Understanding the financial support available when a loved one passes away can be overwhelming. One of the most common questions families ask is: does medicaid pay for funeral expenses? This article explains what Medicaid does and does not cover, how state rules differ, and what families can do right now to prepare without risking vital health coverage.

Medicaid is a major safety-net program for millions of Americans. Its purpose is to provide healthcare coverage for low-income individuals, seniors, people with disabilities, and qualifying families. Because of this focus, many people are surprised to learn that funeral and burial costs are usually not included. Knowing the rules in advance can prevent confusion, delays, and unexpected financial stress during an already difficult time.

The Short Answer on Medicaid and Funeral Costs

At the federal level, Medicaid does not pay for funeral or burial expenses. The program is legally limited to medical and long-term care services. Funeral services, cremation, burial plots, headstones, and memorial events fall outside Medicaid’s standard coverage.

However, this does not mean families are completely without options. Some states offer limited burial assistance programs, and Medicaid rules allow certain funeral planning tools that protect funds without affecting eligibility.

Why Funeral Expenses Are Excluded from Medicaid

Medicaid is structured to provide care while a person is alive. Its budget and regulations are focused on medical needs such as hospital stays, prescriptions, nursing home care, home health services, and doctor visits.

Because funeral costs occur after death, they are not considered a medical expense. This distinction explains why Medicaid coverage stops at the time of death and does not extend to burial or cremation services.

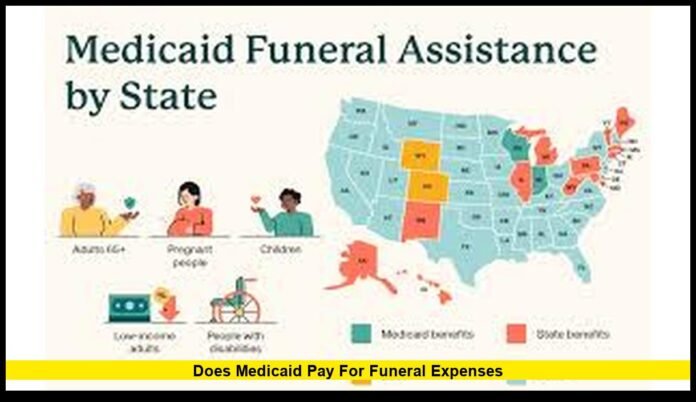

State Burial Assistance Programs Connected to Medicaid

Although Medicaid itself does not cover funeral expenses nationwide, some states provide separate burial or funeral assistance programs for low-income residents, including those who were enrolled in Medicaid.

These programs are state-run, not federally guaranteed, and typically include:

- Strict income and asset limits

- Maximum payment caps

- Required documentation and filing deadlines

- Direct payment to funeral homes or cemeteries

The amount of assistance is usually modest and intended to cover basic services only. Families must often apply quickly after death, and any available life insurance or other funds may need to be used first.

Because rules vary widely, families should always check their specific state’s guidelines.

How Medicaid Allows Funeral Funds to Be Protected

While Medicaid does not directly pay funeral expenses, it does allow individuals to set aside money for burial without losing eligibility. This is done through burial fund exclusions and approved planning tools.

Burial Fund Exclusion

Medicaid permits a limited amount of money to be designated for burial expenses and excluded from countable assets. This amount is often around $1,500, though the exact figure can vary depending on the state and whether other funeral arrangements exist.

This exclusion applies only if the funds are clearly identified for burial purposes.

Irrevocable Funeral Trusts Explained

An irrevocable funeral trust is one of the most effective tools for Medicaid planning.

Key features include:

- Funds placed in the trust cannot be refunded or used for other purposes

- The trust is dedicated solely to funeral and burial expenses

- Money in the trust does not count toward Medicaid’s asset limit

- The trust pays funeral providers directly after death

Many states allow significantly higher amounts to be placed into an irrevocable funeral trust than the standard burial fund exclusion. This makes it possible to plan a complete funeral without risking Medicaid eligibility.

Prepaid Funeral Contracts and Medicaid Rules

Another common planning option is a prepaid funeral contract with a funeral home. These contracts allow individuals to arrange and pay for services in advance.

To remain Medicaid-exempt:

- The contract must be irrevocable

- Funds must be strictly limited to funeral-related expenses

- The agreement must meet state Medicaid requirements

Prepaid contracts often cover essential services but may exclude optional costs such as flowers or memorial receptions. Families should review contracts carefully to ensure compliance.

Other Government Assistance That May Help

When Medicaid does not cover funeral expenses, other programs may provide limited relief:

- Social Security death benefits: A one-time payment available to eligible survivors

- Veterans burial benefits: Available for qualifying veterans and their dependents

- County or local assistance programs: Some local governments offer indigent burial support

These benefits are usually supplemental and rarely cover full funeral costs, but they can reduce the financial burden.

What Families Should Do Now

To avoid confusion and financial strain later, families should take proactive steps:

- Review state Medicaid rules related to burial assistance

- Consider irrevocable funeral trusts or prepaid contracts

- Keep funeral plans documented and accessible

- Consult professionals experienced in Medicaid planning

Advance planning protects both healthcare benefits and loved ones from unexpected expenses.

Have questions or personal experience with this issue? Join the conversation below and stay informed on important benefit updates.