How to file bankruptcy chapter is a question thousands of Americans ask each month as rising living costs, medical debt, and high-interest credit push households toward legal debt relief.

In the United States, bankruptcy is governed by federal law and handled through specialized courts. While the system is uniform nationwide, the procedure is strict, document-heavy, and time-sensitive. Filing correctly can stop collections, halt lawsuits, and provide a lawful path toward eliminating or restructuring debt. Filing incorrectly can lead to dismissal, loss of assets, or denial of discharge.

This article explains how to file bankruptcy chapter in the U.S. today, using current court procedures, required filings, and legal protections in effect in 2026.

What a Bankruptcy Chapter Means Under U.S. Law

A bankruptcy chapter refers to a specific section of the federal Bankruptcy Code that determines how debts are handled.

The most common chapters for individuals are:

- Chapter 7 – Liquidation and discharge of most unsecured debts

- Chapter 13 – Court-approved repayment plan over several years

- Chapter 11 – Reorganization, usually for businesses or very high personal debt

Each chapter has different eligibility rules, filing costs, timelines, and outcomes.

Choosing Between Chapter 7 and Chapter 13

Most personal filings fall under Chapter 7 or Chapter 13.

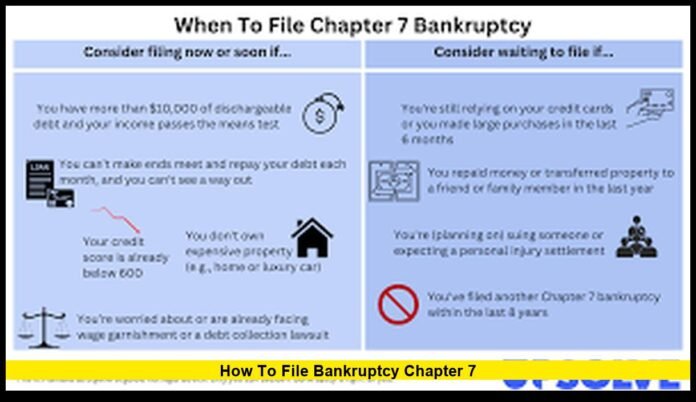

Chapter 7 is designed for people who cannot afford to repay their debts. It allows discharge of most unsecured balances after a short court process. Some property may be sold if it exceeds exemption limits.

Chapter 13 is for people with steady income who need time to catch up on mortgage arrears, car loans, or tax obligations. Debts are reorganized into a structured payment plan lasting three to five years.

Selecting the wrong chapter can delay relief or create financial risk, so eligibility must be confirmed before filing.

Income Testing and Eligibility

For Chapter 7, the Means Test is required. This test compares household income to the state median and analyzes allowable expenses. If income is too high, Chapter 7 may not be available.

For Chapter 13, the filer must:

- Have regular income

- Stay within federal debt limits

- Commit to monthly payments approved by the court

Eligibility is determined at the time of filing and reviewed by the trustee.

Mandatory Credit Counseling

Federal law requires completion of a pre-filing credit counseling course:

- Must be completed within 180 days before filing

- Must be from an approved provider

- Certificate must be filed with the court

This step is mandatory. Skipping it leads to automatic case dismissal.

Preparing Financial Documentation

Accurate disclosure is the foundation of every bankruptcy case. Required records include:

- Federal tax returns

- Proof of income

- Bank account statements

- Credit card and loan balances

- Mortgage and vehicle loan details

- Property deeds and titles

- Monthly household expenses

Every debt and asset must be listed, even if it seems minor or already in collections.

Completing the Bankruptcy Forms

The filing package includes multiple standardized forms:

- Voluntary Petition

- Asset and liability schedules

- Income and expense schedules

- Statement of Financial Affairs

- Creditor matrix

- Means Test forms for Chapter 7

- Repayment plan for Chapter 13

All filings are now submitted through electronic court systems in every district.

Court Filing Fees

As of 2026, the federal filing fees are:

| Chapter | Filing Fee |

|---|---|

| Chapter 7 | $338 |

| Chapter 13 | $313 |

| Chapter 11 | $1,738 |

Installment payments may be approved by the court. Fee waivers are limited to qualifying low-income Chapter 7 filers.

