The natural gas utility has begun 2026 under the spotlight as it reports strong financial results, plans substantial infrastructure improvements, and raises shareholder dividends. Investor attention remains high, reflecting confidence in the company’s consistent earnings growth, disciplined capital allocation, and long-term strategy. The company continues to expand its service footprint while maintaining reliable operations across several U.S. states, solidifying its position in the energy sector.

Early 2026 market activity highlights a steady trading pattern, reflecting investor trust in operational resilience, infrastructure expansion, and revenue stability. The company’s strategic approach to balancing growth with shareholder returns and operational reliability positions it well for both short-term performance and long-term sustainability.

Fiscal 2025 Financial Highlights

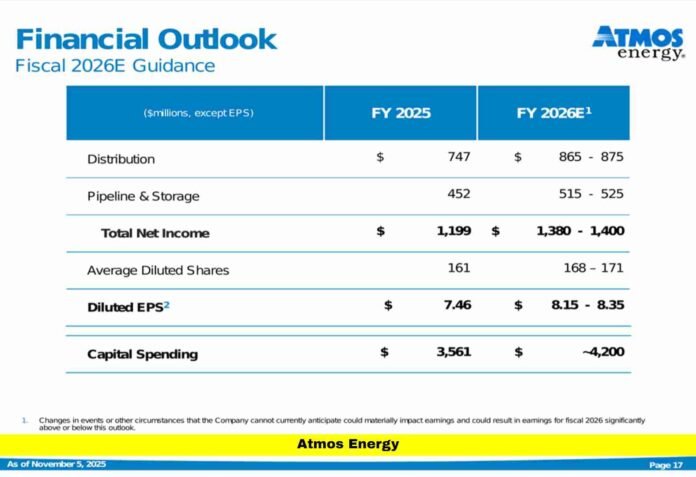

The company concluded 2025 with robust results. Net income reached over $1.2 billion, while earnings per share grew steadily, reflecting operational efficiency and effective management. Revenue growth was supported by expanding customer accounts, disciplined cost management, and steady demand for natural gas services. Profit margins remained strong, highlighting the balance between capital expenditures and operational performance.

Capital investment for the year totaled approximately $3.6 billion. The majority of this investment focused on modernizing pipeline systems, improving reliability, and enhancing safety measures. These upgrades are designed to ensure the long-term integrity of energy delivery and reduce operational risks across its service areas.

Dividend Policy and Shareholder Returns

The company announced an increase in its quarterly dividend to $1.00 per share, bringing the annual dividend to $4.00, a nearly 15% rise from the previous year. This reflects the organization’s commitment to providing stable and growing returns to shareholders. The increase in dividend underscores financial stability, strong cash flow, and management’s focus on maintaining consistent shareholder rewards.

The growth in dividend payments, along with the company’s reliable revenue generation, makes it an attractive option for income-focused investors seeking stable returns in the utility sector.

Fiscal 2026 Guidance and Strategic Planning

For 2026, management projected earnings per share in the range of $8.15 to $8.35, indicating expected growth compared with the prior year. Capital expenditure guidance is set at $4.2 billion, reflecting continued commitment to infrastructure modernization, safety improvements, and expansion initiatives.

This investment approach demonstrates a forward-looking strategy that balances operational reliability, growth, and financial performance. The company aims to strengthen its systems while ensuring a stable return for investors and long-term service continuity for customers.

Infrastructure Projects and System Modernization

Significant resources are allocated to pipeline replacement, system upgrades, and modernization initiatives. These projects enhance reliability, reduce leak risks, and ensure compliance with evolving safety regulations. Investments also focus on environmental performance, including methane reduction programs and system efficiency improvements.

By modernizing infrastructure, the company ensures it can meet rising energy demand and deliver services safely across its service areas. These upgrades reinforce long-term operational stability and align with sustainability goals.

Customer Base Expansion

Customer growth continued in 2025, with thousands of new residential and commercial accounts added. Residential expansion reflects ongoing demand for energy services, particularly for heating and general utility needs. Commercial and industrial customer additions support diversified revenue streams and highlight growing energy requirements in the regions served.

Expanding the customer base not only strengthens revenue predictability but also enables the company to fund further infrastructure improvements and maintain service reliability.

Operational Efficiency and Safety Measures

Operational excellence is central to company strategy. Pipeline monitoring, maintenance programs, and rapid response systems ensure safe and reliable service delivery. Field crews and operational teams respond efficiently to emergencies or service interruptions, reinforcing the company’s commitment to safety and reliability.

Investments in safety and operational protocols not only protect customers but also enhance public trust and strengthen regulatory relationships.

Environmental Sustainability Initiatives

The company prioritizes sustainability in operations. Programs targeting emissions reduction, methane management, and system efficiency have been implemented. Infrastructure upgrades are designed to minimize environmental impact while maintaining operational effectiveness.

