When asking “how much should I have in my 401(k) at 30,” you’re focusing on one of the most important benchmarks in retirement planning. As of 2025, new data shows clear averages and savings targets that can help you understand whether you’re on track or need to make adjustments.

Latest Updates and Benchmarks

As of late 2025, retirement account balances among U.S. workers in their 30s show strong growth despite recent market fluctuations.

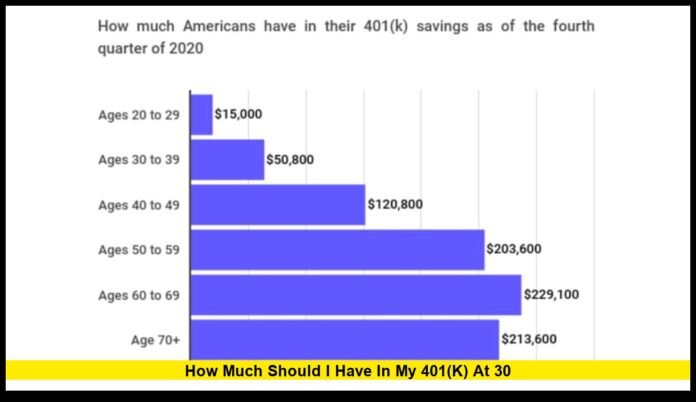

- The average 401(k) balance for people in their 30s is about $193,000, while the median balance is approximately $77,000.

- Most major financial institutions recommend having about one times your annual salary saved by age 30.

- These targets are based on contributing steadily throughout your 20s and taking advantage of employer matches and compound growth.

While averages can vary depending on income, career stage, and location, these numbers represent a realistic benchmark for U.S. workers entering their 30s.

What the Averages Tell Us

The difference between the average and median 401(k) balance is significant.

- The average balance of around $193,000 is skewed by higher-income earners and long-term investors who started early.

- The median balance of about $77,000 reflects a more typical saver at age 30.

If your 401(k) balance is somewhere between $60,000 and $100,000 at age 30, you’re likely close to the national median or slightly above average for your age group.

General Savings Benchmarks

Experts recommend using age-based savings goals as benchmarks for long-term retirement success. Here’s a commonly accepted guide:

| Age | Target 401(k) Savings | Goal Explanation |

|---|---|---|

| 25 | ½ × annual salary | Early savings establish compounding growth. |

| 30 | 1 × annual salary | Major milestone—your first full year’s salary saved. |

| 40 | 3 × annual salary | Mid-career target showing steady progress. |

| 50 | 6 × annual salary | Accounts for higher income and market growth. |

| 60 | 8 × annual salary | Getting close to retirement readiness. |

| 67 | 10 × annual salary | Approximate retirement comfort target. |

If your salary is $60,000, that means having around $60,000 saved by age 30 is an appropriate goal.

If you earn $100,000, your benchmark would be $100,000 saved.

Why the “1× Salary” Rule Makes Sense

The one-times-salary rule by 30 assumes you:

- Start saving in your 20s.

- Contribute at least 10–15% of your income (including employer match).

- Maintain a balanced portfolio with growth-oriented investments.

- Avoid early withdrawals and let compounding do its work.

This benchmark is not about perfection—it’s about direction. By hitting this milestone, you set a strong foundation for future decades of growth.

How to Evaluate Your Progress

Your personal financial situation affects how to interpret this benchmark. Consider these factors:

- Your Career Stage

If you started working later (due to graduate school or career changes), a lower balance at 30 is normal. You can catch up by contributing more aggressively in your 30s. - Your Income Level

If you earn less than $50,000 per year, reaching the 1× rule may take more time. Focus on consistent contributions and capturing employer matches. - Employer Match Programs

Always contribute enough to get your employer’s full match—it’s essentially free money. - Investment Growth Rate

Most 401(k)s are invested in mutual funds or target-date funds. A typical annual return of 6–8% can significantly boost your balance over time. - Debt and Living Expenses

High student loan or credit card debt may temporarily limit contributions. Balance debt repayment with long-term savings goals. - Cost of Living

Living in high-cost areas (like New York or San Francisco) may affect how much you can save early on, but consistency matters more than perfection.

