How to qualify for both Medicare and Medicaid is a pressing concern for many Americans seeking stable, affordable healthcare coverage. Today, federal standards continue to govern Medicare nationwide, while Medicaid operates through state programs that follow updated income and asset rules. Individuals who meet both medical and financial requirements may receive coverage from both programs at the same time, offering broader protection against healthcare costs.

This combined eligibility supports millions of seniors and people with disabilities who rely on consistent access to care.

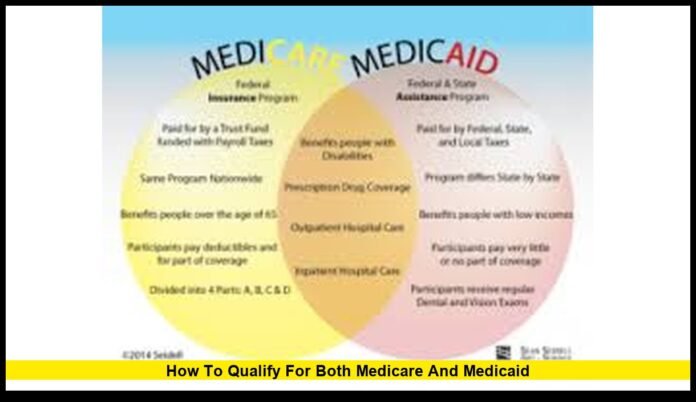

How Medicare and Medicaid Differ

Medicare and Medicaid serve different populations and needs, yet they are designed to work together when someone qualifies for both.

Medicare is a federal health insurance program. It mainly covers adults age 65 and older, along with younger individuals who qualify due to disability or certain long-term medical conditions.

Medicaid is a joint federal and state healthcare program. It provides coverage to people with limited income and financial resources. States administer Medicaid within federal guidelines, which means rules can vary by location.

When a person qualifies for both programs, Medicare generally pays first, and Medicaid helps cover remaining eligible costs.

Who Can Receive Coverage From Both Programs

Dual eligibility applies to individuals who meet specific medical and financial criteria.

People most likely to qualify include:

- Seniors age 65 or older with limited income

- Adults under 65 with qualifying disabilities

- Individuals receiving Supplemental Security Income

- Residents of nursing homes or long-term care facilities

Eligibility is reviewed regularly. Any change in income, household size, or assets can affect qualification status.

Medicare Eligibility Basics

Medicare eligibility follows the same federal standards in every state.

An individual qualifies for Medicare if they meet one of these conditions:

- Age 65 or older and eligible for Social Security benefits

- Under age 65 and receiving disability benefits for the required period

- Diagnosed with certain qualifying long-term medical conditions

Income and assets do not affect Medicare eligibility. Once enrolled, Medicare becomes the primary payer for covered healthcare services.

Medicaid Eligibility Requirements

Medicaid eligibility is based on financial need.

States set income and asset limits within federal requirements, and these limits may change over time.

Key factors used to determine eligibility include:

- Monthly income from all sources

- Countable assets such as savings or investments

- Household size

- State residency

Some assets are excluded. A primary residence, personal belongings, and one vehicle are often not counted toward asset limits.

Different Types of Dual Eligibility

Not everyone who qualifies for both programs receives the same level of assistance.

There are several recognized levels of dual eligibility:

- Full dual eligibility, where Medicaid covers most Medicare cost-sharing and additional services

- Partial dual eligibility, where Medicaid helps pay specific Medicare costs, such as premiums

The level of coverage depends on income, assets, and state Medicaid rules.

What Medicaid Adds to Medicare Coverage

One of the biggest advantages of qualifying for both programs is expanded coverage.

Medicaid may help pay for:

- Medicare Part B premiums

- Deductibles and coinsurance

- Long-term nursing home care

- Home and community-based services

- Vision, dental, and hearing care

This combined coverage often results in minimal out-of-pocket expenses for eligible individuals.

Supplemental Security Income as a Pathway

Supplemental Security Income plays a major role in dual eligibility.

SSI provides monthly financial assistance to older adults and individuals with disabilities who have limited income and resources.

In most states, qualifying for SSI automatically qualifies an individual for Medicaid. Medicare eligibility is determined separately based on age or disability status.

This pathway simplifies enrollment for many people with fixed incomes.

Qualifying Through Disability Status

Individuals under age 65 may qualify for both programs due to disability.

After receiving disability benefits for the required period, Medicare eligibility begins automatically. Medicaid eligibility depends on income and asset limits set by the state.

Many people with long-term disabilities rely on dual eligibility to manage ongoing medical needs and supportive care.

Application Process for Both Programs

There is no single application that enrolls someone in both Medicare and Medicaid at once.

The process usually includes:

- Enrolling in Medicare through Social Security

- Applying for Medicaid through the state Medicaid agency

- Submitting documentation for income, assets, and residency

- Completing required eligibility reviews

Some states offer coordinated systems that reduce paperwork, especially for seniors and individuals with disabilities.

Eligibility Reviews and Redetermination

Maintaining dual eligibility requires ongoing verification.

Medicaid programs conduct periodic reviews to confirm income, assets, and residency. Failure to respond to requests or submit documents on time can result in loss of Medicaid coverage.

Medicare enrollment periods remain federal and unchanged. Dual-eligible individuals often qualify for special enrollment opportunities when changes occur.

Why Dual Eligibility Matters Right Now

Healthcare costs continue to rise across the United States.

Dual eligibility helps protect vulnerable populations by reducing out-of-pocket expenses and expanding access to essential services. Prescription medications, long-term care, and routine medical visits become more affordable.

Understanding how to qualify for both Medicare and Medicaid allows individuals and families to plan ahead and maintain uninterrupted healthcare coverage.

Common Misunderstandings About Qualifying

Many people believe dual eligibility is rare or difficult to achieve.

In reality, millions of Americans qualify each year. Others mistakenly think owning a home automatically disqualifies them, which is often not the case under Medicaid rules.

Clear knowledge of eligibility standards helps people avoid missing valuable benefits.

State-Level Differences to Know

Medicare rules are the same nationwide, but Medicaid varies by state.

Income limits, asset thresholds, and covered services can differ. Some states provide broader Medicaid benefits, while others follow more basic coverage standards.

Knowing state-specific requirements is essential for staying eligible.

Planning Ahead to Maintain Eligibility

Preparation plays a key role in maintaining coverage.

Monitoring income, understanding asset limits, and responding promptly to Medicaid reviews all help prevent coverage gaps. Families often assist older relatives with paperwork to ensure compliance.

Early planning reduces stress and supports continuous access to care.

How Dual Eligibility Improves Healthcare Access

Dual-eligible individuals often benefit from more coordinated care.

Many states support care coordination programs that focus on preventive services, chronic condition management, and long-term support needs.

This approach improves health outcomes and reduces reliance on emergency care.

Long-Term Impact of Dual Eligibility

For many Americans, dual eligibility provides long-term stability.

It supports aging in place, access to supportive services, and financial protection against unexpected medical costs. This coverage combination plays a vital role in the broader healthcare system.

If you or someone you care for has navigated Medicare and Medicaid eligibility, share your experience below and stay connected for ongoing coverage updates.