Automatic Stay Protection

The moment the case is filed, federal law activates the automatic stay. This stops:

- Collection calls and letters

- Wage garnishments

- Lawsuits and judgments

- Foreclosure proceedings

- Repossession actions

- Utility disconnections in many situations

The stay is one of the most powerful protections in U.S. consumer law.

Appointment of the Bankruptcy Trustee

A trustee is assigned to every case. The trustee:

- Reviews all documents

- Verifies income and assets

- Conducts the creditor meeting

- Oversees asset liquidation or payment plans

- Ensures legal compliance

The trustee does not represent the filer or creditors. The trustee enforces the Bankruptcy Code.

The 341 Meeting of Creditors

All filers must attend a formal hearing called the 341 meeting. It usually occurs 3 to 6 weeks after filing.

At this meeting:

- The filer is placed under oath

- Identity is verified

- Financial information is confirmed

- Creditors may ask questions

- The trustee reviews asset and income details

Most meetings are now conducted by video or phone, but attendance is mandatory.

Post-Filing Education Requirement

A second financial education course is required after filing. This course covers:

- Budgeting

- Credit management

- Financial planning

- Debt prevention strategies

The certificate must be filed before the court will issue a discharge order.

How Chapter 7 Proceeds

In Chapter 7:

- Trustee reviews assets

- Exempt property is protected

- Non-exempt property may be sold

- Proceeds are distributed to creditors

- Remaining eligible debts are discharged

Most cases close within three to four months.

How Chapter 13 Proceeds

In Chapter 13:

- A repayment plan is proposed

- The court reviews affordability

- Creditors may object

- A confirmation hearing is held

- Monthly payments begin

- Trustee distributes funds to creditors

- Remaining qualifying debt is discharged after completion

Plans typically last 36 to 60 months.

Debts That Are Commonly Discharged

Dischargeable debts often include:

- Credit card balances

- Medical bills

- Personal loans

- Old utility balances

- Certain lawsuit judgments

These debts are legally eliminated once the court enters the discharge order.

Debts That Usually Remain

Some obligations generally survive bankruptcy:

- Child support and spousal support

- Most student loans

- Recent income taxes

- Criminal fines and restitution

- Certain government penalties

These remain enforceable after the case ends.

Asset Exemptions and Property Protection

Federal and state exemption laws protect essential property, such as:

- A portion of home equity

- A vehicle up to a set value

- Household goods

- Retirement accounts

- Tools of trade

Exemption limits vary by state, but they are applied uniformly within each jurisdiction.

Common Reasons Cases Are Dismissed

Dismissal often occurs due to:

- Missing counseling certificates

- Incomplete schedules

- Failure to attend the 341 meeting

- Not providing tax returns

- Inaccurate income reporting

- Hidden assets

Dismissal removes the automatic stay and can expose the filer to renewed collection action.

Credit Impact After Bankruptcy

A bankruptcy filing remains on credit reports:

- Up to 10 years for Chapter 7

- Up to 7 years for Chapter 13

Despite this, many filers begin receiving credit offers within months. Responsible use and timely payments help rebuild credit scores over time.

Housing and Loan Eligibility After Filing

After discharge:

- FHA and VA mortgage programs may become available after waiting periods

- Auto financing is often obtainable at higher interest rates

- Rental applications may require explanation but are not legally barred

Lenders evaluate income stability and payment history following bankruptcy.

Legal Representation and Self-Filing

Federal law allows individuals to file without an attorney. However:

- Bankruptcy involves strict deadlines

- Asset mistakes can cause permanent loss

- Chapter 13 plans must meet complex statutory rules

- Objections and motions require legal response

Many courts strongly encourage professional legal guidance, especially for repayment cases.

Rebuilding Financial Stability

After the case closes, long-term recovery focuses on:

- Creating a realistic budget

- Building emergency savings

- Using secured credit responsibly

- Avoiding high-interest debt cycles

- Monitoring credit reports for accuracy

Bankruptcy provides a legal reset, but financial discipline determines future stability.

Understanding how to file bankruptcy chapter gives individuals access to powerful federal protections and a lawful route out of overwhelming debt. The process demands honesty, precision, and compliance with every procedural step, but when done correctly, it can restore financial footing and legal peace of mind.

If this guide helped you understand the process, share your thoughts below and stay connected for continued updates on U.S. bankruptcy law and consumer rights.