When you inherit a truck, knowing exactly how to register an inherited truck in Texas is essential. As of October 22, 2025, the Texas Department of Motor Vehicles (TxDMV) and local county tax assessor-collector offices have clearly defined procedures that heirs must follow to legally title and register an inherited vehicle. Below is a detailed, up-to-date guide for U.S. readers explaining each step accurately and clearly.

1. Confirm Ownership Transfer: Heirship vs. Probate

Before you can register an inherited truck, you must legally establish ownership. Texas recognizes two primary ways to do this: heirship or probate.

Heirship (No Formal Probate Required)

If the deceased person’s estate is simple and doesn’t go through probate, heirs can use an Affidavit of Heirship for a Motor Vehicle (Form VTR-262). This form allows legal transfer of ownership from the deceased to the heirs without a court proceeding.

The form must include:

- The deceased owner’s name and date of death.

- The truck’s VIN (vehicle identification number).

- The names of all legal heirs.

- A notarized signature confirming the accuracy of all information.

Once completed, the heirship affidavit is submitted to the county tax office to start the title transfer process.

Probate (Through a Will or Court Order)

If the deceased left a will or if probate is required, the court-appointed executor or administrator will handle the transfer. They must provide official “Letters Testamentary” or “Letters of Administration” proving their authority. The vehicle title then transfers from the estate to the designated heir through the regular title process.

2. Required Documents & Steps to Register the Truck

After confirming ownership, you’ll need to title and register the vehicle in your name. The process involves collecting specific documents and submitting them at your county tax assessor-collector’s office.

Documents You’ll Need:

- Certified copy of the death certificate.

- The truck’s current title (if available). If lost, you can apply for a duplicate or bonded title.

- Affidavit of Heirship for a Motor Vehicle (Form VTR-262), if probate isn’t required.

- Affidavit of Motor Vehicle Gift Transfer (Form 14-317) if the vehicle is being transferred as a gift or inheritance (this allows for a $10 gift tax rate).

- Application for Texas Title and/or Registration (Form 130-U).

- Proof of current Texas liability insurance (minimum $30,000 per person bodily injury, $60,000 per accident, and $25,000 property damage).

- Proof of passing inspection, if you’re in a Texas emissions or safety inspection county.

- Lien release, if the truck was financed and the loan has been paid off.

Submitting the Paperwork:

Take the completed forms and documents to the local county tax assessor-collector’s office. The office will process the title transfer, assess applicable taxes and fees, and issue new registration paperwork in your name.

Fees and Taxes:

- Title application fee: $28–$33 (varies by county).

- Registration fee: Based on vehicle weight and county.

- Gift/inheritance tax: $10 flat rate if no payment or debt transfer occurs.

- Standard motor vehicle tax: May apply if the heir assumes outstanding debt or if the transfer does not qualify as a gift.

Once these steps are complete, you’ll receive a new Texas title in your name and registration for your inherited truck.

3. Special Considerations for Inherited Trucks

Inherited trucks can have additional details to manage, depending on the vehicle’s classification or history.

- Vehicle classification: If your truck is commercial or heavy-duty, extra inspection or weight certification may be required.

- Liens: If a lien appears on the title and no release exists, the transfer cannot proceed until the lien is satisfied.

- Multiple heirs: If multiple heirs share ownership, all must sign the Affidavit of Heirship or agree to transfer ownership to one individual.

- Lost title: A bonded or duplicate title may be necessary if the original cannot be located.

4. Step-by-Step Timeline at a Glance

| Step | Action | Who Handles It |

|---|---|---|

| 1 | Establish heirship or probate | Heir(s) or executor |

| 2 | Gather required documents | Heir(s) or executor |

| 3 | Complete forms (VTR-262, 14-317, 130-U) | Heir(s) |

| 4 | Submit paperwork at county tax office | Heir(s) |

| 5 | Pay taxes and fees | Heir(s) |

| 6 | Receive new title and registration | County issues title |

| 7 | Maintain active registration and insurance | Owner |

5. Recent Updates for 2025

As of 2025, the Texas Comptroller of Public Accounts continues to classify vehicles inherited from an estate as eligible for the $10 gift tax if the heir receives the vehicle without assuming any debt.

