If you’re wondering can you roll over a 401(k) to a Roth IRA, the answer is yes — but it’s a decision that involves several important steps, tax implications, and strategy choices. With recent retirement plan updates in 2025, including provisions from the SECURE 2.0 Act, now is the perfect time to revisit how a rollover might impact your financial future. Many Americans are considering this move to gain tax-free growth potential and flexibility in retirement, but it’s essential to understand how the process works and what to expect before you make any changes.

Recent Developments Affecting Rollovers

In 2025, retirement planning rules have continued to evolve under the SECURE 2.0 Act. This law has modernized the retirement landscape by expanding automatic enrollment in employer-sponsored 401(k) plans and adjusting the rules for required minimum distributions (RMDs). These changes give savers more opportunities to build their nest egg while allowing greater control over how they manage their investments.

Although the SECURE 2.0 Act doesn’t directly modify the rules for rolling over a 401(k) into a Roth IRA, it influences the broader environment surrounding retirement savings. Contribution limits for IRAs remain at $7,000 for individuals under 50 and $8,000 for those 50 and older in 2025. The IRS still allows direct rollovers and conversions, but understanding your tax position before initiating a transfer has become even more important due to inflation adjustments and the potential for higher income brackets.

These regulatory updates mean that if you are thinking about transferring funds from your 401(k) into a Roth IRA, it’s a good time to review both your current tax liability and your future income projections.

Key Points Summary

Rolling a traditional 401(k) to a Roth IRA is possible but triggers income tax in the year you complete the rollover. If your 401(k) is already a Roth account, you can move the money tax-free, provided the plan and timing meet IRS requirements. With the latest retirement law updates, understanding the timing and method of your rollover has become critical. Direct rollovers are preferred, as they avoid tax withholding and potential penalties. The five-year rule for Roth IRAs still applies, so knowing when you can withdraw earnings tax-free is essential before making your move.

How Does a 401(k) to Roth IRA Rollover Work

The process of rolling a 401(k) into a Roth IRA depends on whether your 401(k) is pre-tax or post-tax. If it’s a traditional 401(k), you’ll need to pay taxes on the full amount transferred, since those contributions and earnings have not been taxed yet. If you have a Roth 401(k), your rollover can be tax-free, as you’ve already paid taxes on those contributions.

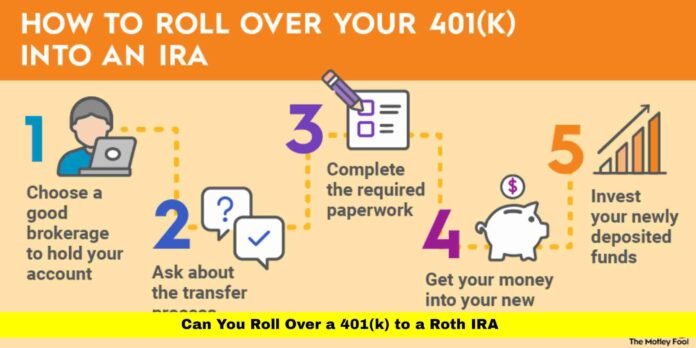

There are two ways to execute a rollover: a direct rollover and an indirect rollover. A direct rollover, also known as a trustee-to-trustee transfer, sends your funds straight from your 401(k) plan to your Roth IRA. This method avoids withholding and ensures compliance with IRS rules. An indirect rollover involves receiving the funds personally and depositing them into a Roth IRA within 60 days, but it’s riskier because taxes may be withheld, and missing the deadline could trigger penalties.

When rolling over a traditional 401(k) to a Roth IRA, the entire converted amount becomes taxable income for that year. This could increase your tax bill significantly, depending on your tax bracket. Additionally, the five-year rule applies to the Roth IRA after the rollover — meaning you must wait at least five years before withdrawing earnings tax-free. If you have an existing Roth IRA that’s already met the five-year requirement, this waiting period may not restart, but it’s best to confirm with your tax advisor.

Employer matching contributions also come with vesting schedules, meaning some funds might not be eligible for rollover until they’re fully vested. If you’re still working for the employer sponsoring the plan, some 401(k) programs restrict in-service rollovers, so always check your plan’s terms before starting.

For example, if you roll $200,000 from a traditional 401(k) into a Roth IRA, and your income places you in the 24% tax bracket, you would owe $48,000 in federal taxes on that rollover. While the tax bill is immediate, future qualified withdrawals from the Roth IRA will be tax-free.

Why Consider a 401(k) to Roth IRA Rollover

Rolling over a 401(k) to a Roth IRA offers multiple long-term benefits. The biggest advantage is the ability to enjoy tax-free withdrawals during retirement. Once the conversion is complete and you meet the five-year rule, both your contributions and investment gains can be withdrawn without any tax liability. This is especially appealing if you expect your tax rate to be higher in retirement than it is today.

