Health insurance touches nearly every part of daily life, from preventive checkups and prescription access to emergency care during unexpected illness or injury. For millions of Americans, the marketplace functions as a vital safety net, providing coverage where few other options exist.

As policy debates continue and critical deadlines approach, the consequences of action or inaction extend far beyond government chambers. Decisions made now will affect household finances, access to medical care, and the ability of healthcare providers to serve their communities. Entire regions, particularly those already facing healthcare access challenges, could feel the ripple effects.

This moment represents more than a policy discussion. It is a turning point that will shape how accessible, affordable, and reliable health coverage remains for millions of people in the years ahead.

Why This Moment Matters

Health insurance touches nearly every part of daily life, from preventive checkups and prescription access to emergency care during unexpected illness or injury. For millions of Americans, the marketplace functions as a vital safety net, providing coverage where few other options exist.

As policy debates continue and critical deadlines approach, the consequences of action or inaction extend far beyond government chambers. Decisions made now will affect household finances, access to medical care, and the ability of healthcare providers to serve their communities. Entire regions, particularly those already facing healthcare access challenges, could feel the ripple effects.

This moment represents more than a policy discussion. It is a turning point that will shape how accessible, affordable, and reliable health coverage remains for millions of people in the years ahead.

The healthcare marketplace is entering one of its most consequential periods in recent years as Americans rush to secure coverage while lawmakers debate decisions that could reshape insurance affordability nationwide. With enrollment deadlines approaching and financial assistance programs facing an uncertain future, millions of households are weighing coverage options under growing pressure.

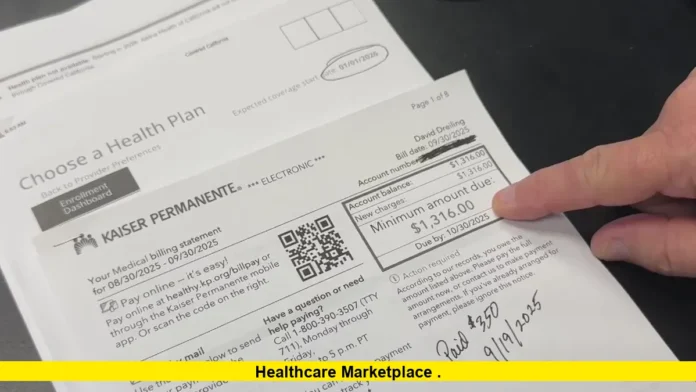

For many consumers, the marketplace has become the primary gateway to health insurance, especially for those without employer-sponsored plans. This year’s enrollment cycle is unfolding amid heightened concern over rising costs, future premium changes, and the long-term stability of the system that supports coverage for millions.

Read Also-UnitedHealthcare Medicare Advantage Plans 2026: What You Need to Know

Why This Enrollment Season Feels Different

Open enrollment always comes with urgency, but this year carries a level of uncertainty that many consumers have not faced before. In recent years, the marketplace benefited from strong participation as financial assistance lowered monthly premiums and broadened eligibility, allowing more Americans to secure coverage at manageable costs. That stability is now in question, forcing shoppers to make decisions without clear visibility into how long current pricing structures may last.

For many households, enrolling this season feels less like a routine annual task and more like a risk calculation. Consumers are locking in coverage for the coming year while simultaneously worrying about whether their plans will remain affordable in the near future. Families already managing rising housing costs, food prices, childcare expenses, and transportation costs are especially sensitive to even small increases in insurance premiums or out-of-pocket spending.

This uncertainty is shaping enrollment behavior in noticeable ways. Some Americans are acting early, prioritizing certainty and continuity of care by securing coverage well before deadlines. Others are delaying decisions, hoping for policy clarity before committing to a plan that could become significantly more expensive down the line. The result is an enrollment season marked by both proactive action and cautious hesitation, reflecting broader anxiety about the future of health coverage affordability.

The Role of Financial Assistance in Affordability

Premium tax credits have been a defining feature of the modern marketplace, fundamentally changing how accessible health insurance is for millions of Americans. By lowering monthly premiums and limiting the share of household income that must be spent on coverage, these credits have allowed many people to maintain insurance without sacrificing other essential expenses. For countless enrollees, this assistance has been the deciding factor between staying insured and going without coverage altogether.

The potential expiration of enhanced financial support introduces significant risk for consumers across income levels. While lower-income households would feel the impact most immediately, middle-income families are also highly exposed. Many of these households do not qualify for employer-sponsored insurance and rely on marketplace plans as their primary and most affordable option. Without continued assistance, the cost of maintaining coverage could quickly exceed what family budgets can absorb.

Rising premiums are only part of the concern. Higher monthly costs often coincide with increased deductibles, copayments, and coinsurance, meaning consumers may pay more both to keep their coverage and to actually use it. For individuals already delaying care due to cost, these combined increases could further discourage preventive services and routine treatment, leading to greater financial and health risks over time.

Political Gridlock Raises the Stakes

Policy debates in Washington have intensified as deadlines approach. Despite broad agreement that sudden cost increases could destabilize coverage, lawmakers remain divided on how to address the issue.

Proposals to extend or restructure financial assistance have faced resistance, leaving no finalized solution in place. As a result, insurers, state agencies, and consumers are preparing for multiple possible scenarios.

This uncertainty complicates planning for insurance providers, who must set future rates without knowing whether current subsidy levels will continue. Those decisions ultimately affect consumers through premiums, plan availability, and provider networks.

Who Relies Most on Marketplace Coverage

The marketplace plays a critical role for Americans who fall outside traditional employer-sponsored insurance systems. This includes self-employed professionals, gig workers, small business owners, early retirees, and individuals working part-time or in industries where health benefits are limited or unavailable. For many in these groups, marketplace plans represent the only realistic path to comprehensive health coverage, leaving few alternatives if costs rise beyond reach.

