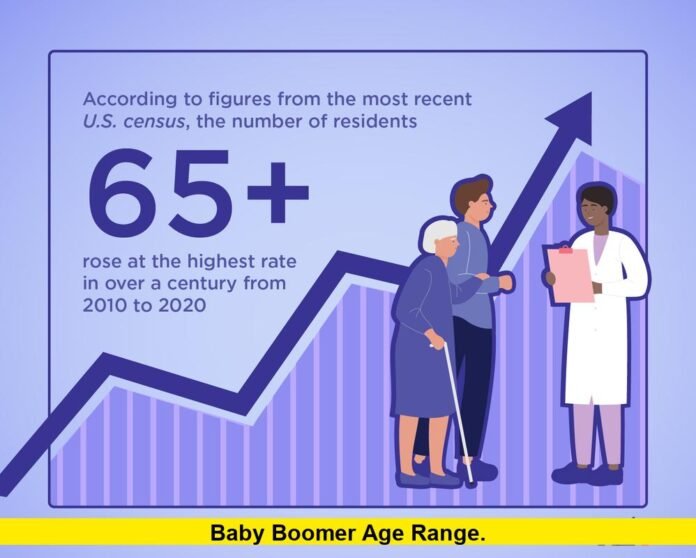

Understanding the baby boomer age range remains essential in 2026 as the generation continues to shape retirement trends, healthcare demand, housing markets, and the U.S. workforce. Baby Boomers represent one of the most influential demographic groups in modern American history, and their age span directly affects economic planning, public policy, and everyday financial decisions.

In general, Baby Boomers are defined as individuals born between 1946 and 1964. Based on that widely used definition, the generation is approximately ages 61 to 79 in 2026. This places most Boomers in retirement or approaching retirement, while a significant number remain active in the labor force.

If you want to understand Social Security debates, healthcare demand, housing transitions, and generational wealth shifts, knowing the age boundaries provides critical context.

Explore how this generation continues to reshape retirement, work, and spending across the United States.

What Is the Official Baby Boomer Age Range in 2026?

The commonly accepted birth years for Baby Boomers run from 1946 through 1964, reflecting the surge in births that followed World War II. This demographic wave created one of the largest generations in U.S. history.

In 2026, that definition places:

- The oldest Boomers near age 79

- The youngest Boomers near age 61

These age markers are widely used by economists, healthcare planners, government agencies, and financial analysts when evaluating long-term population trends.

The age span explains why the generation is central to discussions about retirement systems, Medicare enrollment, and workforce participation.

Why the Boomer Generation Exists

The Baby Boomer label comes from a historic rise in birth rates after World War II. Returning service members, economic growth, and expanding suburban life contributed to a dramatic population increase.

This surge reshaped:

- Housing development

- Education expansion

- Consumer markets

- Transportation infrastructure

- The modern middle class

Because the generation is so large, its life stage transitions have repeatedly shifted the U.S. economy — from school construction decades ago to retirement planning today.

Population Size and Economic Influence

Baby Boomers remain one of the largest adult population groups in the United States. Even as younger generations grow, Boomers continue to hold a substantial share of national wealth.

Key areas of economic influence include:

- Retirement savings and investment markets

- Real estate ownership

- Healthcare spending

- Travel and leisure industries

- Financial services

Many Boomers accumulated assets during decades of economic expansion, which makes their spending patterns important for long-term market forecasts.

Retirement Trends Across the Baby Boomer Age Range

Retirement patterns vary widely across the generation because the age span covers nearly two decades.

Older Boomers (mid-70s to late-70s)

More likely to be fully retired and relying on Social Security, pensions, and savings.

Younger Boomers (early-60s)

More likely to still be working, delaying retirement, or transitioning to part-time roles.

Recent workforce data shows many Boomers choose to remain employed longer than previous generations. Reasons include financial planning, longer life expectancy, and personal preference.

Flexible work, consulting, and part-time roles are common among younger Boomers.

Discover how retirement timing differences are reshaping hiring and workplace experience levels across industries.

Healthcare Demand and Aging Population

Healthcare planning closely tracks the baby boomer age range because aging drives medical demand.

