Estate and inheritance tax discussions are gaining renewed attention in 2026 as Americans face important changes in federal thresholds, stable but complex state rules, and growing concerns about long-term wealth planning. Whether you are a homeowner, retiree, investor, or business owner, understanding how taxes apply when assets transfer after death can have a lasting impact on your family’s financial future.

This in-depth report explains the most up-to-date and confirmed facts about estate vs inheritance tax in the United States for 2026. It clearly outlines how each tax works, who pays it, which states are affected, and why recent federal changes matter right now.

What Is an Estate Tax?

An estate tax is imposed on the total value of a person’s assets at the time of death, before those assets are distributed to heirs. It applies to the estate itself, not the individuals receiving the inheritance.

Federal Estate Tax Rules in 2026

For deaths occurring in 2026, the federal estate tax exemption stands at $15 million per individual. Married couples can effectively shield $30 million from federal estate taxes by combining exemptions.

Only the value of an estate that exceeds these thresholds is subject to tax. The highest federal estate tax rate remains 40 percent on amounts above the exemption.

Several additional rules continue to apply:

- The exemption amount is indexed for inflation going forward.

- Portability remains in effect, allowing a surviving spouse to use any unused portion of a deceased spouse’s exemption.

- The generation-skipping transfer tax exemption matches the estate tax exemption amount.

Because of the high exemption level, the majority of U.S. estates do not owe federal estate tax in 2026. However, larger estates can still face significant tax exposure.

What Is an Inheritance Tax?

Inheritance tax differs fundamentally from estate tax. Instead of taxing the estate, inheritance tax applies to the individuals who receive property or assets from someone who has died.

The federal government does not impose an inheritance tax. However, a limited number of states continue to levy inheritance taxes at the state level.

In states that impose inheritance tax:

- The tax is paid by the beneficiary, not the estate.

- Rates and exemptions often depend on the beneficiary’s relationship to the deceased.

- Immediate family members usually receive preferential treatment, while distant relatives or non-relatives may face higher rates.

States That Impose Inheritance Taxes

As of 2026, only a handful of states still collect inheritance taxes. These states include:

- Kentucky

- Maryland

- Nebraska

- New Jersey

- Pennsylvania

Each of these states has its own system for determining tax rates, exemptions, and beneficiary classifications. In many cases, spouses are fully exempt, while children and grandchildren face reduced or zero tax. Other beneficiaries may pay higher rates.

Because inheritance tax rules vary so widely, the same inheritance can be taxed very differently depending on where the deceased lived and where the beneficiary resides.

States With Estate Taxes

Some states impose estate taxes even when no inheritance tax exists. These taxes apply at the state level and often have much lower exemption thresholds than federal law.

A notable example is New York, which applies estate tax to estates exceeding $7.35 million in 2026. State estate tax rates can rise as high as 16 percent, and the state’s structure includes a sharp tax increase once the threshold is crossed.

Other states with estate taxes maintain their own exemption levels, tax rates, and planning considerations. In many cases, estates that owe no federal tax may still owe substantial state estate taxes.

States With No Estate or Inheritance Tax

Many states impose neither estate tax nor inheritance tax, making them attractive destinations for retirees and high-net-worth individuals. These states include:

- Florida

- Arizona

- Colorado

- Alabama

- Indiana

- Iowa

- South Dakota

- Wisconsin

In these states, assets typically pass to heirs without state-level death taxes, regardless of estate size. However, federal estate tax rules still apply when applicable.

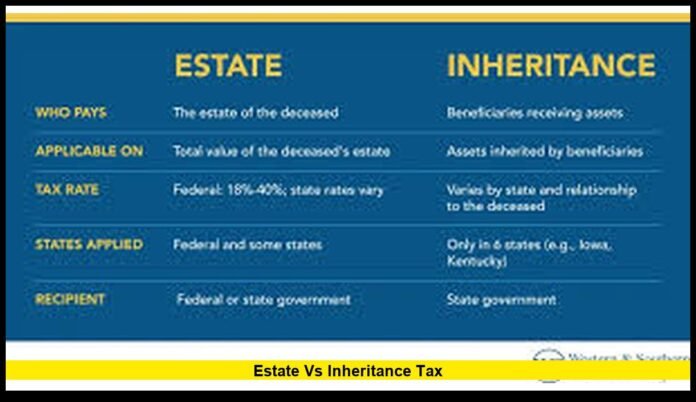

Key Differences Between Estate Tax and Inheritance Tax

Understanding the difference between estate tax and inheritance tax is essential for effective planning.

Who Pays the Tax

- Estate Tax: Paid by the estate before assets are distributed.

- Inheritance Tax: Paid by the beneficiary after receiving assets.

What Is Taxed

- Estate Tax: The total value of the estate above the exemption.

- Inheritance Tax: The value of what each beneficiary receives.

Where It Applies

- Estate Tax: Federal government and certain states.

- Inheritance Tax: Only specific states.

These differences affect how much heirs ultimately receive and how families should plan their estates.

Why 2026 Is a Turning Point

Recent federal legislation permanently raised the federal estate and gift tax exemption to $15 million per person and prevented a significant reduction that had previously been scheduled. This change created greater certainty for long-term planning and reduced the number of estates subject to federal tax.

The annual gift tax exclusion for 2026 remains $19,000 per recipient, allowing individuals to transfer wealth during their lifetime without reducing their lifetime exemption.

These confirmed changes mean:

- Fewer estates owe federal estate tax.

- Larger estates have more flexibility in planning.

- Lifetime gifting strategies remain a powerful tool.

Why Estate Planning Still Matters

Even with higher exemptions, estate planning remains critical in 2026.

State Taxes Can Still Apply

Many states impose estate or inheritance taxes with thresholds far below federal levels. Without planning, families may face unexpected tax bills at the state level.

Asset Complexity

Real estate, retirement accounts, business interests, and investments each follow different tax and transfer rules. Proper planning helps avoid delays, disputes, and unnecessary taxes.

Family Protection

Clear estate planning can prevent conflicts among heirs and ensure assets are distributed according to your wishes.

Common Estate Planning Strategies

While laws vary by state, several approaches remain widely used:

- Lifetime gifting within annual exclusion limits

- Trust structures designed to manage and transfer assets efficiently

- Charitable giving to reduce taxable estate size

- Coordinated planning between spouses to maximize exemptions

These strategies must align with current law and personal financial goals.

What Americans Should Do Now

If you are thinking about your estate in 2026, several steps are especially important:

- Review your state’s estate and inheritance tax laws.

- Understand how federal exemptions apply to your net worth.

- Evaluate whether lifetime gifting fits your financial goals.

- Ensure beneficiary designations are up to date.

- Seek professional guidance to navigate complex rules.

Even modest estates can benefit from clarity and preparation.

Understanding estate vs inheritance tax is no longer optional in 2026—it’s a key part of protecting your legacy and minimizing surprises for your loved ones.

Have questions or insights about estate planning in today’s tax environment? Join the conversation and stay tuned for more updates.