If You’re Behind on Savings

If your balance is below the 1× salary mark, there are effective ways to catch up:

- Increase your contribution rate: Even boosting by 1% each year can have a big impact over time.

- Use automatic escalations: Many 401(k) plans allow automatic yearly increases to your contribution rate.

- Maximize employer match: Ensure you’re contributing enough to get the full company match.

- Cut unnecessary expenses: Redirect savings from subscriptions or discretionary spending into your retirement account.

- Take advantage of tax breaks: 401(k) contributions are pre-tax, reducing your taxable income.

- Avoid early withdrawals: Withdrawing early not only triggers penalties but also stops your money from compounding.

Remember: catching up is very possible in your 30s because time is still on your side.

If You’re On Track or Ahead

If you’ve already hit or surpassed the 1× rule by 30, you’re in great shape. Here’s how to maintain momentum:

- Increase savings as your income grows. When you get a raise, boost your contribution percentage rather than lifestyle spending.

- Diversify your portfolio. Make sure your investments match your risk tolerance and time horizon.

- Monitor fees. High fund management fees can erode long-term returns.

- Rebalance annually. Adjust your mix of stocks, bonds, and cash to stay aligned with your goals.

- Plan future milestones. Aim for 3× salary by 40 to stay on track for a comfortable retirement.

The Power of Compound Growth

Compound interest is what makes early saving so powerful. For example:

- If you invest $6,000 per year starting at 25 and earn 7% annually, by age 30 you’ll have about $42,000.

- Keep going, and by age 67, that same contribution pattern could grow to over $1.1 million—without increasing the annual amount.

That’s why even moderate savings in your 20s have enormous long-term value.

Common Missteps to Avoid

- Waiting too long to start. Every year you delay, you lose compounding growth potential.

- Not taking the full employer match. That’s free money left unclaimed.

- Overly conservative investing. At 30, your portfolio can typically handle more growth-oriented investments.

- Raiding your 401(k). Early withdrawals incur taxes and penalties, plus lost growth.

- Ignoring inflation. Over decades, inflation can erode purchasing power—growth investments help offset that risk.

Practical Example

Let’s take a real-world scenario:

- Age: 30

- Salary: $70,000

- Employer match: 4%

- Employee contribution: 10%

In this case, the total annual contribution is $9,800 (your 10% + employer 4%).

Assuming a 7% annual return, by age 40 you’d have roughly $160,000–$180,000, setting you well ahead of the 3× salary target for that age group.

This example shows how staying consistent pays off more than timing the market.

401(k) Tips for 30-Year-Olds

- Contribute at least 10–15% of your income if possible.

- Review your plan’s fees and switch to lower-cost index funds if available.

- Check your beneficiary designations periodically.

- Consider Roth 401(k) options if your employer offers them.

- Set reminders to increase contributions after every raise.

By focusing on consistency, you can easily catch up or stay ahead of national averages.

Summary Table: 401(k) Target by Age 30

| Annual Income | Recommended 401(k) Balance | Status Indicator |

|---|---|---|

| $50,000 | $50,000 | On track |

| $75,000 | $75,000 | On track |

| $100,000 | $100,000 | Ideal target |

| $120,000+ | $120,000+ | Aggressive saver |

Bottom Line

The answer to “how much should I have in my 401(k) at 30” is generally about one year’s worth of your salary. Whether your balance is higher or lower, the key is to stay consistent, invest wisely, and take advantage of every employer and tax benefit available.

Consistency—not perfection—is what builds long-term retirement security.

What’s your 401(k) balance at 30? Share your experience and let’s help others stay motivated on their financial journey.

Disclaimer:

This content is for informational purposes only and should not be taken as financial advice. Always consult a licensed financial advisor or tax professional for personalized recommendations.