A cash-out refinance is one of the most effective ways for homeowners in 2025 to access their home equity. How does a cash out refinance work? Essentially, it replaces your existing mortgage with a larger loan, giving you the difference in cash. Homeowners can use this strategy for home improvements, debt consolidation, or other financial needs, making it a versatile financial tool in today’s lending market.

KEY POINTS SUMMARY

- Definition: A cash-out refinance replaces your current mortgage with a new, larger loan and provides the difference in cash.

- Eligibility: Usually requires a credit score of 620+, at least 20% home equity, and a debt-to-income ratio below 43%.

- Uses: Cash can be used for home improvements, paying off high-interest debt, or other personal financial goals.

- Risks: Increases your loan balance and monthly payments; failure to repay may lead to foreclosure.

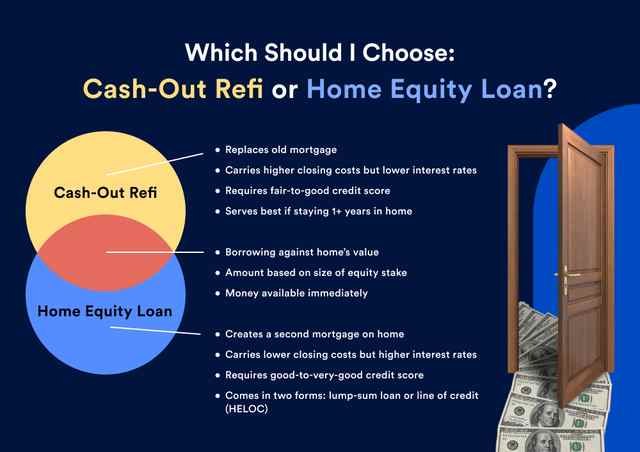

- Alternatives: Home equity loans or lines of credit can provide similar benefits with different terms.

UNDERSTANDING CASH-OUT REFINANCING

A cash-out refinance works by taking out a new mortgage that is larger than your current one. The new loan pays off your existing mortgage, and the remaining balance is given to you as cash. This process allows homeowners to access the equity they’ve built over time without selling their property.

Key aspects to understand include:

- Loan Size: Depends on your home’s value and current mortgage balance.

- Equity Access: Usually, lenders allow up to 80% of your home’s appraised value.

- Repayment Terms: May include a new interest rate and a new loan term, affecting monthly payments.

HOW IT WORKS STEP BY STEP

- Determine Home Equity: Calculate the difference between your home’s current market value and your existing mortgage balance.

- Apply for a New Mortgage: Lenders will assess your credit, income, and equity to determine loan approval.

- Receive Cash: The difference between the new loan and your existing mortgage balance is paid to you.

- Repay the Loan: Monthly payments are made on the new mortgage, which may have different interest rates and terms.

ELIGIBILITY REQUIREMENTS

To qualify for a cash-out refinance, most lenders require:

- Credit Score: Minimum of 620; higher scores often get better rates.

- Home Equity: Typically at least 20% equity is needed.

- Debt-to-Income Ratio: Usually under 43%, though some lenders allow more.

- Loan Seasoning: Many lenders require at least 12 months since your original mortgage.

Meeting these requirements improves your chances of approval and can result in lower interest rates.

BENEFITS OF A CASH-OUT REFINANCE

- Access to Cash: Provides a lump sum for any purpose, including home renovations or paying off debt.

- Lower Interest Rates: Often lower than credit cards or personal loans, saving money over time.

- Debt Consolidation: Can help manage high-interest debts by combining them into one lower-rate loan.

- Home Improvements: Money can be invested into home upgrades that increase property value.

RISKS AND CONSIDERATIONS

- Increased Loan Balance: The new mortgage is higher, increasing monthly payments.

- Potential for Foreclosure: Defaulting on the loan can result in losing your home.

- Closing Costs: Include appraisal fees, origination fees, and other expenses.

- Long-Term Debt: Extends mortgage duration and total interest paid over time.

ALTERNATIVES TO CASH-OUT REFINANCING

- Home Equity Loan: A second mortgage offering a fixed lump sum and predictable payments.

- Home Equity Line of Credit (HELOC): A revolving credit line based on your home’s equity.

- Personal Loan: An unsecured option without tapping home equity, though interest rates may be higher.

RECENT TRENDS IN CASH-OUT REFINANCING

In 2025, cash-out refinance activity has surged. Homeowners are leveraging their accumulated equity to secure larger funds. Key trends include:

- Average cash-out amounts: Around $94,000 per homeowner.

- Average monthly payment increase: $590, due to higher loan balances.

- Average rate increase: 1.45 percentage points compared to original mortgage.

- Rising home values: Median home prices reached $435,500, boosting available equity.

This popularity highlights homeowners’ need for liquidity, but also the importance of understanding financial obligations and repayment capacity.

STRATEGIES TO MAXIMIZE SUCCESS

- Check Credit Reports: Correct errors to improve creditworthiness.

- Reduce Debts: Lower debt-to-income ratio before refinancing.

- Maintain Stable Income: Lenders value consistent employment history.

- Compare Lenders: Shop around for the best rates and terms.

- Use Funds Wisely: Ensure cash is allocated to high-value or necessary expenses.

CONCLUSION

A cash-out refinance can be a powerful tool for homeowners looking to unlock their home equity in 2025. By understanding how a cash out refinance works, reviewing eligibility requirements, and evaluating the benefits and risks, homeowners can make informed financial choices. Always assess your personal situation carefully and consider consulting a financial advisor to ensure this strategy aligns with your long-term goals. Share your experiences or questions in the comments to join the conversation.

FAQ

Q1: Can I use cash from a cash-out refinance for anything?

Yes, it can be used for home improvements, debt consolidation, or other financial needs.

Q2: Will a cash-out refinance affect my credit score?

It can impact your score; timely payments improve it, while missed payments may harm it.

Q3: How long does a cash-out refinance take?

Typically 30–45 days, depending on lender processing and loan complexity.

Disclaimer: The content is for general informational purposes and not professional financial advice. Consult a financial advisor before making refinancing decisions.