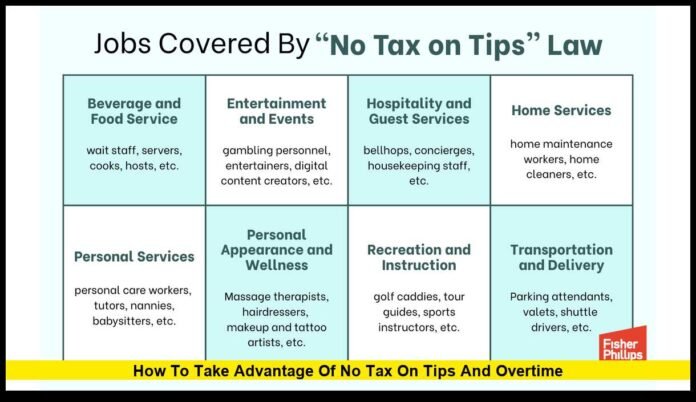

Industries Most Affected

The deduction is especially relevant in sectors where variable pay is common:

- Restaurants and bars

- Hotels and resorts

- Casinos and entertainment venues

- Healthcare and emergency services

- Manufacturing and warehousing

- Transportation and logistics

- Utilities and infrastructure maintenance

In these fields, overtime and tips often represent a significant share of total compensation.

Common Misunderstandings

“My Employer Won’t Withhold Any Tax Now”

Withholding still occurs. The deduction is applied when the tax return is filed, not when each paycheck is issued.

“All My Overtime Is Deductible”

Only the premium portion qualifies. Regular hourly wages do not.

“Service Charges Count as Tips”

Mandatory charges added by the business are wages, not tips, and do not qualify.

“State Taxes Are Eliminated Too”

Many states do not follow the federal rule and still tax all tips and overtime normally.

Planning for Long-Term Savings

While the current law applies for several years, its continuation depends on future legislative action. Workers can maximize current benefits by:

- Ensuring full income reporting

- Using retirement contributions to manage taxable income

- Coordinating overtime scheduling with income thresholds

- Consulting tax professionals when income fluctuates widely

Strategic planning can make the difference between partial and full use of the deduction.

Why Accurate Reporting Matters

The deduction is available only for income that is:

- Properly reported

- Verifiable

- Reflected on official tax documents

Failure to report tips or misclassify overtime can lead to:

- Loss of the deduction

- Back taxes

- Penalties

- Interest assessments

Compliance protects both financial savings and legal standing.

The Real Impact on Take-Home Pay

For workers who consistently receive tips or work long hours, the deduction can:

- Increase net annual income

- Reduce effective tax rates

- Provide greater financial stability

- Improve budgeting accuracy

The benefit is especially valuable in high-cost areas where overtime is common and service jobs rely heavily on gratuities.

Staying Informed as Rules Evolve

Tax rules can change, and adjustments to deduction limits, reporting standards, or income thresholds may occur in future years. Workers should:

- Review updates before each filing season

- Check employer guidance

- Use reliable tax preparation tools

- Seek professional advice when income structures change

Being proactive ensures continued access to the full benefit.

Understanding how to take advantage of no tax on tips and overtime can help working Americans protect more of their earnings, and staying informed will ensure you are ready to benefit from every dollar the law allows you to keep.