Major trends include:

- Increased Medicare enrollment as Boomers age into eligibility

- Rising demand for chronic disease management

- Growth in home healthcare services

- Expansion of senior living and assisted living options

- Greater focus on preventive care and longevity

Healthcare systems continue adjusting capacity as more Boomers move into older age brackets.

This demographic shift influences hospital planning, insurance design, and long-term care services nationwide.

Housing Market Impact

Boomers have played a major role in shaping the housing market for decades, and their current life stage is creating new shifts.

Important housing trends include:

- Downsizing after retirement

- Aging in place modifications

- Relocation to retirement-friendly states

- Increased demand for single-level homes

- Growth in multigenerational housing

Because Boomers hold a large share of homeownership, their decisions directly affect housing inventory and price dynamics.

Some markets experience rising supply as older homeowners sell, while others see limited turnover as many choose to remain in their homes.

Wealth Transfer and Financial Planning

One of the biggest economic stories tied to the baby boomer age range involves generational wealth transfer. As Boomers age, assets gradually pass to younger generations through inheritance, gifts, and estate planning.

Financial institutions track this shift closely because it influences:

- Investment strategies

- Tax planning

- Real estate ownership patterns

- Small business succession

- Retirement account distributions

Advisors report increased focus on estate planning, long-term care costs, and retirement income sustainability.

Boomers Still in the Workforce

Despite retirement headlines, millions of Baby Boomers continue working in 2026. Their presence remains significant across sectors such as healthcare, education, consulting, skilled trades, and leadership roles.

Employers often value Boomer workers for:

- Institutional knowledge

- Mentorship ability

- Professional experience

- Stability in leadership positions

Some organizations now design phased retirement programs to retain experienced employees while supporting gradual transitions.

This trend reflects both workforce shortages and changing retirement expectations.

Technology Adoption Among Boomers

Technology use among Boomers has grown steadily over the past decade. While early narratives framed the generation as slower adopters, usage patterns show strong engagement with digital tools.

Common digital behaviors include:

- Online banking and financial management

- Telehealth appointments

- Social media communication with family

- Streaming entertainment

- E-commerce shopping

Younger Boomers, in particular, demonstrate high comfort with smartphones and digital services.

This shift influences product design, customer support strategies, and accessibility standards.

How Boomers Compare With Other Generations

Generational boundaries help explain differences in life stage priorities.

- Silent Generation: Born before 1946

- Baby Boomers: Born 1946–1964

- Generation X: Born 1965–1980

- Millennials: Born 1981–1996

Baby Boomers sit between post-war America and the modern digital economy. Many experienced analog childhoods but adapted through decades of rapid technological change.

This unique position shapes their financial habits, work expectations, and consumer behavior.

Why the Baby Boomer Age Range Remains Important

Search interest around generational definitions continues because the Boomer generation affects multiple policy and business decisions.

Areas strongly influenced include:

- Social Security planning

- Medicare funding

- Labor shortages

- Housing supply

- Caregiving trends

- Retirement savings behavior

As the generation moves further into retirement years, these issues remain central to economic discussions.

Understanding the age span provides a framework for analyzing long-term demographic change in the United States.

The Next Decade for Baby Boomers

Over the next ten years, more Boomers will transition into advanced retirement stages. This will likely increase focus on healthcare infrastructure, caregiving support, and retirement income planning.

At the same time, younger Boomers will continue influencing the workforce, entrepreneurship, and consulting sectors.

The generation’s size ensures its economic impact will remain significant even as younger generations grow.

Conclusion

The baby boomer age range defines a generation that has shaped nearly every major economic phase in modern U.S. history. From post-war growth to today’s retirement transformation, Boomers remain central to national planning, housing trends, and healthcare demand.

Because the age span covers individuals in different retirement stages, understanding the generation requires recognizing its internal diversity. Some are fully retired, while others remain professionally active.

As the country navigates aging population challenges and opportunities, the Boomer generation continues to play a defining role.

What changes are you seeing as Baby Boomers move through retirement? Share your perspective or return for more generational insights shaping everyday life.