By integrating environmental initiatives into capital projects and operational planning, the company strengthens its reputation as a responsible energy provider and aligns with long-term industry trends toward sustainable energy delivery.

Financial Strength and Capital Management

Strong liquidity and careful capital allocation enable the company to fund large-scale infrastructure projects while maintaining financial stability. Access to capital markets ensures sufficient resources for ongoing modernization and safety programs without compromising operational efficiency.

The company maintains a balanced capital structure that supports creditworthiness, reduces financing costs, and allows for flexible investment planning, reinforcing investor confidence.

Market Performance and Investor Sentiment

Stable earnings growth, rising dividends, and consistent infrastructure investment have contributed to favorable market performance. Shares have reflected confidence in long-term strategic execution and predictable cash flow generation. Investors are drawn to the company’s resilience in a regulated market and its ability to maintain financial stability amidst broader energy sector fluctuations.

Stock performance mirrors the company’s operational success and investor trust in its growth plans, making it a reliable utility-focused investment.

Regulatory Environment and Rate Adjustments

The regulatory framework significantly influences operations. Approvals for rate adjustments allow the company to recover costs associated with infrastructure improvements and operational expenses. Public hearings and regulatory reviews ensure transparency and fair consideration of customer impacts.

Rate adjustments are structured to balance cost recovery for the company while minimizing the burden on consumers, ensuring long-term financial and operational sustainability.

Customer Communication and Community Engagement

Maintaining clear communication with customers is a strategic priority. The company informs residents and businesses about infrastructure projects, service changes, and rate adjustments. Engagement programs help customers understand the reasons behind decisions and the benefits of system modernization, safety upgrades, and improved service reliability.

Community involvement enhances trust and aligns operational plans with public expectations, fostering positive relationships across service areas.

Challenges in the Utility Sector

While the company demonstrates strong performance, it faces industry-wide challenges, including regulatory approvals, economic pressures, and fluctuating material costs. Rising labor and equipment costs can affect project timing and expenditure. Additionally, natural gas price variability and broader energy market trends can influence operational costs and customer rates.

Management addresses these challenges through strategic planning, operational efficiency, and proactive regulatory engagement to maintain stability and ensure continued growth.

Operational Resilience and Reliability

Reliability is a key factor in maintaining customer confidence. Systems are designed to minimize service interruptions and maintain operational continuity. Proactive maintenance and monitoring help detect and address potential issues before they impact customers.

The company’s focus on operational resilience supports long-term service quality, safety, and efficiency, reinforcing trust among consumers and investors.

Long-Term Growth and Strategic Outlook

Looking forward, growth priorities include expanding the customer base, modernizing infrastructure, and improving safety measures. Environmental initiatives remain central to long-term strategy, with methane reduction and system efficiency programs complementing capital projects.

Financial discipline, combined with stable cash flow and rising dividends, provides a strong foundation for future expansion and sustained investor confidence.

Impact on U.S. Energy Markets

As a major natural gas distributor, the company plays a critical role in energy delivery across its service regions. Its infrastructure supports residential heating, industrial processes, and electricity generation. Reliable service during peak demand, particularly winter months, underscores the importance of operational stability.

System modernization and customer expansion help meet growing energy needs while reinforcing the company’s integral role in regional energy security.

Community and Stakeholder Focus

Community engagement, transparency, and stakeholder communication are core operational principles. By involving regulators, customers, and local communities in decision-making processes, the company ensures alignment between operational objectives and public expectations.

Public hearings and informational initiatives demonstrate a commitment to open dialogue, fostering trust and supporting informed decision-making about energy delivery and cost recovery.

Investor Considerations and Risk Factors

Potential investors should consider the company’s stability, regulatory environment, and ongoing capital investment needs. While financial performance has been strong, challenges such as infrastructure costs, material price fluctuations, and regulatory timing can impact results.

Understanding these factors is essential for evaluating potential risks and rewards. The company’s disciplined approach to capital allocation, infrastructure planning, and operational management helps mitigate these risks.

Outlook for 2026 and Beyond

Guidance for 2026 emphasizes earnings growth, continued infrastructure investments, and dividend increases. Customer expansion, modernization of pipelines, and safety improvements are central to the strategic plan.

Sustainability initiatives, operational resilience, and financial discipline create a solid foundation for long-term growth. Continued investment in customer service and system reliability positions the company to meet future energy needs efficiently.

Disclaimer

This article is provided for informational purposes only and does not constitute financial, investment, or trading advice. Market conditions may change rapidly, and past performance does not guarantee future results. Readers should conduct independent research or consult a qualified financial professional before making any investment decisions related to this company or its stock.

How do you view the company’s growth and infrastructure plans for 2026? Share your insights in the comments or stay informed as developments unfold.