When Americans plan for retirement, one of the first questions they ask is about the average social security check at age 62. This age marks the earliest point at which workers can begin collecting retirement benefits, and for millions, it becomes the starting line of their post-career income. In 2026, updated benefit data and cost-of-living adjustments offer a clearer picture of what early retirees can expect, how much income is permanently reduced, and how the decision to claim early shapes long-term financial security.

Understanding how Social Security works at age 62 is essential, not only for those about to retire, but also for workers in their 40s and 50s who are planning ahead. The difference between claiming early and waiting just a few years can translate into tens of thousands of dollars over a lifetime.

Why Age 62 Is the Earliest Claiming Point

The Social Security system allows workers to begin collecting retirement benefits as early as age 62. This option exists to provide flexibility for people who leave the workforce earlier due to health issues, job loss, caregiving responsibilities, or personal choice.

However, claiming at 62 comes with a permanent reduction in monthly benefits. The system is designed so that those who claim early receive smaller checks for a longer period, while those who wait receive larger checks for a shorter period. The goal is to balance lifetime payouts, but individual outcomes can vary greatly depending on how long a person lives and how much income they need month to month.

Read Also-When does the no tax on social security start

The Average Social Security Check at Age 62 in 2026

In 2026, the average monthly benefit for retirees who begin claiming at age 62 is about $1,415 per month after the latest cost-of-living adjustment.

This figure reflects the typical payment received by workers who have earned close to the national average over their careers and who chose to start benefits at the earliest possible age. Some people receive less, particularly those with lower lifetime earnings or gaps in employment. Others receive more, especially those who worked consistently at higher wages.

Even so, this average provides a realistic benchmark for early retirees trying to estimate their future income.

How Early Claiming Reduces Your Monthly Benefit

For workers born in 1960 or later, full retirement age is 67. Claiming at 62 means starting benefits five years early. That decision triggers a permanent reduction of roughly 30 percent compared with what the same person would receive at full retirement age.

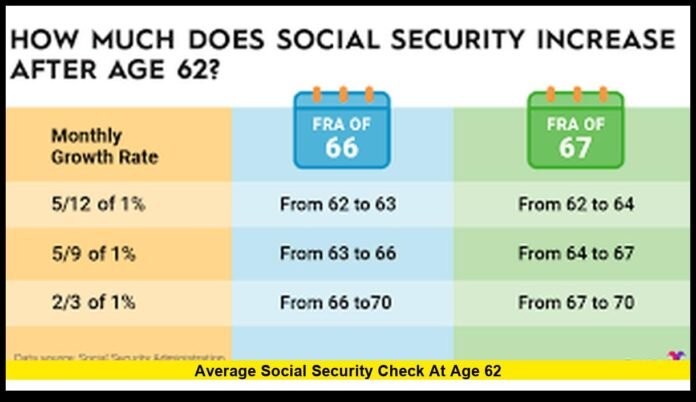

This reduction happens month by month:

- Benefits are reduced slightly for each month claimed before full retirement age.

- By age 62, the maximum early-claiming reduction is applied.

- The lower amount continues for life, even after reaching full retirement age.

For example, someone entitled to $2,000 per month at full retirement age might receive only about $1,400 at age 62. That $600 difference every month can significantly affect long-term financial stability.

How Benefits Grow if You Wait

Delaying Social Security beyond age 62 increases monthly payments. The longer a person waits, the higher the check becomes, up to age 70. This is due to two factors:

- Avoiding early-claiming penalties

- Earning delayed retirement credits for each year benefits are postponed past full retirement age

In 2026, average monthly benefits by claiming age look roughly like this:

- Age 62: about $1,415

- Age 63: about $1,430

- Age 64: about $1,490

- Age 65: about $1,660

- Age 66: about $1,860

- Age 67: about $2,020

- Age 70: about $2,250

The difference between claiming at 62 and waiting until 70 can exceed $800 per month. Over a 20-year retirement, that gap can add up to nearly $200,000 in total benefits.

How the 2026 Cost-of-Living Adjustment Affects Checks

In 2026, Social Security benefits increased due to a cost-of-living adjustment (COLA) of 2.8 percent. This adjustment raised monthly payments to help offset inflation and rising living costs.

For someone receiving the average age-62 benefit:

- A pre-COLA check of about $1,377 rose to roughly $1,415.

- The increase added around $38 per month, or about $456 per year.

While COLA helps preserve purchasing power, it does not reverse early-claiming reductions. The percentage increase applies to the already-reduced benefit amount, meaning those who claimed early still remain permanently behind those who waited.

How the Age-62 Benefit Compares to the Overall Average

Across all retired workers, the average Social Security benefit in 2026 is about $2,071 per month. This is significantly higher than the average check received by new retirees at 62.

The gap exists because:

- Many retirees waited until full retirement age or later.

- Some had higher lifetime earnings.

- Delayed retirement credits raised their benefit levels.

This comparison highlights how early claiming places retirees at the lower end of the benefit scale for the rest of their lives.

Why Many Americans Still Claim at 62

Despite the financial advantage of waiting, a large share of Americans continue to claim benefits at 62. Common reasons include:

- Health concerns: Some fear they may not live long enough to benefit from delaying.

- Job loss: Older workers who struggle to find new employment may rely on Social Security as income.

- Immediate expenses: Medical bills, housing costs, or debt may force early claiming.

- Lifestyle choices: Some simply prefer to enjoy retirement earlier, even with a smaller monthly check.

These decisions are deeply personal and often shaped by circumstances rather than strategy alone.

The Long-Term Impact on Retirement Security

Because Social Security provides a guaranteed, inflation-adjusted income for life, the size of the monthly benefit plays a major role in retirement stability.

A smaller check at 62 can mean:

- Less protection against rising healthcare costs

- Greater reliance on savings, which may run out

- Reduced ability to handle emergencies

- Lower survivor benefits for a spouse

For couples, claiming strategies become even more important, as one spouse’s benefit can determine the income of the surviving partner later in life.

How Earnings History Shapes Your Personal Benefit

The average social security check at age 62 is only a reference point. Actual benefits depend on:

- Your highest 35 years of earnings

- How much you paid in Social Security taxes

- The age at which you claim benefits

Workers with long, high-earning careers may receive well above the average, even when claiming early. Those with interrupted work histories or lower wages may receive much less.

Reviewing your Social Security earnings record and estimated benefits well before retirement can help avoid surprises.

Planning Ahead for a Stronger Retirement

Financial planners often recommend:

- Running benefit estimates for multiple claiming ages

- Considering part-time work instead of early claiming

- Using retirement savings strategically to delay Social Security

- Coordinating benefits with a spouse for maximum lifetime income

The decision to claim at 62 should be based on health, savings, expected longevity, and household needs—not just on reaching the earliest eligible age.

The Bigger Picture for Social Security in 2026

Social Security remains the primary source of income for most retired Americans. While cost-of-living adjustments help, they do not fully shield retirees from rising expenses, especially in healthcare and housing.

As life expectancy increases and retirement lasts longer, the value of a higher monthly check becomes even more important. Understanding the trade-offs of early claiming is one of the most critical steps in building a secure retirement plan.

Are you considering claiming at 62, or do you plan to wait? Share your thoughts and stay connected for the latest updates on retirement benefits and planning.