Older adults who have not yet reached Medicare eligibility are among the most vulnerable to premium increases. Because pricing is partly based on age, these enrollees already face higher baseline costs compared with younger consumers. Even modest increases can significantly affect affordability, forcing some to downgrade coverage or consider going uninsured during a period of life when healthcare needs often increase.

Younger adults respond differently to rising costs. While they typically have lower healthcare usage, they are also more price-sensitive and may opt out of coverage entirely if premiums rise sharply. This trend can weaken the overall insurance risk pool, placing upward pressure on costs for remaining enrollees.

Families with children face their own set of challenges. Health insurance ensures access to preventive care, vaccinations, routine checkups, and emergency treatment, all of which are essential for children’s well-being. When premiums and out-of-pocket costs climb, families must weigh coverage decisions against other household priorities, intensifying financial stress in already tight budgets.

Marketplace Stability and the Risk Pool

The long-term health of an insurance marketplace depends on broad and balanced participation across age groups and health statuses. When younger and healthier individuals remain enrolled alongside those with greater medical needs, insurers can spread costs more evenly, helping to keep premiums stable and predictable for all participants.

Rising prices threaten this balance. If healthier enrollees decide coverage is no longer affordable and exit the system, the average cost of care for remaining participants increases. Insurers must then adjust premiums upward to account for higher expected medical expenses. This feedback loop can accelerate rapidly, making coverage increasingly expensive and discouraging new enrollment.

Over time, these pressures can reduce competition as insurers reassess their participation in higher-risk markets. Fewer plan options and narrower provider networks may follow, limiting consumer choice and weakening the overall marketplace. Regulators have consistently stressed that maintaining a stable risk pool is essential to avoiding these outcomes.

Stability benefits more than just individual enrollees. Healthcare providers depend on predictable insurance coverage to manage patient care and financial planning, while insurers rely on steady enrollment to sustain operations. A balanced marketplace supports continuity, access, and affordability across the broader healthcare system.

Consumer Protections and Oversight Efforts

In response to past challenges, regulators have strengthened oversight of marketplace operations. Recent rules focus on protecting consumers from improper enrollments, ensuring clear communication, and maintaining accurate eligibility determinations.

These measures aim to preserve trust in the system and ensure that people who sign up receive the coverage they expect. States have also increased outreach efforts, emphasizing deadlines and encouraging consumers to review plan details carefully before enrolling.

While these protections improve the enrollment experience, they cannot fully offset the impact of significant cost increases if financial assistance expires.

What Enrollees Should Consider Before Choosing a Plan

Choosing a health plan requires more than comparing monthly premiums. While the upfront cost is important, deductibles, copayments, coinsurance, and annual out-of-pocket limits all play a major role in determining what coverage will actually cost over the course of a year. A plan with a lower premium may appear attractive but can lead to higher expenses if medical care is needed.

Provider networks are another key consideration. Enrollees should confirm that preferred doctors, hospitals, and specialists are included, as out-of-network care can significantly increase costs or limit access to services. Prescription drug coverage also deserves close attention, particularly for individuals who rely on ongoing medications, as formularies and cost-sharing levels can vary widely between plans.

Different plans serve different financial strategies. Some consumers prioritize lower monthly payments and accept higher deductibles, especially if they expect minimal healthcare use. Others opt for more comprehensive coverage to reduce financial risk during unexpected illness, injury, or ongoing treatment.

No matter which option is chosen, timing is critical. Enrolling before deadlines helps ensure continuous coverage and avoids gaps that could leave individuals responsible for the full cost of medical care. Acting on time provides financial protection and peace of mind as the new coverage year begins.

The Broader Impact on the Health System

Changes to the marketplace do not occur in isolation. Hospitals, clinics, and physicians are affected when coverage rates fluctuate. Higher uninsured rates often lead to increased uncompensated care, particularly in rural and underserved areas.

Healthcare systems already operating on thin margins may struggle if more patients lose coverage or delay care due to cost concerns. This can affect access to services, staffing levels, and the availability of specialized care.

From an economic standpoint, widespread coverage also supports workforce stability by enabling people to manage health conditions and remain employed.

Looking Toward the Future of Coverage

The months ahead will be critical in determining the direction of the healthcare marketplace and its ability to serve millions of Americans. Decisions made now will shape not only premium levels but also public trust in the system’s long-term reliability. For consumers who depend on consistent access to care, stability matters as much as affordability.

In the short term, individuals and families are focused on securing coverage for the upcoming year and avoiding gaps that could leave them financially exposed. At the same time, policymakers and insurers face the complex task of balancing budget realities, political priorities, and the need to keep coverage within reach for a broad population.

The marketplace has shown an ability to adapt through policy shifts, economic changes, and enrollment fluctuations. Its future resilience, however, will depend on whether forthcoming decisions reinforce affordability, encourage participation, and maintain a balanced risk pool. The choices made in the near future will help determine whether coverage gains are preserved or gradually eroded.

Why This Moment Matters

Health insurance touches nearly every part of daily life, from preventive checkups and prescription access to emergency care during unexpected illness or injury. For millions of Americans, the marketplace functions as a vital safety net, providing coverage where few other options exist.

As policy debates continue and critical deadlines approach, the consequences of action or inaction extend far beyond government chambers. Decisions made now will affect household finances, access to medical care, and the ability of healthcare providers to serve their communities. Entire regions, particularly those already facing healthcare access challenges, could feel the ripple effects.

This moment represents more than a policy discussion. It is a turning point that will shape how accessible, affordable, and reliable health coverage remains for millions of people in the years ahead.

The future of coverage is being shaped right now. Share your perspective in the comments or stay informed as decisions unfold that could redefine access to affordable healthcare.