The phrase BCBS Medicare Advantage Plans has become one of the most searched topics among seniors and health policy watchers in 2025. Blue Cross Blue Shield (BCBS) — one of America’s most recognized health insurers — continues to play a major role in Medicare coverage, serving millions of older adults through its regional Medicare Advantage (MA) plans. As the healthcare landscape evolves heading into 2026, BCBS enrollees are seeing several updates related to benefits, availability, and enrollment options.

Rising Enrollment and Market Growth

Blue Cross Blue Shield has seen substantial growth in its Medicare Advantage plans during 2025. Data shows that BCBS companies collectively added hundreds of thousands of new members this year, even as the overall Medicare Advantage market experienced slower growth compared to previous years. States like Michigan, North Carolina, Minnesota, and Pennsylvania have seen the most notable increases in membership.

This rise in enrollment reflects growing trust in BCBS’s offerings, which combine broad hospital networks, affordable premiums, and extra benefits like dental, hearing, and fitness programs. The strong brand reputation of BCBS across multiple states continues to attract new seniors each year.

However, this expansion also comes with challenges. With growing membership, insurers must balance costs and maintain quality of care — an issue that has prompted some BCBS affiliates to modify or scale back their plans in certain areas.

Upcoming Changes in BCBS Medicare Advantage Plans for 2026

As 2026 approaches, BCBS is making strategic adjustments to its Medicare Advantage lineup. In some states, new plan options are being introduced, while in others, specific plans are being retired. These changes are part of the company’s broader effort to align with updated Medicare policies and manage healthcare costs.

In states like Vermont, for example, BCBS has announced that it will discontinue select Medicare Advantage plans at the end of 2025. Meanwhile, in larger states such as Texas and Florida, the insurer is expanding its MA offerings, bringing more counties into its coverage network.

Members are encouraged to review their Annual Notice of Change (ANOC) documents to understand how their plans might be affected. Adjustments may include changes in provider networks, premiums, and prescription drug formularies.

Key Benefits That Continue to Define BCBS Medicare Advantage

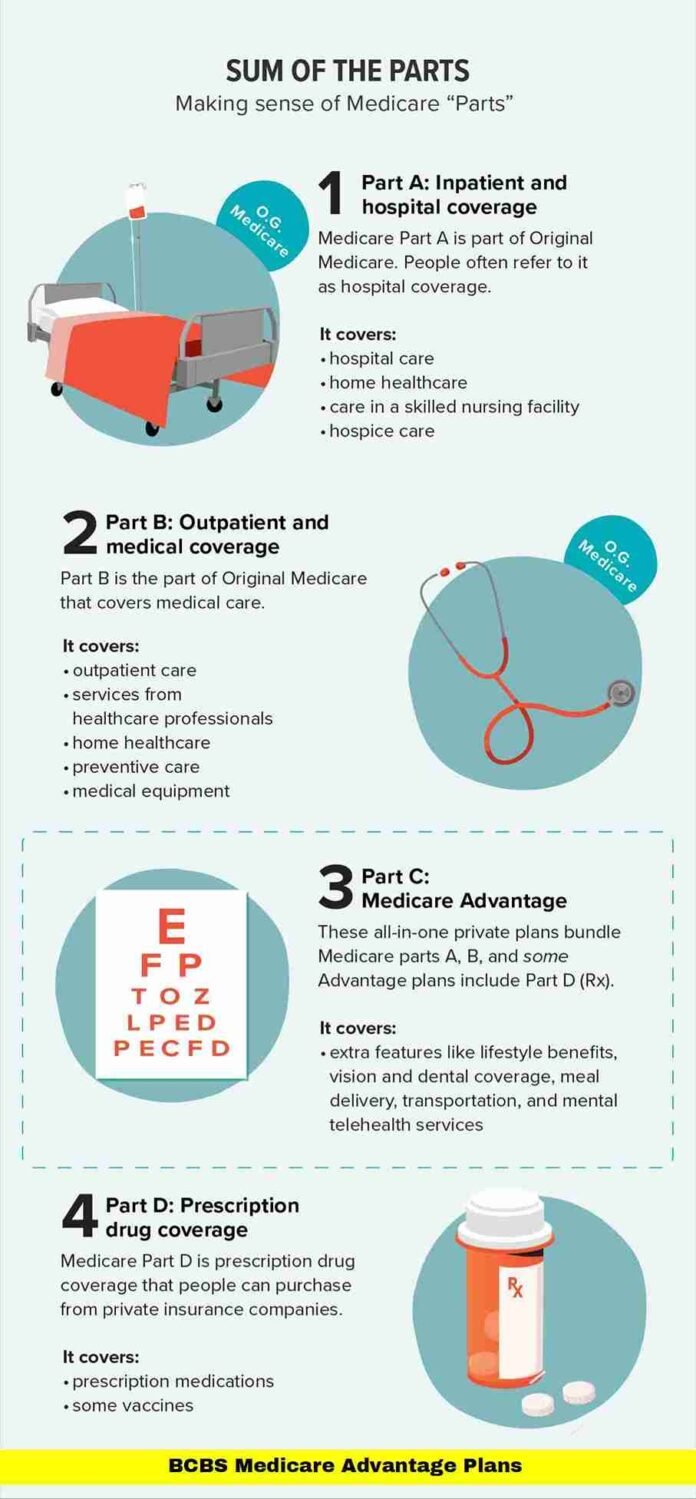

Despite certain plan exits, BCBS remains committed to delivering comprehensive Medicare Advantage benefits. These plans combine Medicare Part A (hospital insurance) and Part B (medical insurance), often with Part D (prescription drug coverage) included.

