When handling the affairs of a deceased loved one, one of the most important steps is understanding how to get a tax ID number for an estate. This number, also called an Employer Identification Number (EIN), is essential for managing estate assets, filing tax returns, and opening bank accounts. Without it, the estate cannot comply with federal tax laws or complete necessary financial transactions. This guide provides a step-by-step walkthrough of the process and key considerations for estate executors or personal representatives.

Key Points Summary

- What is an Estate EIN?

An Employer Identification Number (EIN) is a nine-digit number issued by the IRS to identify an estate or trust for tax purposes. - Who Needs an EIN for an Estate?

Any estate that earns income, holds assets, or needs a bank account requires an EIN. - How to Apply:

You can apply online, by fax, or by mail using IRS Form SS-4. Online applications are processed immediately. - Required Information:

Include the decedent’s full legal name, Social Security Number (SSN), date of death, and the executor’s information. - Processing Time:

Online applications are instant, fax takes a few days, and mail can take up to four weeks.

Understanding Why Estates Need a Tax ID Number

Every estate that generates income or requires financial transactions needs a tax ID number. It is used for:

- Filing Estate Tax Returns: Estates must file Form 1041 if they earn income after the decedent’s death.

- Opening Bank Accounts: Financial institutions will not open an estate account without an EIN.

- Managing Estate Assets: The EIN is required to report income, deductions, and distributions accurately.

- Compliance with IRS Regulations: Having a separate EIN ensures the estate follows federal tax laws and avoids penalties.

Obtaining an EIN early in the estate administration process simplifies tasks and prevents delays in accessing funds or paying obligations.

Step-by-Step Process to Obtain a Tax ID Number for an Estate

1. Gather All Required Information

Before applying, ensure you have:

- Decedent’s Details: Full legal name, Social Security Number, date of death.

- Executor or Personal Representative Information: Full name, SSN, and contact information.

- Estate Information: Date of probate or location of estate administration.

Having this information ready prevents errors that can delay the application.

2. Choose the Application Method

The IRS offers three ways to obtain an EIN for an estate:

Online Application

- Fastest method.

- Submit via the IRS website and receive your EIN immediately.

Fax Application

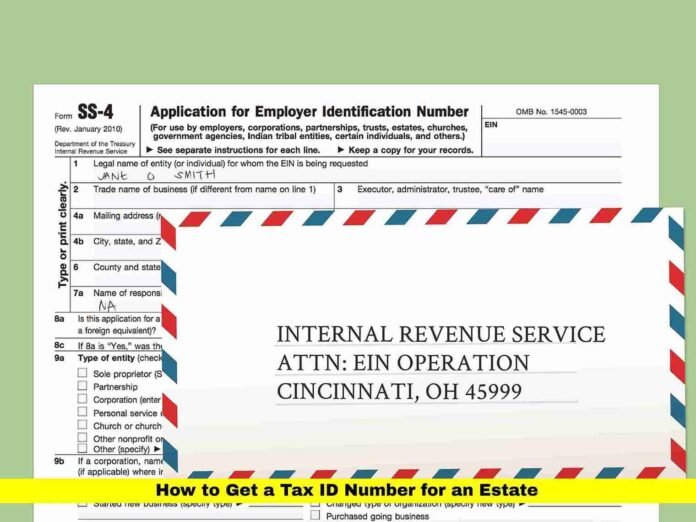

- Complete Form SS-4 and fax it to the IRS.

- If you include a return fax number, the IRS will return the EIN within four business days.

Mail Application

- Complete Form SS-4 and send it by mail to the IRS.

- Processing usually takes up to four weeks.

3. Complete IRS Form SS-4

Form SS-4 is required to apply for an EIN for an estate. Key fields include:

- Line 1: Enter the decedent’s full legal name.

- Line 3: Enter the decedent’s Social Security Number.

- Line 4a: Enter the decedent’s address at the time of death.

- Line 7a: Provide the executor’s full name.

- Line 9a: Select the entity type “Estate.”

- Line 10: Enter the date of death.

- Line 13: Enter the executor’s SSN and contact information.

Accuracy is critical. Mistakes can delay processing or require resubmission.

4. Submit the Form and Receive the EIN

- Online: Submit through the IRS website and get your EIN immediately.

- Fax: Fax the completed form and receive the EIN within four business days.

- Mail: Mail the form and expect processing to take several weeks.

Once received, store the EIN confirmation letter safely. You will need it for filing tax returns, opening accounts, and managing estate transactions.

Common Mistakes to Avoid When Applying

- Incorrect Entity Type: Always select “Estate.”

- Missing Information: Double-check that all fields are completed.

- Executor Details Mismatch: Ensure the executor’s name and SSN match official probate records.

- Errors in SSN or Date of Death: Inaccurate information can delay or invalidate the application.

When an Estate Needs an EIN

An estate must obtain an EIN if it:

- Files a Tax Return: Estates with income must file Form 1041.

- Opens a Bank Account: Banks require an EIN to open accounts in the estate’s name.

- Holds Income-Generating Assets: Real estate, investments, or business interests require an EIN for reporting purposes.

Even estates without immediate income often benefit from obtaining an EIN to streamline administration.

Tips for Executors Managing the Estate EIN

- Apply Early: Start the process soon after being appointed executor to avoid delays.

- Keep Records: Maintain copies of the EIN confirmation and related correspondence.

- Use the EIN Consistently: All estate tax filings and bank accounts should reference the EIN, not the decedent’s SSN.

- Consult Professionals: A tax advisor or probate attorney can help avoid mistakes and ensure compliance.

Advanced Considerations for Estate Tax Filing

- Estates that earn income must file Form 1041 annually.

- Income distributed to beneficiaries is reported on Schedule K-1 and tied to the estate EIN.

- Large estates may also require estate tax returns (Form 706).

- The EIN ensures that the IRS can accurately track income and tax obligations.

Key Benefits of Obtaining an EIN Early

- Smooth Estate Administration: Enables opening accounts and paying debts quickly.

- Separates Estate from Personal Accounts: Helps avoid commingling funds.

- Simplifies Tax Reporting: Keeps the estate’s financial matters organized and compliant.

- Reduces Legal Complications: Ensures all estate transactions are properly documented under the estate EIN.

Frequently Asked Questions

Q1: Can I get an EIN before being appointed as executor?

No, only the appointed executor or personal representative can apply for the estate EIN.

Q2: Is there a fee to get an EIN for an estate?

No, obtaining an EIN from the IRS is completely free.

Q3: Can the decedent’s SSN be used instead of an EIN?

No, the decedent’s Social Security Number cannot be used after death. The estate must have a separate EIN.

Disclaimer: The information in this article is for general informational purposes only and does not constitute legal or tax advice. Please consult a qualified professional regarding your specific estate situation.