Investor focus across U.S. financial markets continues to gravitate toward AMZN as the new year unfolds. Early 2026 trading has highlighted measured volatility, steady participation, and persistent attention from both institutional and retail market participants. Rather than dramatic price swings, recent activity reflects a market recalibrating expectations after a transformative year for large-cap technology.

The equity’s role as a market bellwether remains intact. Its movements are often interpreted as signals of broader confidence in consumer demand, enterprise technology spending, and long-term growth strategies within the U.S. economy.

Early-Year Trading Patterns and Investor Positioning

The opening weeks of 2026 have revealed disciplined trading behavior. Price movement has been defined more by consolidation than by directional extremes, suggesting investors are assessing forward guidance rather than reacting to short-term headlines. This pattern aligns with a broader market environment marked by cautious optimism.

Portfolio rebalancing at the start of the year has influenced volume, yet participation levels remain robust. The absence of panic-driven selling points to sustained confidence, even as market participants remain selective about new entries.

Standing Among U.S. Large-Cap Equities

Within the U.S. equity landscape, this company occupies a rare position due to the scale and diversity of its operations. Its influence extends across consumer services, enterprise infrastructure, logistics, and digital commerce, allowing it to absorb sector-specific disruptions more effectively than narrowly focused peers.

Market capitalization alone ensures continued visibility. Index exposure further amplifies attention, making this equity a constant reference point for broader market health and technology sector sentiment.

Business Model Depth and Revenue Diversity

A defining strength lies in revenue diversity. Consumer transactions generate massive scale, while service-based operations contribute disproportionately to operating income. This balance reduces reliance on any single business line and enhances resilience during periods of uneven economic growth.

Operational improvements implemented over recent years have refined cost structures across fulfillment, transportation, and digital services. These efficiencies are now embedded within the business, supporting margins even as investment continues.

Enterprise Infrastructure and Profit Stability

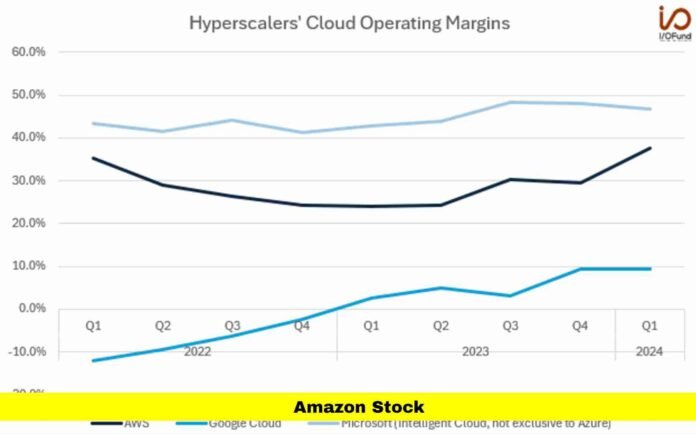

Enterprise infrastructure operations remain central to earnings stability. Demand from organizations seeking scalable computing power and advanced data capabilities continues to shape long-term revenue expectations. This segment’s margin profile provides a stabilizing counterweight to the capital intensity of consumer-facing operations.

Investors closely monitor this area as an indicator of enterprise confidence across the U.S. economy. Sustained demand signals continued willingness among businesses to invest in long-term digital capacity.

Strategic Spending and Technology Integration

Large-scale investment remains a core theme. Capital allocation toward advanced technology, automation, and system-wide integration reflects a strategy focused on long-term dominance rather than short-term optics. These investments affect near-term cash flow but are widely viewed as foundational.

Technology integration across logistics, customer interaction, and internal systems has already begun to yield efficiency gains. Market participants increasingly focus on execution quality rather than headline spending figures alone.

Consumer Activity and Retail Performance

Consumer-facing operations continue to anchor revenue generation. U.S. shoppers prioritize convenience, reliability, and speed—areas where operational scale provides a lasting advantage. Delivery optimization and subscription engagement reinforce customer retention.

Even as discretionary spending faces periodic pressure, flexibility in pricing and fulfillment allows the business to adapt without sacrificing service quality. This adaptability remains a critical factor shaping investor confidence.

Advertising Growth and Earnings Mix

Digital advertising has become an increasingly important earnings contributor. Brands value direct access to high-intent consumers, positioning this platform as a preferred destination for marketing spend. The resulting revenue carries favorable margins and relatively low capital intensity.

As this segment grows, it enhances earnings quality by balancing cost-heavy operations with scalable, high-margin income. Investors often cite this shift as a key reason for long-term valuation support.

Operational Discipline and Margin Management

Cost management has emerged as a visible priority. Improvements in fulfillment efficiency, labor productivity, and transportation optimization have strengthened operating performance. These gains demonstrate a commitment to disciplined growth rather than unchecked expansion.

Market sentiment reflects appreciation for this balance. Efficiency-driven margin improvement reinforces confidence that growth remains sustainable even in a competitive environment.

Volatility, Sentiment, and Market Psychology

Short-term price movement is influenced by broader market psychology. Interest rate expectations, macroeconomic signals, and sector rotation frequently drive daily fluctuations. Despite this, long-term holders have largely maintained positions, signaling confidence in structural value.

Periods of consolidation are increasingly interpreted as healthy recalibration rather than stagnation. Stability during uncertain market phases is often viewed as a sign of institutional conviction.

Relative Positioning Within Technology Leaders

Compared to other technology leaders, this equity offers a distinct profile. Hardware-dependent firms face product-cycle risk, while advertising-centric models are sensitive to marketing budgets. Diversification across services and commerce reduces exposure to single-cycle downturns.

Performance comparisons vary by timeframe, yet long-term positioning remains supported by operational breadth and adaptability. This structural resilience continues to differentiate it within the sector.

Key Themes Investors Are Monitoring

Looking ahead, investor focus centers on execution rather than expansion announcements. Earnings performance, margin trends, and cost control will shape expectations. Updates related to infrastructure scaling and technology deployment will further influence valuation narratives.

Consumer behavior indicators and enterprise spending trends will also play a significant role. Each reporting cycle has the potential to recalibrate sentiment based on guidance clarity and operational results.

Risk Considerations and Market Sensitivity

Despite structural strengths, risks remain. High capital requirements can temporarily pressure cash flow. Regulatory scrutiny remains an ongoing consideration given scale and market influence.

Macroeconomic shifts, changes in consumer confidence, or reduced enterprise spending could also introduce volatility. Awareness of these factors remains essential for informed market participation.

Long-Term Confidence and Strategic Adaptability

Long-term confidence rests on adaptability. The ability to refine operations, integrate emerging technologies, and respond to market shifts has historically underpinned success. This adaptability continues to support constructive long-range sentiment.

Rather than relying on a single growth narrative, future performance appears linked to the combined strength of commerce, services, and infrastructure. This multifaceted approach remains central to long-term expectations.

Why Market Attention Continues

Sustained attention reflects relevance rather than speculation. Few companies influence consumer habits, enterprise systems, and digital infrastructure simultaneously. This influence ensures ongoing scrutiny and engagement from market participants.

As innovation and execution remain aligned, interest is unlikely to diminish. Instead, expectations will continue evolving alongside performance and market conditions.

Disclaimer

This article is intended for informational purposes only and does not constitute financial, investment, or trading advice. Market conditions are subject to change, and past performance does not guarantee future results. Readers should conduct their own research or consult a qualified financial professional before making investment decisions. The publisher accepts no responsibility for actions taken based on the information presented.

How do you see AMZN shaping the market this year? Share your perspective in the comments or stay connected for continued updates and insights.