Credit card interest rates remain one of the most closely watched financial indicators in the United States as 2026 begins, reflecting both economic policy shifts and the growing pressure on household budgets. These rates determine how expensive it is for millions of Americans to carry balances, manage emergencies, and finance everyday purchases when cash flow falls short.

Over the past year, borrowing costs tied to revolving credit have stayed elevated even as broader inflation has shown signs of easing. For consumers, this means that the cost of using plastic continues to be far higher than most other common forms of debt, including auto loans and mortgages. Understanding why these rates remain high, how policy discussions could affect them, and what the current environment means for cardholders is essential for anyone navigating personal finances in the U.S. today.

The Current Level of Credit Card Interest Rates

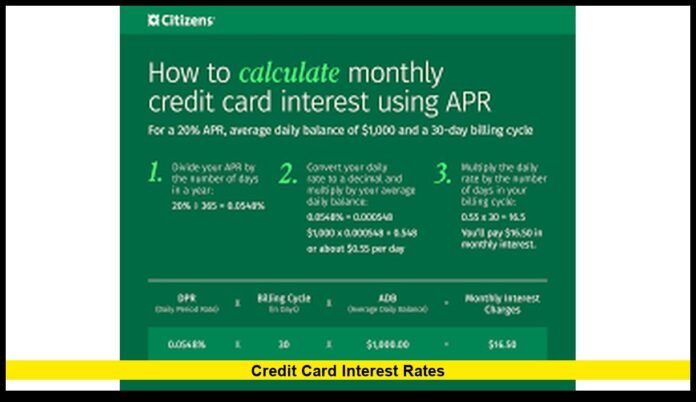

Across the U.S., average annual percentage rates on credit cards are still hovering around the highest range seen in decades. Many mainstream cards now carry APRs near or above 20 percent, while some accounts, particularly for borrowers with weaker credit profiles, exceed that level by a wide margin.

These figures represent the cost of borrowing on balances that are not paid in full each month. Because credit cards are designed as revolving credit, interest compounds daily, making long-term balances especially expensive. Even small differences in APR can translate into hundreds or thousands of dollars in additional interest over time.

While recent movements in broader interest rate policy have eased some borrowing costs, credit card APRs tend to lag behind. Issuers are slower to reduce rates than to raise them, and competitive pressures often focus more on rewards and perks than on interest reductions. As a result, cardholders continue to face steep costs when they rely on credit for ongoing expenses.

Why Credit Card Rates Are Higher Than Other Loans

Credit cards differ from most other forms of consumer lending in one critical way: they are unsecured. There is no asset, such as a home or vehicle, backing the loan. If a borrower defaults, the lender has limited recourse, which raises risk.

To offset that risk, issuers price cards with higher interest. They also factor in:

- Borrower credit history: Consumers with strong credit scores typically qualify for lower APRs, while those with past delinquencies or limited credit history pay much more.

- Economic conditions: When uncertainty rises, lenders tend to build in additional risk premiums.

- Rewards and benefits: Cards that offer travel points, cash back, or premium services often come with higher interest rates to help fund those programs.

- Competition among issuers: While banks compete for customers, they also balance profitability, which can keep average rates elevated even in competitive markets.

Because of these factors, credit card interest rates rarely move in lockstep with other lending products. Even modest shifts in national interest rate policy can take months to be reflected in card pricing, if at all.

Policy Debate Brings New Attention to Borrowing Costs

In early 2026, the national conversation around consumer credit intensified after renewed calls for limiting how high credit card interest rates can go. The proposal centered on placing a temporary cap on APRs, with the goal of easing the financial burden on households carrying balances.

Supporters of such measures argue that persistently high rates trap many families in cycles of debt. When a large share of monthly payments goes toward interest rather than principal, progress becomes slow, and financial stress builds. A lower ceiling, they say, could provide immediate relief and improve financial stability for millions of Americans.

Opponents, however, caution that strict limits could reshape the credit market in ways that are not always favorable to consumers. Lenders might respond by tightening approval standards, reducing credit limits, or increasing fees to compensate for lower interest income. The result could be fewer options for borrowers who rely on credit cards for short-term liquidity or emergencies.

Although no binding nationwide change has yet taken effect, the discussion alone has underscored how central credit card interest rates are to economic policy and household finances.

How Financial Institutions View the Current Environment

Banks and card issuers operate within a delicate balance. On one hand, they compete for customers by offering rewards, convenience, and digital tools. On the other, they must manage default risk, regulatory requirements, and capital costs.

From the industry’s perspective, current credit card interest rates reflect:

- Risk management needs in an environment where consumer debt levels remain high.

- Operational and compliance costs tied to issuing and servicing millions of accounts.

- Economic uncertainty, which can lead lenders to price conservatively.

Executives at major financial institutions have emphasized that interest income supports not only lending operations but also fraud protection, customer service, and technology investments. Any broad change to rate structures would therefore ripple across multiple aspects of the card ecosystem.

Credit unions, which often offer lower average rates due to their nonprofit, member-owned structure, also monitor these debates closely. While they generally charge less than large banks, they face similar concerns about sustainability and access to credit for higher-risk borrowers.

Impact on Different Types of Cardholders

The effect of high credit card interest rates is not uniform across all consumers. Experiences vary based on how individuals use their cards and their financial profiles.

Consumers Who Pay in Full

Those who pay their balances in full each month typically avoid interest altogether. For them, APR levels matter less in day-to-day finances, though they can still influence decisions when choosing between card offers.

Revolvers Carrying Balances

Borrowers who carry balances from month to month feel the full impact of high rates. Interest can significantly extend the time it takes to repay debt, especially when only minimum payments are made. For these consumers, even small reductions in APR can lead to meaningful savings over time.

New Applicants and Credit-Challenged Borrowers

Applicants with limited or damaged credit histories often receive cards with the highest rates. While these products can help rebuild credit, the cost of borrowing is substantial. Any shift in lending standards could affect their ability to access or maintain credit.

Broader Economic Effects

Credit card interest rates also play a role beyond individual households. When borrowing costs are high, discretionary spending may slow as more income is diverted to servicing debt. This can influence retail sales, travel, and other consumer-driven sectors.

Conversely, if rates were to decline significantly, households might have more flexibility to spend or save, potentially supporting economic growth. However, such changes must be balanced against financial system stability and responsible lending practices.

Economists often view revolving credit trends as a barometer of consumer confidence. Rising balances at high rates can signal financial strain, while stable or declining balances may suggest improved household resilience.

What Consumers Can Do in a High-Rate Environment

While policy discussions continue, individuals still need practical strategies to manage the cost of borrowing. Some common approaches include:

- Prioritizing high-interest balances when making extra payments.

- Exploring balance transfer offers that provide lower introductory rates, while carefully reviewing terms.

- Maintaining strong credit habits to qualify for better rates over time.

- Limiting reliance on revolving credit for long-term expenses when possible.

Financial education and careful budgeting become especially important when interest rates remain elevated, as small changes in payment behavior can have a large impact over months and years.

Looking Ahead

The path of credit card interest rates in the United States will depend on a mix of economic conditions, regulatory decisions, and market competition. Discussions about potential limits, consumer protections, and lending practices are likely to continue throughout 2026.

For now, the reality is clear: borrowing on credit cards remains expensive, and the cost of carrying balances is a significant factor in household financial health. Whether through policy changes, market shifts, or improved consumer awareness, how these rates evolve will remain a key issue for both individuals and the broader economy.

Understanding the forces behind today’s numbers helps consumers make informed choices and stay prepared for whatever adjustments may come next in the U.S. credit landscape.