Roth IRAs also eliminate the requirement for minimum distributions (RMDs), giving you more control over when and how you access your funds. This flexibility can help you manage your taxable income in retirement, especially if you want to leave your savings untouched for longer or pass them to your heirs.

Additionally, Roth IRAs often offer broader investment choices than most employer-sponsored 401(k) plans, allowing you to diversify your portfolio more effectively. From individual stocks and ETFs to alternative assets, a Roth IRA provides greater freedom in how your money is invested.

Another reason many high-income earners choose this route is because the income limits that typically restrict direct Roth IRA contributions don’t apply to rollovers. Even if your income exceeds the standard threshold for contributing to a Roth IRA, you can still roll over funds from a 401(k) into one through what’s known as a Roth conversion.

What to Watch Out For

While the advantages are appealing, there are also potential downsides. The biggest one is the immediate tax impact. If you convert a large 401(k) balance, you could face a significant tax bill in the year of conversion. This might push you into a higher tax bracket and reduce your overall cash flow. Paying the taxes from other funds, rather than the 401(k) itself, is ideal because using retirement money to cover taxes reduces the amount available to grow tax-free.

Another factor to consider is the five-year rule. If you withdraw earnings before this time frame ends, you could owe both income tax and a 10% penalty. Timing is critical, especially for those approaching retirement or needing access to funds soon.

You should also evaluate whether rolling out of your employer’s 401(k) plan makes you lose certain benefits. Some employer plans offer low-cost institutional funds or loan features that aren’t available in an IRA. Once you move your funds, those features disappear.

Finally, future tax policy changes could affect the long-term value of your Roth conversion. If tax rates decrease, the upfront tax cost may not deliver as much benefit. Strategic timing — possibly spreading conversions across multiple years — can help minimize your total tax burden.

How New Retirement Law Impacts the Decision

Although the SECURE 2.0 Act hasn’t altered the fundamental rules for rollovers, it’s changed the overall retirement landscape. Automatic enrollment, delayed RMD ages, and higher catch-up contribution limits have increased flexibility for savers. These updates may influence whether and when you decide to perform a Roth conversion.

The IRS has also issued clearer guidance for handling after-tax contributions within 401(k) plans. Some savers can now roll after-tax contributions into Roth IRAs without paying additional taxes, provided the funds are properly separated from pre-tax balances. This “mega backdoor Roth” strategy has gained traction among high earners looking to maximize tax-free retirement savings.

Another trend is the growing acceptance of in-service rollovers, which allow employees to roll funds into IRAs without leaving their current jobs. However, this depends on your employer’s plan policies. Reviewing your specific 401(k) rules before initiating any transfer is crucial.

Questions to Ask Before You Roll Over

Before you make the decision to roll over your 401(k) into a Roth IRA, it’s important to consider a few key questions. Determine whether your 401(k) is traditional or Roth, as this dictates whether you’ll owe taxes on the conversion. Evaluate your current income level and whether adding the rollover amount to your taxable income could push you into a higher bracket. Ensure you have enough funds outside of your retirement savings to pay any taxes due.

Also, check your employer’s rules on in-service rollovers and vesting. If you still work for the company, confirm whether you’re allowed to move your funds now or must wait until you leave. Review your state’s tax rules as well, since state-level income tax can increase your total conversion cost.

Finally, consider how this decision fits into your overall retirement strategy. If you plan to retire soon and withdraw your savings within a few years, the benefits of tax-free growth might not outweigh the immediate tax cost. But if you have a long time horizon, the compounding potential of a Roth IRA can make a strong case for conversion.

Final Thoughts

The question of can you roll over a 401(k) to a Roth IRA has a simple answer — yes, you can — but the smarter question is whether you should. A rollover can open the door to tax-free growth, eliminate required distributions, and offer more investment flexibility. Yet, it also brings immediate tax consequences that can be substantial depending on your financial situation.

With the latest retirement changes in 2025, now is the right time to evaluate whether a Roth IRA rollover aligns with your long-term goals. Discuss your situation with a financial or tax professional to weigh your current tax burden against your future benefits. A well-timed conversion can transform your retirement savings, giving you more freedom and security in the years ahead.

FAQ

Q1: Do I have to roll over my 401(k) to a Roth IRA when I change jobs?

No. You can leave your funds in your old employer’s plan, move them to a new employer’s 401(k), or roll them into an IRA. Converting to a Roth IRA is optional and depends on your tax strategy.

Q2: Does the rollover count as a contribution toward the annual limit?

No. Rollovers and conversions are not considered regular contributions, so they don’t affect your annual IRA contribution limits.

Q3: Can I undo a Roth IRA rollover if I change my mind?

No. Once you convert a 401(k) to a Roth IRA, the transaction is irreversible. You cannot recharacterize or “undo” it under current IRS rules.

Disclaimer: This article is for informational purposes only and should not be taken as financial or tax advice. Consult a certified advisor before making any retirement account changes.