County tax assessor offices across Texas have confirmed that the process for title transfers due to inheritance remains unchanged from prior years, though some counties now allow partial online submission of forms before in-person verification.

Additionally, inspection requirements for trucks registered in designated emissions counties—such as Travis, Harris, Dallas, and Tarrant—remain mandatory before registration can be issued.

6. Common Mistakes to Avoid

When registering an inherited truck in Texas, these common errors often delay the process:

- Missing required forms: Forgetting to include the heirship affidavit or gift transfer affidavit causes immediate rejection.

- Incomplete insurance or inspection paperwork: You must present proof of valid insurance and a current inspection.

- Overlooking taxes: Even inherited trucks can be subject to fees beyond the $10 gift tax if debt or consideration is involved.

- Not handling liens: A title showing an active lien cannot transfer until the lienholder provides an official release.

- Delaying registration: Texas law requires prompt title transfer and registration after an inheritance; long delays can complicate ownership.

7. Frequently Asked Questions (FAQ)

Q1: Do I need to go through probate to register an inherited truck in Texas?

A: Not necessarily. If the estate doesn’t require probate, you can complete the transfer using the Affidavit of Heirship for a Motor Vehicle. Probate is only needed for complex estates or when disputes exist.

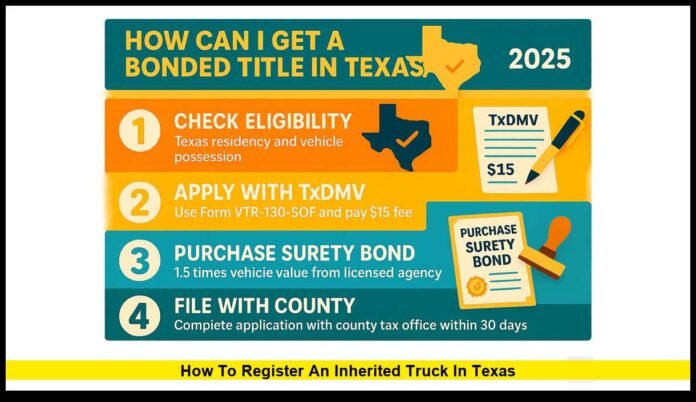

Q2: What if the deceased didn’t leave a vehicle title?

A: You can request a duplicate title or apply for a bonded title through the TxDMV if you have sufficient proof of ownership.

Q3: How much will I pay in taxes to register the truck?

A: If you’re inheriting the truck and not paying any money or assuming debt, you’ll pay a flat $10 gift tax. Otherwise, the standard 6.25% motor vehicle tax applies.

Q4: Can multiple heirs jointly register the truck?

A: Yes, but all heirs must agree and sign the necessary forms. If one person takes ownership, the others must release their interest in writing.

Q5: Do I need an inspection if the truck hasn’t been driven?

A: Yes. Even unused or inherited vehicles must pass Texas safety and emissions inspections before registration in applicable counties.

Q6: How long do I have to register the truck after inheritance?

A: It’s recommended to complete the title transfer and registration within 30 days of inheritance to avoid penalties or complications.

8. Step-By-Step Summary Checklist

✅ Determine if probate or heirship applies.

✅ Collect the death certificate and title documents.

✅ Complete Forms VTR-262, 14-317, and 130-U.

✅ Get proof of inspection and insurance.

✅ Submit paperwork to your county tax office.

✅ Pay applicable title and registration fees.

✅ Obtain new plates and registration in your name.

By following this checklist carefully, you can ensure a smooth, lawful transfer of your inherited truck in Texas.

9. Final Notes & Best Practices

Registering an inherited truck in Texas can feel complicated, but the process is straightforward if you stay organized. The key is to ensure all ownership documents are accurate, forms are notarized where required, and any lien or tax issues are resolved before you visit your county tax office.

Once registered, maintain current insurance and inspection records to remain compliant with Texas vehicle laws.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. Laws and procedures may vary slightly by county. For personal or complex estate issues, consult a Texas probate or tax attorney.

Thank you for reading. Feel free to share your thoughts or ask a question below — your experience may help other Texas drivers facing the same process.