Members typically enjoy access to a range of additional benefits beyond what Original Medicare offers, including:

- Preventive dental and vision care

- Routine hearing exams and hearing aids

- Fitness programs such as SilverSneakers

- Over-the-counter allowances and wellness incentives

- Annual out-of-pocket maximums that protect against large medical bills

These features make BCBS MA plans highly competitive, particularly for seniors who value both affordability and access to preventive care.

Regional Variations in Plan Offerings

Because BCBS operates through independent companies in different states, its Medicare Advantage offerings vary by region. What’s available in North Carolina may differ significantly from what is offered in Illinois or California.

For instance, Blue Cross Blue Shield of Texas provides MA coverage in nearly all counties, offering a range of HMO and PPO options. On the other hand, smaller states may have fewer plan types or limited service areas due to market size and provider availability.

This regional structure allows BCBS to tailor its plans to local healthcare networks and demographics, but it also means members must review details carefully to ensure their preferred doctors and hospitals remain in-network.

Financial and Policy Factors Impacting BCBS Plans

The Medicare Advantage market is facing cost pressures nationwide, and BCBS is not immune to these trends. Rising medical expenses, inflation, and reimbursement rate changes from the Centers for Medicare & Medicaid Services (CMS) have forced many insurers to rethink their offerings.

To manage costs while maintaining quality, BCBS has focused on preventive care and digital health innovations. Many plans now feature telehealth services, care coordination programs, and tools that help members monitor chronic conditions more effectively.

At the same time, some plans may see moderate increases in premiums or co-payments to offset these rising operational costs.

How Members Can Prepare for Plan Changes

For current BCBS Medicare Advantage members, staying proactive is key during this transition period. Here’s what to do to stay protected:

- Review Annual Notices of Change (ANOC): Every fall, BCBS sends a summary of upcoming changes to your plan’s benefits and costs.

- Compare Plans During Enrollment: The Medicare Annual Enrollment Period (October 15 – December 7) allows you to switch or modify coverage for the next year.

- Verify Your Provider Network: Ensure your doctors, specialists, and hospitals remain covered under your plan.

- Check Prescription Coverage: Formularies can change yearly; confirm your medications are still covered at an affordable cost.

- Evaluate Total Costs: Don’t focus solely on premiums — check out-of-pocket limits, copays, and additional perks.

Taking these steps ensures members can make informed decisions about whether to stay with their current BCBS plan or explore other Medicare Advantage options.

Why Many Seniors Still Prefer BCBS Medicare Advantage

Even with market fluctuations, BCBS Medicare Advantage remains a top choice for millions of seniors. The reasons are simple: brand trust, reliability, and comprehensive care. BCBS has decades of experience managing health plans and maintaining relationships with top healthcare providers nationwide.

Additionally, many BCBS plans emphasize care coordination — a feature that helps seniors manage chronic conditions more efficiently through preventive visits, screenings, and wellness programs. The emphasis on whole-person health gives members more peace of mind than basic Original Medicare coverage alone.

Moreover, BCBS’s presence in both urban and rural markets ensures seniors in smaller communities also have access to quality care options.

Technology and Innovation in BCBS Medicare Advantage

Technology continues to reshape the way healthcare is delivered, and BCBS has embraced this shift. Through its Medicare Advantage plans, the company offers digital health tools designed to improve convenience and outcomes.

Members can access virtual doctor visits, online wellness coaching, and 24/7 nurse hotlines. These services are particularly valuable for seniors who prefer the comfort and safety of managing certain medical needs from home.

Additionally, BCBS continues to invest in data-driven care coordination platforms that track patient progress and identify gaps in care, helping prevent unnecessary hospitalizations and improving quality of life.

Looking Ahead to the 2026 Enrollment Season

As the 2026 Medicare enrollment season approaches, BCBS plans are expected to evolve further. Industry experts anticipate that more insurers, including BCBS affiliates, will refine their plan portfolios to focus on sustainable growth rather than broad expansion.

For consumers, this means fewer redundant plan options but stronger, more reliable offerings. The company is also expected to enhance its supplemental benefits, such as fitness memberships and mental health support, to meet the growing demand for holistic healthcare solutions.

Overall, while the Medicare Advantage market faces challenges, BCBS remains well-positioned to serve millions of beneficiaries with stability and innovation.

Frequently Asked Questions (FAQs)

Q1: What is a BCBS Medicare Advantage Plan?

BCBS Medicare Advantage Plans are private health plans offered by Blue Cross Blue Shield companies that provide all Original Medicare benefits and often include extras such as dental, vision, and prescription drug coverage.

Q2: Are BCBS Medicare Advantage plans available nationwide?

Yes, but plan availability varies by state. BCBS operates through regional affiliates, so the options and benefits depend on your location.

Q3: Can I switch my BCBS Medicare Advantage plan?

Yes. You can switch or modify your plan during the Medicare Annual Enrollment Period (October 15 to December 7) or under special enrollment circumstances.

DisclaimerThis article is intended for informational purposes only and does not constitute medical or legal advice. Plan details, benefits, and availability may vary by region and are subject to change each year. Readers are advised to consult directly with Blue Cross Blue Shield or visit the official Medicare website for the most accurate and updated information regarding Medicare Advantage plans.